In the grand scheme of things, the Export-Import Bank isn’t the worst government program or the one that most needs to be abolished.

- Entitlement programs are a far bigger threat to America’s long-run fiscal stability the Ex-Im Bank, with Medicaid serving as a particularly sobering example.

- Handouts to the Paris-based Organization for Economic Cooperation and Development, on a per-dollar-spent basis, do more damage than the Export-Import Bank.

- There are entire departments of the federal government, such asEducation or Housing and Urban Development, that should be abolished before we worry about the Ex-Im Bank.

But here’s the deal. Achieving any of the goals listed above would require approval of the House, approval of the Senate, and signed legislation from the President.

So I’m not exactly holding my breath for immediate victories.

In the case of the Export-Import Bank, though, victory is possible. Authorization for this odious form of corporate welfare automatically sunsets later this year.

In other words, so long as either the House or the Senate say no (which simply means choosing to do nothing), taxpayers win.

In other words, so long as either the House or the Senate say no (which simply means choosing to do nothing), taxpayers win.

This is why getting rid of the Export-Import Bank is a real test of whether Republicans are serious about shrinking the size and scope of government.

And just in case you need a reminder of why this bit of cronyism should disappear, here’s some of what Veronique de Rugy recently wrote for The Hill.

Politicians are hoarders. Instead of filling up their homes with junk and refusing to throw any of it away, they surround themselves with bloated government programs and come up with excuses to not get rid of any of them.

And if you go down the rickety stairs to the mildew-filled basements of their homes, surrounded by dead mice, you’ll find the Ex-Im Bank.

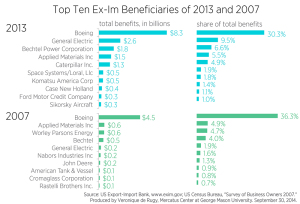

Ex-Im simply isn’t the job creator that it claims to be. The bank itself reported that only 16 percent of its beneficiaries were seeking to overcome limitations in private sector export financing. And in cases where the private sector didn’t think it was a good idea to finance a deal, why should taxpayers have backed it instead? The truth is that the bulk of Ex-Im’s activities benefit large, politically connected companies. Indeed, over 65 percent of Ex-IM Bank’s loan guarantee program benefits aerospace giant Boeing, which currently has a market cap of $106 billion. …the Congressional Budget Office projects that taxpayers will have to shoulder $2 billion in losses over the next decade. Even when there aren’t losses, it merely shows that the private sector could have handled the financing. Second, Ex-Im places the 99.96 percent of U.S. small businesses that it doesn’t subsidize at a competitive disadvantage because the subsidies artificially lower costs for privileged competitors.

Indeed. You should watch this excellent video from Mercatus to learn more about the destructive economic impact of the Export-Import Bank.

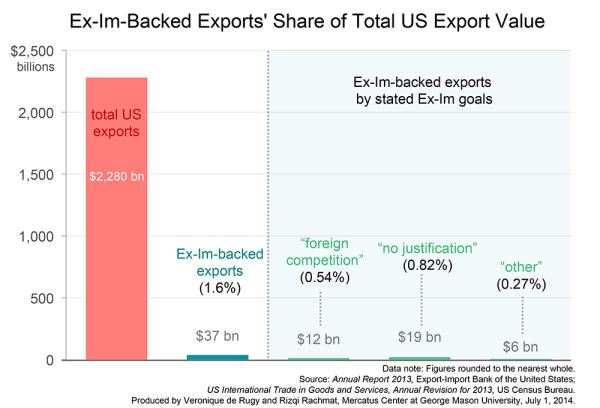

Defenders of the program say it’s necessary for American exports, but only a tiny share of exports get these subsidies.

And here’s a look at export-related jobs. As you can see, it’s preposterous to claim the Ex-Im Bank plays a big role.

And remember, by the way, that this chart looks at the “seen” jobs. If you countthe “unseen” jobs destroyed by subsidies and intervention, the overall impact would be very negative.

You can peruse lots of additional evidence at this Mercatus link. The bottom line is that the only argument for the Export-Import Bank is that it helps to perpetuate a corrupt insider scam.

But if you’re not a lobbyist, cronyist, corporate fat cat, or other form of insider, the Ex-Im Bank is a lose-lose proposition.