A couple of days ago, I wrote about the new rankings from the World Economic Forum’s Global Competitiveness Report and noted that America’s private sector is considered world class but that our public sector ranks poorly compared to many other developed nations.

To elaborate on the depressing part of that observation, let’s now look at the Tax Foundation’s recently released International Tax Competitiveness Index.

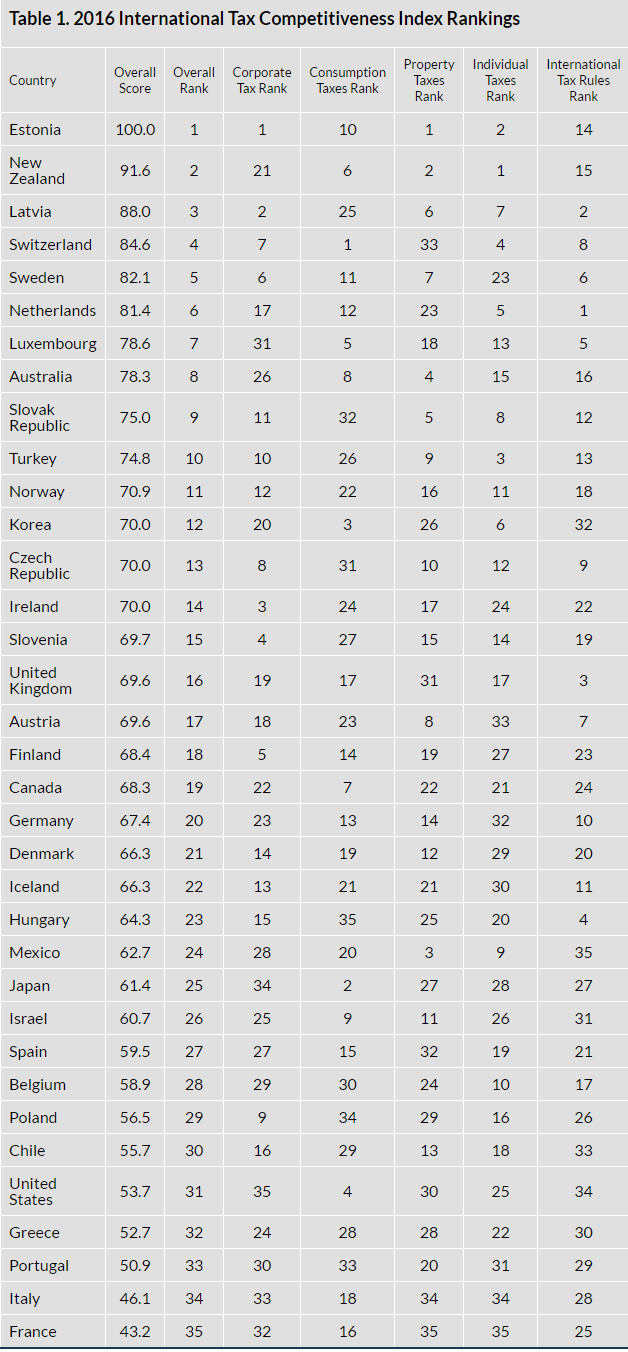

Lots of data and lots of countries. Estonia gets the top score, and deservedly so. It has a flat tax and many other good policies. It’s also no surprise to see New Zealand and Switzerland near the top.

If you’re curious about America’s score, you’ll have to scroll way down because the United States ranks #31, below even Belgium, Spain, and Mexico.

If you look at how the U.S. ranks in the various categories, we have uniformly poor numbers for everything other than “Consumption Taxes.” So let’s be very thankful that the United States doesn’t have a value-added tax (VAT). If we did, even France would probably beat us in the rankings (I hope Rand Paul and Ted Cruz are paying attention to this point).

And if you wonder why some nations with higher top tax rates rank above the U.S. in the “Individual Taxes” category, keep in mind that there are lots of variables for each category. And the U.S. does poorly in many of them, such as the extent to which there is double taxation of dividends and capital gains.

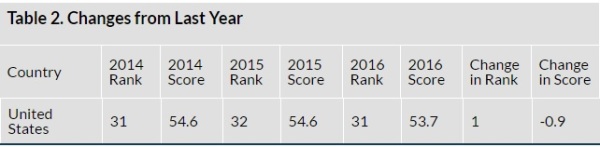

By the way, there is some “good” news. Compared to the 2014 ranking, the United States is doing “better.” Back then, there were only two nations with lower scores, Portugal and France. In the new rankings, the U.S. still beats those two nations, and it also gets a better score than Greece and Italy.

But we’re only “winning” this contest of weaklings because the scores for those nations are falling faster than America’s score.

Here’s the 2014-2016 data for the United States. As you can see, we’ve dropped from 54.6 to 53.7.

P.S. The Tax Foundation’s International Tax Competitiveness Index is superb, but I hope they make it even better in the future by adding more jurisdictions. As of now, it only includes nations that are members of the OECD. That’s probably because there’s very good and comparable data for those countries (the OECD pushes very bad policy, but also happens to collect very detailed numbers for its member nations). Nonetheless, it would be great to somehow include places such as Hong Kong, Singapore, Bermuda, and the Cayman Islands (all of which punch way above their weight in the international economy). It also would be desirable if the Tax Foundation added an explicit size-of-government variable. Call me crazy, but Sweden probably shouldn’t be ranked #5 when the nation’s tax system consumes 50.4 percent of the economy’s output (this size-of-government issue is also why I asserted South Dakota should rank above Wyoming in the Tax Foundation’s State Business Tax Climate Index).