With both Hillary Clinton and Bernie Sanders agitating for higher taxes (and with more than a few Republicans also favoring more revenue because they don’t want to do any heavy lifting to restrain a growing burden of government), it’s time to examine the real-world evidence on what happens when politicians actually do get their hands on more money.

Is it true, as we are constantly told by the establishment, that higher tax burdens a necessary and practical way to reduce budget deficits and lower debt levels?

This is an empirical question rather than an ideological one, and the numbers from Europe (especially when looking at the data from the advanced nations that are most similar to the US) are especially persuasive.

I examined the European fiscal data back in 2012 to see whether the big increase in tax revenue starting in the late 1960s led to more red ink or less red ink.

You won’t be surprised to learn that giving more money to politicians didn’t lead to fiscal probity. The burden of taxation climbed by about 10-percentage points of economic output over four decades, but governments spent every single penny of the additional revenue.

They actually spent more than 100 percent of the additional revenue. The average debt burden in these Western European nations jumped from 45 percent of GDP to 60 percent of GDP.

I often share this data when giving speeches since it is powerful evidence that tax increases are not a practical way of dealing with debt and deficits.

But in recent years, audiences have begun to ask why I compare numbers from the late 1960s (1965-1969) with the data from the last half of last decade (2006-2010). What would the data show, they’ve asked, if I used more up-to-date numbers.

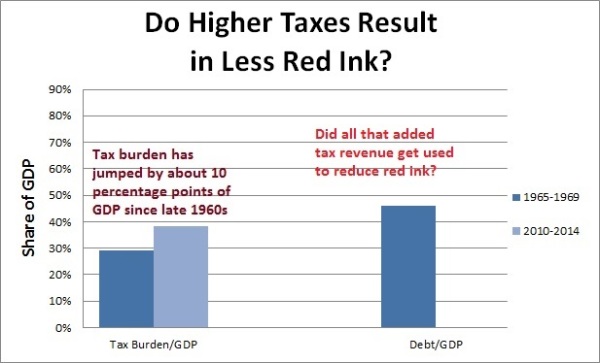

So it’s time to re-calculate the numbers using the latest data and share some new charts about what happened in Europe. Here’s the first chart, which shows on the left that there’s been a big increase in the tax burden over the past 45 years and shows on the right average debt levels at the beginning of the period. And I ask the rhetorical question about whether higher taxes led to less red ink.

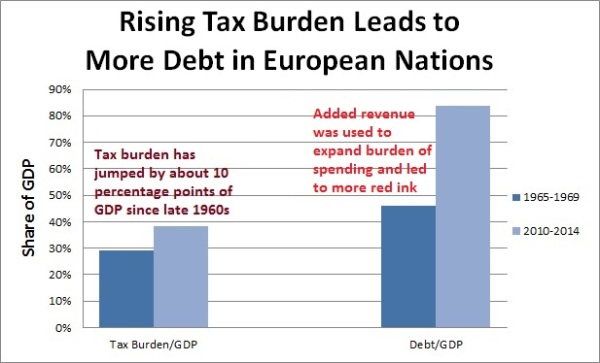

Now here’s the updated answer.

What we find is that debt levels have soared. Not just from 45 percent of GDP to 60 percent of GDP, as shown by the 2012 numbers, but now to more than 80 percent of economic output.

In other words, we can confirm that the giant increase in the tax burden over the past few decades has backfired. And we can also confirm that the big income tax hikes and increases in value-added taxes in more recent years have made matters worse rather than better.

I can’t imagine that anyone needs any additional evidence that tax increases are misguided.

But just in case, let’s look at the findings in some newly released research from the European Central Bank.

Since the start of the sovereign debt crisis, in early 2010, many Euro area countries have adopted fiscal consolidation measures in an attempt to reduce fiscal imbalances and preserve their sovereign creditworthiness. Nonetheless, in most cases, fiscal consolidation did not result.

That doesn’t sound like good news.

I wonder whether it has anything to do with the fact that “fiscal consolidation” in Europe almost always means higher taxes? And, indeed, the ECB number crunchers have confirmed that the tax-hike approach is bad news.

The aim of this paper is to investigate the effects of fiscal consolidation on the general government debt-to-GDP ratio in order to assess whether and under which conditions self-defeating effects are likely to materialise… In the case of revenue-based consolidations the increase in the debt-to-GDP ratio tends to be larger and to last longer than in the case of spending-based consolidations. The composition also matters for the long term effects of fiscal consolidations. Spending-based consolidations tend to generate a durable reduction of the debt-to-GDP ratio compared to the pre-shock level, whereas revenue-based consolidations do not produce any lasting improvement in the sustainability prospects as the debt-to-GDP ratio tends to revert to the pre-shock level.

The two scholars at the ECB then highlight the lessons to be learned.

…strategy is more likely to succeed when the consolidation strategy relies on a durable reduction of spending, whereas revenue-based consolidations do not appear to bring about a durable improvement in debt sustainability. Moreover, delaying fiscal consolidation until financial markets pressures threaten a country’s ability to issue debt, may have a cost in terms of a less sizeable reduction in the debt-to-GDP ratio for given consolidation effort, even if it is undertaken on the spending side. This is an important policy lesson also in view of the fact that revenue-based consolidations tend to be the preferred form of austerity, at least in the short run, given also the political costs that a durable reduction in government spending entail.

In other words, the bottom line is a) that tax hikes don’t work, b) reform is harder if you wait until a crisis has begun, and c) the real challenge is convincing politicians to do the right thing when they instinctively prefer tax hikes.

P.S. It’s worth pointing out that the value-added tax has generated much of the additional tax revenue (and therefore enabled much of the added burden of government spending) in Europe.