I’m generally a fan of Australia. I wrote my dissertation on the country’s private Social Security system, and I’m always telling policy makers we should copy their approach. The Aussies also abolished death taxes, which was a very admirable choice.

I even wrote that Australia is the place to go if politicians wreck the American dream and turn us into a New World version of Greece.

But that doesn’t mean there isn’t plenty of foolish policy Down Under.

A column in the Sydney Morning Herald notes that the mining-heavy state of Western Australia faces a fiscal crisis even though it enjoyed a lengthy economic boom when there was a lot of demand for natural resources.

…the state has recently attracted much attention – and derision – for the way its policy making elite squandered the wealth generated by the resources boom. …how WA managed to emerge from the once in a lifetime mining boom with an estimated debt burden of $40 billion by 2020 and a projected budget deficit of $4 billion is one of the West’s great mysteries. Or not, if you bother to look at what happened.

Ironically, the author of the column didn’t bother to look at what happened. He wasted a lot of ink extolling the supposed virtues of Norway’s oil-financed sovereign wealth fund, but he never shared any fiscal data.

Why he omitted this very relevant information is a bit of a mystery. It’s certainly not because it’s hidden. I’m on the other side of the world, but my intern managed to get spending and revenue data for Western Australia without any heavy lifting.

And what do we see? Can we learn why the Aussie state is in a fiscal mess?

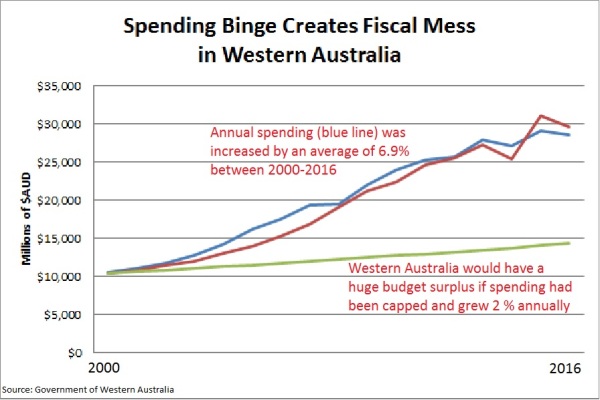

The answer, unsurprisingly, is that politicians in Western Australia spent too much money. Annual outlays grew by an average of nearly seven percent each year.

That spending spree may not have seemed reckless when the resources boom was generating big increases in government receipts.

But as happened in both Alberta and Alaska, the chickens of fiscal profligacy eventually come home to roost when there are resources-fueled spending binges.

Not that all politicians in Western Australia have learned from their mistakes.

WA Nationals leader Brendon Grylls certainly has…launched a rather lonely campaign to make the miners pay more tax.

By the way, the National Party is supposed to be on the right side of the political spectrum, yet this politician wants to blame mining companies even though it was the government that squandered so much money. Makes me wonder if his middle initial is “W“?

Anyhow, there is a larger lesson for the rest of us – assuming, of course, that we want sensible fiscal policy.

The main conclusion we should draw is that it is vitally important to control spending in boom years. That’s when lots of revenue is flowing to the government and it’s very difficult for politicians to resist the temptation to spend that windfall revenue.

A spending cap, though, solves this problem.

And research from the International Monetary Fund echoes this argument.

One of the desirable features of expenditure rules compared to other rules is that they are not only binding in bad but also in good economic times.

The European Central Bank reached the same conclusion.

…if governments have fiscal rules in place, the results suggest that governments can no longer fully use their fiscal space and (on average) are even forced to reduce their current expenditures.

Even the Organization for Economic Cooperation and Development agrees.

…spending rules can can limit pro-cyclical spending in the presence of revenue windfalls in good times.

So we know the right solution. Now the challenge is convincing politicians (who are often governed by bad incentives) to tie their own hands.

P.S. Now I understand why Crocodile Dundee didn’t like giving Australian politicians any more money than absolutely necessary.

———

Image credit: Chris Samuel | CC BY 2.0.