Why did a for-profit college pay former President Bill Clinton the staggering sum of $16.5 million to serve as an “honorary chancellor for Laureate International Universities”? Was it because he had some special insight or expertise on how to improve education?

Why did Goldman Sachs pay former Secretary of State Hillary Clinton hundreds of thousands of dollars for a couple of speeches? Was it because she had valuable observations about the economy and investments?

The answer to all those questions is that companies sometimes are willing to transfer large sums of money to influential politicians because they want something in exchange.

In some cases, they want help from powerful insiders so they can use the coercive power of government to take other people’s money, which is reprehensible and disgusting. In other cases, they are seeking to guard against being victimized with high taxes and punitive regulations and so they pay “protection money” to powerful insiders in hopes of being left alone, which is unfortunate but understandable.

In either case (one moral and the other immoral), the companies are making rational decisions. Politicians have immense ability to tax, spend, and regulate, so it makes sense to get on their good side, either by giving them money directly or contributing to their campaigns.

This is a problem in the United States, of course, but it’s also a problem in Europe.

Consider the curious case of José Manuel Barroso, the recently retired President of the European Commission who was recently hired by Goldman Sachs to be “non-executive chairman of Goldman Sachs International.” According the press release from the company, he will…well, it’s not clear what his role will be or what value he will provide. All we get is fluff about his political career and a murky statement that, “He will also be an advisor to Goldman Sachs.”

So let’s look at his Wikipedia bio. Maybe we’ll find some evidence that he has great expertise on investment matters. But all we find there is that he’s been a career politician, first in Portugal and then in Brussels (where he was a bit of a laughingstock).

There’s no indication that he ever held a job in the private sector. But we do get this tidbit.

In his university days, he was one of the leaders of the underground Maoist MRPP (Reorganising Movement of the Proletariat Party, later PCTP/MRPP, Communist Party of the Portuguese Workers/Revolutionary Movement of the Portuguese Proletariat).

That doesn’t sound like the pedigree of someone who just landed a lavishly compensated position in the supposed temple of global capitalism.

But the real story is that Barroso isn’t a communist (at least not now) and Goldman Sachs isn’t a bastion of free markets. Instead, both of them are expert practitioners of cronyism.

Indeed, the cronyism angle is so obvious in this case that the European Commission has launched an ethics probe.

Which is very upsetting to Senor Barroso. The Financial Times reported on the controversy.

José Manuel Barroso has accused the European Commission — a body he led for 10 years — of being “discriminatory” and “inconsistent” after the EU’s executive arm set up an ethics probe to examine his new role at Goldman Sachs. …Mr Barroso vigorously defended his decision to take a job as adviser with the US investment bank, which triggered a backlash across the EU. …French president François Hollande described the appointment as being “legally possible, but morally unacceptable”. …The committee will examine Mr Barroso’s contract to ascertain whether it complies with Mr Barroso’s obligation under EU law “to behave with integrity and discretion” when taking appointments or benefits after leaving office. Campaigners have argued that Mr Barroso could be stripped of his pension — worth €15,000 per month — if he is found to have violated these rules. …Other former members of the commission have gone on to take high-profile roles with big businesses, leading some to claim that Goldman Sachs has been singled out because of its role in the financial crisis.

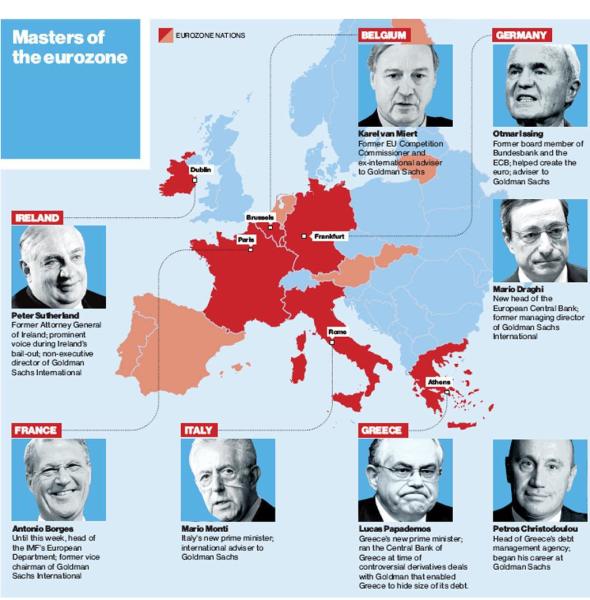

Though it’s worth noting that Barroso is simply the latest example of a revolving door between senior euro-crats and Goldman Sachs.

The bottom line is that Barroso hasn’t behaved with integrity. But that’s true of his entire career. Taking a position with Goldman Sachs is simply a way of monetizing decades of cronyism.

P.S. Shifting back to the US version of cronyism, Kevin Williamson has a must-read analysis of the corrupt nexus of Wall Street and Washington.

P.P.S. The solution to this mess (other than Glenn Reynold’s revolving-door surtax) is to dramatically shrink the size and scope of government. When there’s less to steal, there will be fewer thieves.