Does the economic chaos in Greece suggest that government should be bigger?

Is Venezuela’s economic collapse evidence that larger governments boost growth?

Should we learn from Italy’s pervasive stagnation that public sectors should be expanded?

Most people, looking at this real-world evidence, would quickly answer no to these questions.

But Eduardo Porter is not most people. Writing for the New York Times, he openly argues that government should be bigger. Much bigger.

Over the last six years, according to the Pew Research Center, four out of every five — or more — have said the government makes them feel either angry or frustrated. …These frustrated Americans may not fully realize it, under the influence of decades worth of sermons about government’s ultimate incompetence and venality. But there’s a strong case for more government — not less — as the most promising way to improve the nation’s standard of living.

He bases much of his column on the work of four left-wing academics.

Here’s his summary of their work.

The scholars laid out four important tasks: improving the economy’s productivity, bolstering workers’ economic security, investing in education to close the opportunity deficit of low-income families, and ensuring that Middle America reaps a larger share of the spoils of growth. Their strategy includes more investment in the nation’s buckling infrastructure and expanding unemployment and health insurance. It calls for paid sick leave, parental leave and wage insurance for workers who suffer a pay cut when changing jobs. And they argue for more resources for poor families with children and for universal early childhood education.

Improving productivity would be a very good idea. Indeed, producing more output per unit of capital and labor is basically how we become richer.

But while Porter and the statist academics might recognize that higher productivity is a good destination, the route they choose (bigger government, more punitive tax burden, additional regulation, lots of mandates, etc) will move the economy in the opposite direction.

If we want more growth, the best way to boost productivity is with capital formation and entrepreneurship. But leftists, with their fixation on inequality, are reflexively opposed to the types of tax reforms that enable more saving, investment, and risk-taking.

Instead, they want the suffocating embrace of the European welfare state.

They propose raising government spending by 10 percentage points of the nation’s gross domestic product ($1.8 trillion in today’s dollars), to bring it to some 48 percent of G.D.P. by 2065. …Here are some other things Europeans got from their trade-off: lower poverty rates, lower income inequality, longer life spans, lower infant mortality rates, lower teenage pregnancy rates and lower rates of preventable death. And the coolest part, according to Mr. Lindert — one of the authors of the case for big government — is that they achieved this “without any clear loss in G.D.P.”

There are several assertions here that cry out for correction (poverty indices should measure actual poverty rather than income distribution) and elaboration (is inequality bad when all income classes in America have more income than their counterparts in Europe?), but the most absurd claim is the “coolest part” aboutEurope making government bigger without sacrificing prosperity.

This is absurd. Living standards in Europe (even Western Europe) are far below American standards. And even though convergence theory tells us that poorer nations should grow the fastest,Europe no longer is closing the gap with the United States.

Indeed, the gap is actually widening.

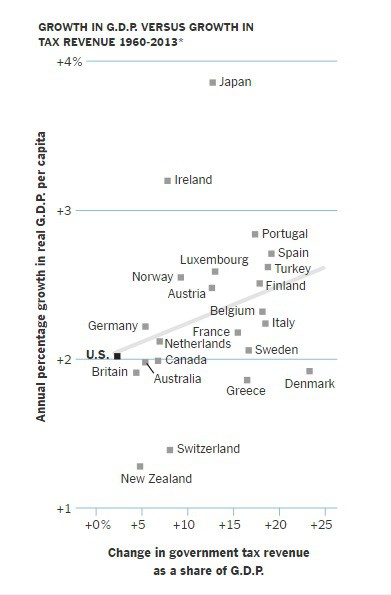

So how does Porter justify his anti-empirical statements? For evidence of his remarkable assertion about European growth, Porter’s column includes this chart, which (we are supposed to believe) shows that “many countries where government has grown the most have also experienced stronger economic growth.”

In reality, though, this chart merely shows the long-established relationship known as Wagner’s Law, which is that politicians figure out how to redistribute lots of money once nations become comparatively wealthy.

If Porter bothered to follow the academic evidence, he would see that nations can enjoy rapid growth and become rich during periods with small government and free markets, but growth slows considerably once politicians impose high tax rates and lots of redistribution.

By the way, Porter’s column contains two rather interesting accidental admissions. He confesses that a) a value-added tax is necessary to finance big welfare states (and one of the academics cited by Porter has explicitly acknowledged this point), and b) he admits that income taxes impose considerable economic damage.

Europe’s reliance on consumption taxes — which are easier to collect and have fewer negative incentives on work — allowed them to collect more money without generating the kind of economic drag of the United States’ tax structure, which relies more on income taxes.

Porter is completely correct about the role of the VAT in enabling much bigger government. This helps to explain why I’m so fixated on smothering every VAT proposal in its infancy, even when proposed with ostensibly good intentions (for instance, the Rand Paul tax plan and Ted Cruz tax plan).

Though he seems to be implying that a VAT isn’t bad for the economy. This is nonsense. First, the VAT enables bigger government, which necessarily damages the economy because capital and labor are diverted from the more productive and efficient private economy.

Though he seems to be implying that a VAT isn’t bad for the economy. This is nonsense. First, the VAT enables bigger government, which necessarily damages the economy because capital and labor are diverted from the more productive and efficient private economy.

And a VAT also is bad for the economy because it drives a wedge between pre-tax income and post-tax consumption. Which is exactly the same argument against payroll taxes and income taxes on wages and salaries. The only accurate argument he could make is that VATs don’t do as much damage, per dollar raised, as income tax systems thatinclude double taxation of saving and investment.

But I’m digressing.

Let’s close by re-focusing on the main topic of whether more government spending is associated with better economic performance.

I could cite research by the World Bank to show that Porter and his academic buddies are wrong. I also could share research from the European Central Bank. Orplenty of other sources.

But I (not-so-humbly) think these two CF&P videos are the best summary.

Here’s the empirical evidence on government spending and growth.

And here’s the empirical evidence on the growth-maximizing size of government (hint: much smaller than Porter suggests).