Greece is special, though not in a good way.

The nation has such a pro-welfare mentality that pedophiles get disability benefits. And the regulatory mindset is so nutty that you need to submit a stool sample if you want to create an online company.

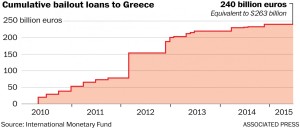

While those are bizarre examples of foolish government, Greece is probably best known for bailouts. Lots of them.

While those are bizarre examples of foolish government, Greece is probably best known for bailouts. Lots of them.

The politicians spent too much money and drove the economy into a ditch. And ever since, they’ve been trying to tax their way back to solvency, apparently oblivious to the fact that the private sector can’t rescue the economy if it’s being taxed into oblivion.

And that’s not idle rhetoric. A new report from The Economist gives us a very good warning of what happens when politicians get too greedy.

The story starts with an anecdote about a Greek entrepreneur who failed. But he didn’t fail because of a bad idea or a poor work ethic. Instead, the government got too greedy and taxed him into exile.

Panagiotis Korfoksyliotis set up a business in Athens in 2011, ferrying tourists around by car…he paid his staff a decent wage and declared all his earnings. Unfortunately, the taxman did not repay the kindness. Sharp increases in business taxes have prompted Mr Korfoksyliotis to pack his bags and move his company and his life to Bulgaria. Now he employs drivers to take foreign visitors around that country’s tourist spots instead.

And it turns out that Mr. Korfoksyliotis has lots of company.

He is part of a growing trend. …Greek governments desperate for cash have sought to squeeze it from companies, despite evidence that this is driving them away to places like Bulgaria, Cyprus and Albania. …by some estimates more than 200,000 businesses have closed or in some cases left Greece since then. ……accountants, lawyers and businesspeople reckon that perhaps as many as 10,000 Greek-owned firms have moved abroad. In a recent survey of 300 firms, Endeavor Greece, a non-profit organisation that helps entrepreneurs, found that more than a third had either left or were thinking about going.

And guess what? When a whole bunch of entrepreneurs and businesses decide that it’s no fun to work hard when the government is the main beneficiary, they leave. And all of sudden the politicians no longer have as much income to tax.

Between 2009 and 2014 the taxable profits declared by the country’s businesses fell by more than €5 billion ($5.6 billion) to €10 billion.

Wow, that’s a big Laffer Curve effect, even when including all the other factors that would have caused taxable income to decline over the past few years.

We also see the impact of tax competition in this story. The nations that are being sensible are attracting jobs and investment. Greece, of course, isn’t in that category.

Other euro-crisis countries, such as Portugal and Ireland, cut business taxes or kept them low, to encourage investment and growth. …But Greece has raised its corporation-tax rate from 20% in 2012 to 29% in 2015… Greece’s tax rise makes Bulgaria’s rate of just 10% even more alluring; likewise Cyprus’s 12.5% rate and Albania’s 15%.

But what’s really amazing is that Greece will probably go from bad to worse.

…the left-wing ruling coalition is not listening. It is now proposing a 20% rise in a levy on companies’ profits that goes toward pensions. Carry on in this vein, and there will not be many businesses, or much profit, left to tax.

Let that final sentence sink in. Our friends at The Economist are very much part of the left-leaning establishment. Yet they ended the story with about as powerful of an endorsement of the Laffer Curve as one could imagine.

In the meantime, I’ll end my column with an utterly depressing assessment of Greece’s future.

The country is basically doomed. In part, this is because government is too big. But it’s even more because the social capital of the Greek people has been eroded by decades of handouts and subsidies.

And when people think that it’s morally acceptable to use the coercive power of government to take money from their neighbors, it’s just a matter of time before than society collapses.

And when people think that it’s morally acceptable to use the coercive power of government to take money from their neighbors, it’s just a matter of time before than society collapses.

Why? Because people like Mr. Korfoksyliotis eventually decide that it’s no fun being enslaved by a bunch of looters and moochers.

The Economist slowly but surely seems to be waking up to this reality.

But I have very little hope for Bernie Sanders. Like the Syriza government, he would double down on higher taxes even as more and more taxpayers decided to “go Galt.” And just like Greece, there will be no turning back when we reach that dependency tipping point.

P.S. While part of me wants Greece to suffer because of bad politicians and scrounging voters, even I don’t want to subject the Greeks to this much torture.