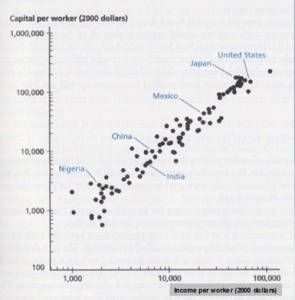

The most compelling graph I’ve ever seen was put together by Andrew Coulson at the Cato Institute. It shows that there’s been a huge increase in the size and cost of the government education bureaucracy in recent decades, but that student performance has been stagnant. But if I had to pick a graph that belongs in second place, it would be this relationship between investment and labor compensation.

But if I had to pick a graph that belongs in second place, it would be this relationship between investment and labor compensation.

The clear message is that workers earn more when there is more capital, which should be a common-sense observation. After all, workers with lots of machines, technology, and equipment obviously will be more productive (i.e., produce more per hour worked) than workers who don’t have access to capital.

And in the long run, worker compensation is tied to productivity.

This is why the President’s class-warfare proposals to increase capital gains tax rates, along with other proposals to increase the tax burden on saving and investment, are so pernicious.

The White House claims that the “rich” will bear the burden of the new taxes on capital, but the net effect will be to discourage capital investment, which means workers will be less productive and earn less income.

Diana Furchtgott-Roth of Economics 21 has some very compelling analysis on the issue.

President Obama will propose raising top tax rates on capital gains and dividends to 28 percent, up from the current rate of 24 percent. Prior to 2013, the rate was 15 percent. Mr. Obama seeks to practically double capital gains and dividend taxes during the course of his presidency, a step that would have negative effects on investment and economic growth. …the middle class would be harmed by higher capital gains tax rates, because capital would be more likely to go offshore. …[a] higher rate would have negative effects on the economy by reducing U.S. investment or driving it overseas. If firms pay more in capital gains taxes in America, they would make fewer investments — especially in the businesses or projects that most need capital — and they would hire fewer workers, many of them middle-class. Higher capital gains taxes would reduce economic activity, especially financing for private companies, innovators, and small firms getting off the ground. Taxes on U.S. investment would be higher compared with taxes abroad, so some investment capital is likely to move offshore.

At this point, I want to emphasize that the point about higher taxes in America and foregone competitiveness isn’t just boilerplate.

According to Ernst and Young, as well as the Organization for Economic Cooperation and Development, the United States has one of the highest tax rates on capital gains in the entire developed world.

The only compensating factor is that at least these destructive tax rates aren’t imposed on foreign investors. Yes, it’s irritating that our tax code treats U.S. citizens far worse than foreigners, but at least we benefit from all the overseas capital being invested in the American economy.

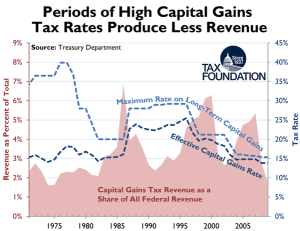

By the way, Diana also points out that higher capital gains tax rates may actually lose revenue for the simple reason that investors can decide to hold assets rather than sell them.

Here’s some of what she wrote, accompanied by a chart from the Tax Foundation.

…higher capital gains tax rates rarely result in more revenue, because capital gains realizations can be timed. When rates go up, people hold on to their assets rather than selling them, expecting that rates will go down at some point. …Capital gains tax revenues rose after 1997, when the rate was reduced from 28 percent to 20 percent, and again after 2003, when rates were reduced further to 15 percent… The decline in rates resulted in higher tax receipts from owners of capitals, as they sold assets, giving funds to Uncle Sam.

Yes, the Laffer Curve is alive and well.

Not that Obama cares. If you pay close attention at the 4:20 mark of this video, you’ll see that he wants higher capital gains tax rates for reasons of spite.

But I don’t care about the revenue implications. I care about good tax policy. And in an ideal tax system, there wouldn’t be any tax on capital gains.

It’s a form of double taxation with pernicious effects, as the Wall Street Journalexplained back in 2012.

…the tax on the sale of a stock or a business is a double tax on the income of that business. When you buy a stock, its valuation is the discounted present value of the earnings. …If someone buys a car or a yacht or a vacation, they don’t pay extra federal income tax. But if they save those dollars and invest them in the family business or in stock, wham, they are smacked with another round of tax. Many economists believe that the economically optimal tax on capital gains is zero. Mr. Obama’s first chief economic adviser, Larry Summers, wrote in the American Economic Review in 1981 that the elimination of capital income taxation “would have very substantial economic effects” and “might raise steady-state output by as much as 18 percent, and consumption by 16 percent.” …keeping taxes low on investment is critical to economic growth, rising wages and job creation. A study by Nobel laureate Robert Lucas estimates that if the U.S. eliminated its capital gains and dividend taxes (which Mr. Obama also wants to increase), the capital stock of American plant and equipment would be twice as large. Over time this would grow the economy by trillions of dollars.

John Goodman also has a very cogent explanation of the issue.

…why tax capital gains at all? …The companies will realize their actual income and they will pay taxes on it. If the firms return some of this income to investors (stockholders), the investors will pay a tax on their dividend income. If the firms pay interest to bondholders, they will be able to deduct the interest payments from their corporate taxable income, but the bondholders will pay taxes on their interest income. …Eventually all the income that is actually earned will be taxed when it is realized and those taxes will be paid by the people who actually earned the income. ……why not avoid all these problems by reforming the entire tax system along the lines of a flat tax? The idea behind a flat tax can be summarized in one sentence: In an ideal system, (a) all income is taxed, (b) only once, (c) when (and only when) it is realized, (d) at one low rate.

And if you want to augment all this theory with some evidence, check out the details of this comprehensive study published by Canada’s Fraser Institute.

For more information, here’s the CF&P video I narrated, which explains why the capital gains tax should be abolished.