At the risk of understatement, I’m not a fan of Keynesian economics.

The disdain is even apparent in the titles of my columns.

- Notwithstanding Keynesian Fantasies, Redistribution Does Not Stimulate Growth

- Japan’s Descent into Keynesian Parody

- Has Keynesian Economics Finally Jumped the Shark?

- More Keynesian Primitivism from the Congressional Budget Office

- The Perplexing Durability of Keynesian Economics

- White House Stimulus Report Based on “Keynesian Fairy Dust”

- Four Reasons Why Keynesian Stimulus Does Not Work

- The Keynesian Crackup Continues: From Space Aliens to Food Stamp Stimulus

- Where Are the ’60s Hippies Now that They’re Needed to Fight Keynesianism

- Keynes Was Wrong on Stimulus, but the Keynesians Are Wrong on Just About Everything

- Why Is Keynesian Economics Like a Freddy Krueger Movie?

- The Keynesian Crack-Up

- Keynesian Economics and the Wizard of Oz

And these are just the ones with some derivation of “Keynes” in the title. I guess subtlety isn’t one of my strong points.

That being said, there are some elements of Keynesian economics that are reasonable.

I’ve written, for instance, that reductions in government spending can be temporarily painful because labor and capital don’t get instantaneously reallocated.

And I don’t object to the notion of shifting government outlays so they take place when the economy is weak (assuming, of course, that the spending is for a sensible and constitutional purpose).

So I was very interested to see that Tyler Cowen and Alex Tabarrok of George Mason University have a new video on fiscal policy and the economy as part of their excellent series at Marginal Revolution University.

Interestingly, “Keynes” is mentioned only once, and then just in passing, even though the discussion is about discretionary Keynesian fiscal policy.

Here are my thoughts on the video.

- Near the beginning, Alex discusses how an economic shock can lead to a downturn as households cut back on their normal expenditures. That’s quite reasonable, but I wish there had been some acknowledgement that negative shocks are often the result of bad government policy (i.e., the mistakes that caused and/or exacerbated the recent financial crisis or the Great Depression) .

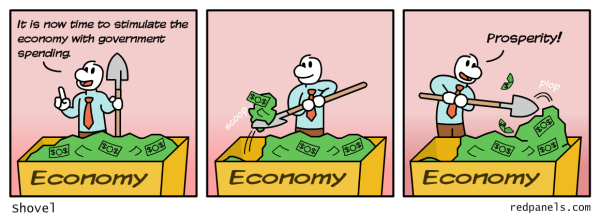

- There was no discussion of how government can put money into the economy without first taking the money out of the economy via taxes or borrowing (see cartoon below, or my video on the topic). One can argue, of course, that Keynesian policy leads to more consumer spending by borrowing money from credit markets and giving it to people, but doesn’t that simply lead to less investment spending? Perhaps there’s an implicit hypothesis that banks will just sit on the money in a weak economy, or maybe the assumption is that the government can artificially boost overall spending in the short run by borrowing money from overseas. Analysis of these issues, including the tradeoffs, would be valuable.

- Because of my concerns about government inefficiency, I enjoyed the discussion about targeting vs timeliness, but Keynesians only care about having the government somehow dump money into the economy. And they’ll use any excuse, even a terrorist attack.

- Tyler points out that the textbook view of Keynesian economics is that governments should run deficits when there’s a downturn and surpluses when the economy is strong, but he is understandably concerned that politicians only pay attention to the former and ignore the latter.

- Raising unemployment benefits is not the win-win situation implied by the conversation since academic research shows that longer periods of joblessness when people get money for not working.

- I’m not convinced that adjusting the payroll tax will have significant benefits. What’s the evidence that companies will make long-run hiring decisions based on short-run manipulations of the tax?

- The discussion at the end about fiscal rules got me thinking about how Keynesians should support a spending cap since it means spending can still climb during a recession (even if revenues fall). Of course, the tradeoff is that they would have to accept modest spending increases when the economy is strong (and revenues are surging).

Here’s an amusing cartoon strip on Keynesian stimulus from the same artist who gave us gems on the minimum wage and guaranteed income.

P.S. Since today’s topic is Keynesian economics here’s the famous video showing the Keynes v. Hayek rap contest, followed by the equally entertaining sequel, which features a boxing match between Keynes and Hayek. And even though it’s not the right time of year, here’s the satirical commercial for Keynesian Christmas carols.