Our statist friends like high taxes for many reasons. They want to finance bigger government, and they also seem to resent successful people, so high tax rates are a win-win policy from their perspective.

They also like high tax rates to micromanage people’s behavior. They urge higher taxes on tobacco because they don’t like smoking.They want higher taxes on sugary products because they don’t like overweight people. They impose higher taxes on “adult entertainment” because…umm…let’s simply say they don’t like capitalist acts between consenting adults. And they impose higher taxes on tanning beds because…well, I’m not sure. Maybe they don’t like artificial sun.

Give their compulsion to control other people’s behavior, these leftists are very happy about what’s happened in Berkeley, California. According to a study published in the American Journal of Public Health, a new tax on sugary beverages has led to a significant reduction in consumption.

Here are some excerpts from a release issued by the press shop at the University of California Berkeley.

…a new UC Berkeley study shows a 21 percent drop in the drinking of soda and other sugary beverages in Berkeley’s low-income neighborhoods after the city levied a penny-per-ounce tax on sugar-sweetened beverages. …The “Berkeley vs. Big Soda” campaign, also known as Measure D, won in 2014 by a landslide 76 percent, and was implemented in March 2015. …The excise tax is paid by distributors of sugary beverages and is reflected in shelf prices, as a previous UC Berkeley study showed, which can influence consumers’ decisions. …Berkeley’s 21 percent decrease in sugary beverage consumption compares favorably to that of Mexico, which saw a 17 percent decline among low-income households after the first year of its one-peso-per-liter soda tax that its congress passed in 2013.

I’m a wee bit suspicious that we’re only getting data on consumption by poor people.

Why aren’t we seeing data on overall soda purchases?

And isn’t it a bit odd that leftists are happy that poor people are bearing a heavy burden?

I’m also amused by the following passage. The politicians want to discourage people from consuming sugary beverages. But if they are too successful, then they won’t collect all the money they want to finance bigger government.

In Berkeley, the tax is intended to support municipal health and nutrition programs. To that end, the city has created a panel of experts in child nutrition, health care and education to make recommendations to the City Council about funding programs that improve children’s health across Berkeley.

In other words, one of the lessons of the Berkeley sugar tax and the 21-percent drop in consumption is that the Laffer Curve applies to so-called sin taxes just like it applies to income taxes.

But the biggest lesson to learn from this episode is that it confirms the essential insight of supply-side economics. Simply stated, when you tax something, you get less of it.

Which is something that statists seem to understand when they urge higher “sin taxes,” but they deny when the debate shifts to taxes on work, saving, entrepreneurship, and investment.

I’m not joking. I debate leftists all the time and they will unabashedly argue that it’s okay to have higher tax rates on labor income and more double taxation on capital income because taxpayers supposedly don’t care about taxes.

Oh, and the same statists who say that high tax burdens don’t matter because people don’t change their behavior get all upset about “tax havens” and “tax competition” because…well, because people will change their behavior by shifting their economic activity where tax rates are lower.

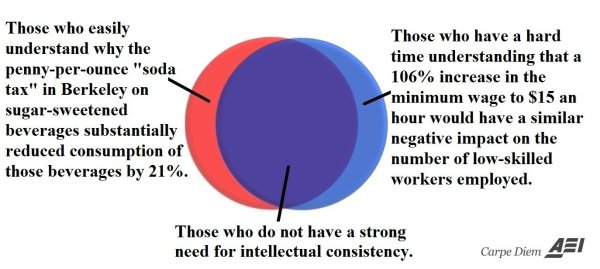

It must be nice not to be burdened by a need for intellectual consistency.

Speaking of which, Mark Perry used the Berkeley soda tax as an excuse to add to his great collection of Venn Diagrams.

P.S. On the issue of sin taxes, a brothel in Austria came up with an amusing form of tax avoidance. The folks in Nevada, by contrast, believe in sin loopholes. And the Germans have displayed Teutonic ingenuity and efficiency.

———

Image credit: Marlith | CC BY-SA 3.0.