In my presentations about how to deal with budgetary deterioration and fiscal crisis, I often share with audiences a list of nations that have achieved very positive results with spending restraint.

The middle column shows how these countries limited the growth of government spending for multi-year periods.

The middle column shows how these countries limited the growth of government spending for multi-year periods.

The next column of numbers reveals how multi-year spending restraint leads to significant reductions in the amount of economic output that is diverted to the government.

And when you address the underlying problem of excessive government spending, you automatically ameliorate the symptom of red ink, as shown in the final column of numbers.

At this point, I usually ask the audience whether they’ve ever seen a similar table that purports to show nations that have obtained similarly good results with tax increases.

The answer is no, of course, though it’s not really a fair question to people who don’t study fiscal policy.

More important, I ask the same question when I have debates with my statist friends from left-wing organizations. They generally try to change the subject. Some of them bluster about “fairness.” And a few of them think Sweden is an acceptable answer until I point out that it became rich when government was small but began to lose ground once a large welfare state was imposed beginning in the 1960s (as explained in this video).

But Sweden wouldn’t be a good answer even if its economy hadn’t slowed down. That’s because the question is how to climb out of a fiscal hole. In which case Sweden actually provides evidence for my position!

To understand why tax increases aren’t the right way to deal with a fiscal mess, let’s look at Greece. From the moment the crisis began, Greek politicians started raising taxes. And they haven’t stopped, with many of the tax hikes being cheered by international bureaucracies.

This is a never-ending story.

With new chapters being written all the time. Here’s a report from Reuters on the latest “reform” package from Greece. As you might suspect, it’s basically a bunch of tax hikes. Here’s what the politicians approved on social insurance taxes.

Sets social security contributions at 20 percent of employees’ net monthly income – with 13.3 percent burdening employers and 6.7 percent employees. Reforms the social security contribution base from notional to actual incomes for the self-employed, including farmers and lawyers, forcing them to make a contribution to pension funds which is phased in over a five-year period to 20 percent of their income.

There are also income tax increases.

Lowers the income tax-free threshold, or personal allowance, to an average of around 8,800 euros a year from around 9,500; makes income bands narrower, increases tax coefficients. Lowest tax band is now 22 percent on a gross income of 20,000 a year compared to 22 percent for 25,000 euros which existed previously. The upper tax band, of 45 percent, is now imposed on gross incomes exceeding 40,000 as opposed to 42 percent on income above 42,000 under the previous arrangement. Includes EU farming subsidies on taxable income.

And there are further income tax hikes as part of the “solidarity” levy, which is basically another income tax.

Solidarity Levy…on net incomes ranges from the lowest 2.2 percent on incomes from 12,000 to 20,000 a year, to 5.0 percent up to 30,000, and 6.5 percent up to 40,000. The highest band is 10 percent on incomes above 220,000. By comparison, the highest band in that category was 8.0 percent before the new reform was pushed through, on earnings exceeding half a million euros.

And there also will be more double taxation.

Dividends Tax: Increases to 15 percent from 10 percent.

You would think this big package of tax hikes might satisfy the crowd in Athens for a year or two.

But that would be a very bad assumption. Amazingly, the politicians in Greece already are looking for additional victims, as reported by ABC News.

Already, a new bill is being prepared, calling for higher taxes on a range of products, from tobacco to beer to broadband Internet connections. This bill is expected to pass later in the month.

And they’re not exactly apologetic about their tax-aholic actions.

Prime Minister Alexis Tsipras and his ministers defended their plans, saying…that taxes were better than spending cuts. …Labor Minister George Katrougalos, who introduced the bill, said that…the bill’s provisions showed the way forward for social policy in a Europe dominated by pro-market “neoliberals.”

Sadly, Mr. Katrougalos may be correct. I won’t be surprised if the rest of Europe follows Greece off the cliff.

Though he’s smoking crack if he thinks the rest of the continent is dominated by neoliberals (i.e., classical liberals or libertarians).

Not that we’ve established that Greece has been trying to solve its fiscal mess with tax hikes, let’s look at the results.

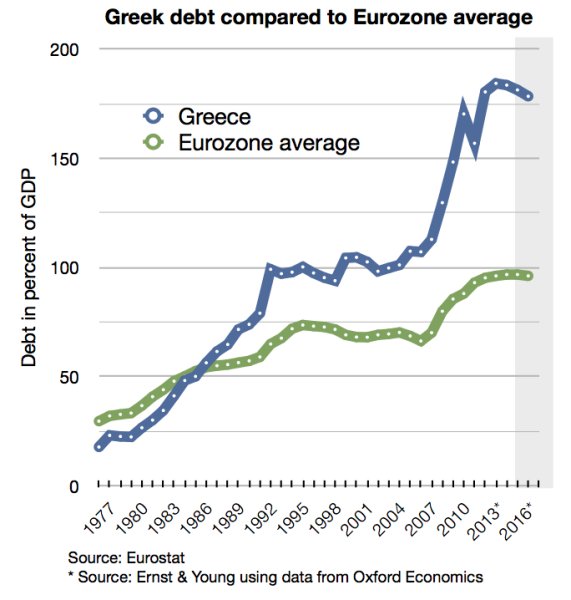

Has debt been reduced? Hardly, though to be fair it seems to have stabilized.

In any event, we haven’t seen the big reductions in debt that are associated with spending restraint

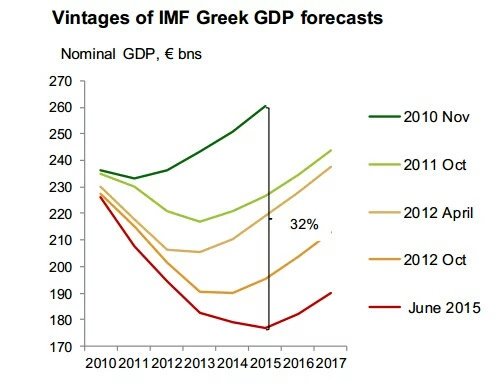

And what about the economy? Here, the news is uniformly grim, doubtlessly in large part because of all the tax hikes.

It’s rather ironic this chart is based on periodic IMF forecasts since that bureaucracy is infamous for advocating endless tax hikes.

One wonders if the IMF bureaucrats will eventually learn some lessons?

I’m not holding my breath, just like I’m not optimistic that Greek politicians will address the real problem in their country of excessive dependency caused by a bloated public sector.

But maybe the rest of us (other than Hillary and Bernie) can learn what not to do.