Regular readers know that I don’t approve of drug use, but that I also favor legalization because the Drug War has been a costly and ineffective failure.

(And it’s led to horrible policies such as intrusive money-laundering laws and Orwellian asset-forfeiture laws).

So I was happy when folks in Colorado voted to decriminalize marijuana use, even if part of me didn’t like the idea that politicians would gain a new source of tax revenue.

If nothing else, what’s happening in Colorado (and Washington state) will be an interesting social experiment.

And even though we only have a modest bit of data, I’m going to be bold and assert that we can already learn two lessons from what’s happened.

1. Politicians are so greedy that they set taxes too high.

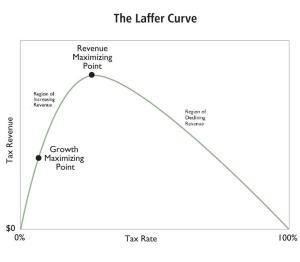

In the real world, there’s this thing called the Laffer Curve. And what it shows is that excessive tax rates don’t generate big piles of tax revenue because people change their behavior.

I’ve made this point before when dealing with personal income tax rates, corporate tax rates, capital gains taxes, and tobacco taxes.

I’ve made this point before when dealing with personal income tax rates, corporate tax rates, capital gains taxes, and tobacco taxes.

Simply stated, the political class is so anxious to get more of our money that they impose punitive tax rates that fail to generate the desired amount of revenue.

And it’s also true with taxes on marijuana.

But don’t believe me. Let’s look at some news sources about what’s happened in Colorado.

Here are some excerpts from a Daily Beast report.

According to the Colorado Department of Revenue, the state collected $44 million in taxes from recreational marijuana in 2014, $25 million less than predicted. …why did recreational marijuana sales in Colorado fall short? …Coloradoans bought less recreational marijuana than they could have… Looking at the taxes on cannabis in the state, it’s not hard to see why. Pot taxes in Colorado are steep. In Denver, for example, an eighth of cannabis can come with four taxes: an excise tax, regular sales tax, special sales tax (for pot retailers), and a special city tax. That equals a markup of roughly 30 percent. …many pot aficionados looked at the numbers and decided to stick with their medical marijuana programs or their other dealers.

Here’s some similar analysis from a New York Times article.

Colorado’s tax results underscore a big conflict facing public officials considering marijuana legalization. Taxes should be kept low if the goal is to eliminate pot’s black market. …Colorado has also shown that pot-smokers don’t necessarily line up to leave the tax-free black market and pay hefty taxes. If medical pot is untaxed, or if pot can be grown at home and given away as in Colorado, the black market persists.

And here are some passages from the Mic’s analysis.

David Huff…from Aurora, told the AP that the state’s taxes on marijuana, which increase the price of pot by 30 percent or more, are too, um, high. “I don’t care if they write me a check, or refund it in my taxes, or just give me a free joint next time I come in. The taxes are too high, and they should give it back,” Huff said. …only 60 percent of Coloradans obtained their marijuana through a legal exchange in 2014. Some buyers are using the state’s legal medical marijuana, which is untaxed, as a source for green, while others take advantage of Amendment 64’s provision allowing the personal use of as many as six marijuana plants. The products of those plants have flooded the black market, depriving Colorado of more taxable pot.

The bottom line is that politicians better figure out how to limit their greed if they truly want the legal market to function properly.

2. A spending cap ensures that new revenue won’t finance bigger government.

I’m a big fan of restraining the growth of government. Needless to say, this means I don’t like giving politicians new sources of revenue.

That’s my view on all of the proposals for new revenue that are percolating in the corridors of power, including energy taxes, financial taxes,value-added taxes, and wealth taxes.

But if there’s actually some sort of binding limit on the growth of government, then politicians can’t use new revenue to finance a more bloated public sector.

And thanks to the nation’s best expenditure limit, that’s the case in Colorado.

Here’s what Mic wrote on the topic.

Colorado’s state constitution limits how much tax money the state treasury can receive before having to return it to taxpayers. The provision, known as the Taxpayer Bill of Rights, or TABOR… Since Colorado’s economy has been growing as a faster rate than expected, the state underestimated its total revenue, which means Centennial State residents may soon get a cut of the estimated $50 million in taxes collected from the sale of recreational marijuana during its first year of legalization. …TABOR, passed in 1992, dictates that Colorado can’t spend revenue made from taxation if those revenues grow faster than the rate of inflation and population growth. That money, known as a TABOR bonus, must be refunded to taxpayers unless voters approve a revenue change. This amendment has netted Colorado taxpayers about $3.3 billion since 1992.

Let’s return to the Daily Beast story.

In a state with one of the strictest tax and expenditure limitations in the country, Colorado operates under a Taxpayer Bill of Rights called TABOR. According to the bill, refunds are to be considered when state tax revenues don’t match up to the state estimates. This year, owing to a slight rise in the economy, the overall revenue was higher.

Though you won’t be surprised to learn that politicians want to figure out a way of spending the money. Check out these passages from the aforementionedpiece in the New York Times.

Colorado will likely have to return to voters to ask to keep the pot tax money. That’s because of a 1992 amendment to the state constitution that restricts government spending. The amendment requires new voter-approved taxes, such as the pot taxes, to be refunded if overall state tax collections rise faster than permitted. Lawmakers from both parties are expected to vote this spring on a proposed ballot measure asking Coloradans to let the state keep pot taxes.

So both Republicans and Democrats will join hands in an effort to spend the money.

Gee, knock me over with a feather. What a surprise!

But let’s not focus on whether politicians want more of our money. Let’s learn from TABOR.

What it teaches us is that you get better policy when you limit the growth of government spending. And the closest thing we have to TABOR at the national level is the Swiss Debt Brake.

It’s worked very well in Switzerland because it puts the focus on the underlying problem of too much government. Notwithstanding the name, it limits the annual growth of spending, not the growth of debt.

The moral of the story is that when you address the real problem of too much spending, you automatically address the symptom of red ink.

And politicians presumably won’t have much incentive to impose higher taxes if they can’t use the money to buy votes with bigger government, so it’s a win-win situation!