Over the past few years, Hillary Clinton has taken advantage of several opportunities to demonstrate that she doesn’t understand economics.

Though that’s not a problem. I have friends who routinely demonstrate their economic ignorance by saying things that don’t make sense.

The problem is that Hillary may actually wind up in a position of power. So there’s a danger that the entire nation could be victimized because of her disregard of the laws of supply and demand.

Let’s look at a fresh example. The New York Times has a story about Ms. Clinton’s latest effort to bribe people with their own money.

Hillary Rodham Clinton on Monday will propose major new spending by the federal government that would help undergraduates pay tuition at public colleges without needing loans. …her proposals…would cost $350 billion over 10 years…about $175 billion in grants would go to states that guarantee that students would not have to take out loans to cover tuition at four-year public colleges and universities.

To make matters worse, some of this money would be used to bribe states into additional spending (sort of the higher-education version of Obamacare’s Medicaid scam).

In return for the money, states would have to end budget cuts to increase spending over time on higher education, while also working to slow the growth of tuition, though the plan does not require states to cap it.

And to make matters even worsier (yes, that’s a made-up word, but it seems appropriate), there’s a big tax increase to finance Ms. Clinton’s new scheme.

Mrs. Clinton would pay for the plan by capping the value of itemized deductions that wealthy families can take on their tax returns.

I don’t like distortionary tax preferences, but loopholes should be eliminated as part of a shift to a low-rate flat tax, not to finance the vote-buying schemes of the crowd in Washington.

But let’s set aside the concerns about fiscal policy and focus on what Clinton’s plan would mean for higher education.

And we’ll start with a thought experiment. Imagine you sold cars and the government decided to give people lots of money to buy your products.  In the world of economics, this causes the “demand curve” to shift to the right.

In the world of economics, this causes the “demand curve” to shift to the right.

Now answer a simple question: Would car prices under this policy (a) increase, or (b) decrease?

The obvious answer is (a). That’s certainly what has happened in the healthcare sector because of programs such as Medicare and Medicaid. That also happened in housing last decade thanks to bad monetary policy and corrupt Fannie Mae and Freddie Mac subsidies.

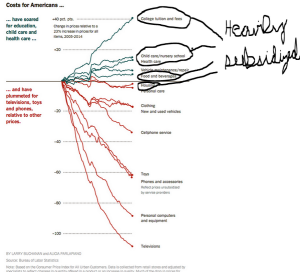

Moreover, there’s lots of evidence that the same thing already has happened with higher education. And now there’s new research that reaches the same conclusion.

As pointed out by the Wall Street Journal, recent scholarly data confirms that colleges and universities jack up prices to capture the additional subsidies.

Politicians…their solutions—cheap loans and taxpayer cash—end up increasing the cost of a degree. The latest evidence that schools jack up tuition to absorb federal money comes in a new report from the Federal Reserve Bank of New York. …The Fed researchers looked at how colleges responded when Congress bumped up per pupil aid limits between 2006 and 2008. Sure enough, students took out more loans, but universities gobbled up most of the money. Ohio University economist Richard Vedder connected these dots a decade ago, estimating in 2006 that every dollar of grant aid raised tuition 35 cents. He now looks prescient. The New York Fed study found that for every new dollar a college receives in Direct Subsidized Loans, a school raises its price by 65 cents. For every dollar in Pell Grants, a college raises tuition by 55 cents. This is one reason tuition has outpaced inflation every year for decades, while the average borrower now finishes college owing more than $28,000.

So what’s the bottom line? What will happen if Hillary Clinton expands subsidies to higher education?

Simple, more government subsidies will mean more wasteful inefficiency and higher costs.

Administrative bloat, reduced faculty loads and Shangri La dorms… College will continue to be expensive as long as government aid amounts to a wealth transfer to universities.

In other words, Ms. Clinton’s plan will double down on the policies (described inthis video) that already have made college needlessly expensive.

All she’s doing is shifting more of the cost onto the backs of taxpayers. Fortunately, there is a solution to this mess. Simply get the federal government out of the education business. This would reverse the bad policies that have caused colleges and universities to become more expensive and less efficient.

Fortunately, there is a solution to this mess. Simply get the federal government out of the education business. This would reverse the bad policies that have caused colleges and universities to become more expensive and less efficient.

Sadly, this ideal approach probably won’t be adopted anytime soon.

But that doesn’t mean progress is impossible. Washington may actually move policy a bit in the right direction. And Elizabeth Warren (yes, that Elizabeth Warren) may even play a constructive role.

As reported by the Wonkblog section of the Washington Post, there’s growing interest in a plan to make colleges and universities partly responsible when students default on loans.

A coalition of liberal and conservative lawmakers is promoting a plan on Capitol Hill that would force colleges to pay up when their students default. If schools share the risk of borrowing or have some “skin in the game,” policymakers figure they would work harder to keep costs down….Senate Democrats, led by Elizabeth Warren (D-Mass.) and Jack Reed (D-R.I.), introduced legislation in 2013 requiring schools with default rates above 15 percent to reimburse the government 5 percent of the total defaulted debt. The higher the default rate, the higher the penalty. …Congressional Republicans are renewing the call for schools to share the risk of borrowing, as are presidential hopefuls Wisconsin Gov. Scott Walker and Ben Carson. The policy is being considered as a part of the re-authorization of the Higher Education Act.

The story even has some very sensible economic analysis about how third-party payer should be blamed for rising prices.

As it stands, there is little incentive for colleges to keep costs under control. As long as there is a supply of students and federal financial aid, both for-profit and nonprofit schools can charge high prices and encourage people to take out loans to cover the cost. If schools had a financial stake in every student’s ability to repay loans, they might be less inclined to saddle students with debt in the first place—or they might lower costs altogether.

Gee, what a shocking thought. If people have to play with their own money rather than taxpayer money, they suddenly behave more responsibly!