I’ve often complained that government-created third-party payer is the main problem with America’s healthcare system, and I was making that point well before Obamacare was imposed upon the country.

The issue is very straightforward. In a genuine free market, people pay “out of pocket” for routine expenses. And they rely on insurance only in cases where they may face large, unexpected costs.

The issue is very straightforward. In a genuine free market, people pay “out of pocket” for routine expenses. And they rely on insurance only in cases where they may face large, unexpected costs.

But in our current healthcare system, thanks to Medicare,Medicaid, and the tax code’s healthcare exclusion, most of us buy services with other people’s money and that dramatically distorts incentives.

Here’s some of what I wrote about this messed-up approach back in 2009.

…our pre-paid health care system is somewhat akin to going to an all-you-can-eat restaurant. We have an incentive to over-consume since we’ve already paid. Except this analogy is insufficient. When we go to all-you-can-eat restaurants, at least we know we’re paying a certain amount of money for an unlimited amount of food. Many Americans, by contrast, have no idea how much of their compensation is being diverted to purchase health plans. Last but not least, we need to consider how this messed-up approach causes inefficiency and higher costs. We consumers don’t feel any need to be careful shoppers since we perceive that our health care is being paid by someone else. Should we be surprised, then, that normal market forces don’t seem to be working? …Imagine if auto insurance worked this way? Or homeowner’s insurance? Would it make sense to file insurance forms to get an oil change? Or to buy a new couch? That sounds crazy. The system would be needlessly bureaucratic, and costs would rise because we would act like we were spending other people’s money. But that’s what would probably happen if government intervened in the same way it does in the health-care sector.

As you can see, I’m frustrated.

I think the system is inefficient from an economic perspective. But I’m also a consumer, and I’m very dissatisfied whenever I have to deal with the healthcare system.

Fortunately, more and more people are adding their two cents on this topic.

Here’s some great analysis on the issue by Mark Perry of the American Enterprise Institute. He starts by pointing out how prices for health care generally climb much faster than the overall CPI price level.

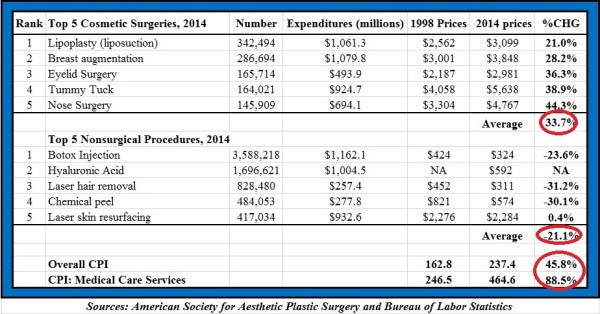

Between 1998 and 2014 the price of medical care services in the US (as measured by the BLS’s CPI for Medical Care Services) has increased by 88.5%, or more than twice the 45.8% increase in consumer prices in general over that period… On an annual basis, medical care costs in the US have increased more than 4% per year compared to an average inflation rate of only 2.4% over the last 16 years.

He then explains that a big problem is third-party payer, which eviscerates normal market forces.

As a result, consumers are relatively insensitive to price, which means producers and providers can charge more and be relatively inefficient.

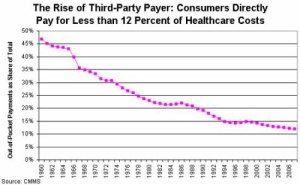

One of the reasons that medical care costs in the US have increased almost twice as much as general consumer prices since 1998 is that a large and increasing share of medical costs are paid by third parties (private health insurance, Medicare, Medicaid, Department of Veterans Affairs, etc.) and only a small and shrinking percentage is paid out-of-pocket by consumers. According to data from the Census Bureau, almost half (47%) of health care expenditures in 1960 were paid by consumers out-of-pocket, and by 1990 that share had fallen to 20% and by 2009 to only 12%. …Consumers of health care have no incentive to monitor prices and be cost-conscious buyers of medical services when they only pay 10% themselves, and the incentives of medical care providers to hold costs down are greatly reduced knowing that their customers aren’t price sensitive.

Mark then asks what the world would look like if the free market was allowed to function. And he identifies a niche in the healthcare system where that happens.

How would the market for medical services operate differently if consumers were paying out-of-pocket for medical procedures in a competitive market? Well, we can look to the $7.5 billion US market for elective cosmetic surgery for some answers.

And the information he shares is remarkable.

The table…shows the top five most popular surgical procedures and top five most popular non-surgical procedures for 2014, the number of each of those procedures performed last year, the total expenditures for each procedure, the average price per procedure both in 1998 and 2014, and the percent increase in price since 1998 for each procedure. …For the top ten most popular cosmetic procedures last year, none of them has increased in price since 1998 more than the 45.8% increase in consumer price inflation…, meaning the real price of all of those procedures have fallen over the last 16 years. …For three of the top five favorite non-surgical procedures in 2014 (botox, laser hair removal and chemical peel), the nominal prices have actually fallen since 1998 by large double-digit percentage declines of -23.6%, -31.2% and -30.1%. …none of the ten cosmetic procedures in the table above have increased in price by anywhere close to the 88.5% increase in medical care services since 1998.

Here’s Mark’s chart, and I’ve circled the relevant bits of data.

Just in case it’s not obvious, Mark then draws the should-be-obvious conclusions from this data.

Simply stated, when people spend their own money, they are careful shoppers. And when consumers are careful shoppers, that leads to competitive pressure on producers and providers to be much more efficient.

The competitive market for cosmetic procedures operates differently than the traditional market for health care in important and significant ways. Cosmetic procedures, unlike most medical services, are not usually covered by insurance. Patients paying out-of-pocket for cosmetic procedures are cost-conscious, and have strong incentives to shop around and compare prices at the dozens of competing providers in any large city. Because of that market competition, the prices of almost all cosmetic procedures have fallen in real terms since 1998, and some non-surgical procedures have even fallen in nominal dollars before adjusting for price changes. In all cases, cosmetic procedures have increased in price by less than the 88.5% increase in the price of medical care services between 1998 and 2014.

That last sentence is the key. Because of third-party payer, overall health care expenses have climbed about twice the rate of inflation.

For cosmetic surgery, where normal market forces operate thanks to an absence of government-imposed and government-subsidized third-party payer, prices climb slower than overall inflation.

Here’s an Economics 101 video on the problem of third-party payer.

As you can see, Obamacare made the problem worse, but it’s just one small part of a really big problem caused by decades of government intervention.