With all of the GOP presidential candidates proposing varying plans to reduce the tax burden and reform the tax system, I’m constantly asked which one is best.

But that’s hard to answer because all of the proposals have features I like…as well as some features that leave me underwhelmed, or perhaps even worried.

My fantasy proposal is to have no income tax, or any broad-based tax, because we shrink the federal government to less than 5 percent of economic output (which is what existed for much of our nation’s history).

But since most of my fantasies won’t happen (at least in the near future), my intermediate goal is to junk the current tax system and replace it with a simple and fair flat tax, which would mean a low tax rate, no double taxation, and no corrupt and distorting tax preferences.

The bad news is that there hasn’t been a stampede by candidates to embrace this type of fundamental tax reform. But the good news is that they all want to move in that direction.

The best site for seeing what the various candidates are proposing is the Tax Foundation, and you can click here to learn everything that you need to know about their plans. There’s less detail, but the Committee for a Responsible Federal Budget also has a helpful summary that can be perused here.

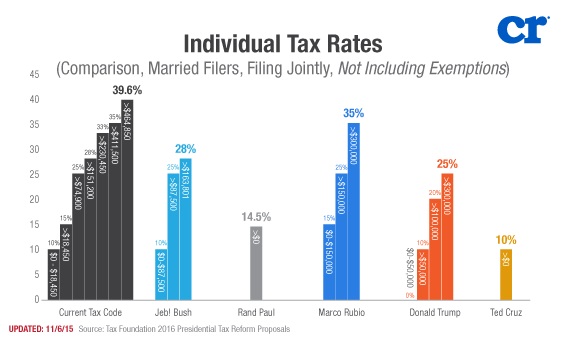

Conservative Review put together some useful graphs to compare the major plans. Here’s the tax rate structure for households.

Though this is not very accurate since the value-added taxes in the plans put forth by Rand Paul and Ted Cruz mean the real tax rates on labor income would actually be 29 percent and 26 percent, respectively.

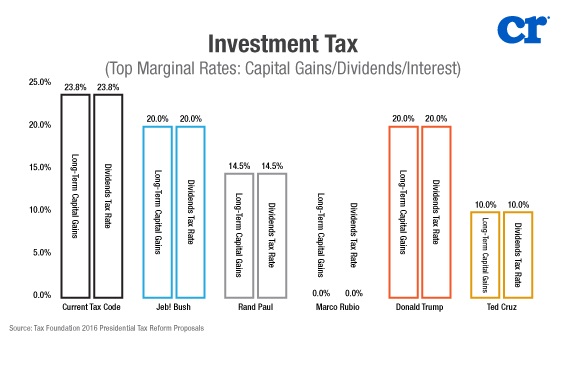

And here’s the degree of double taxation in the major plans.

What stands out in this chart is the fact all the candidates want to reduce double taxation, but Marco Rubio’s plan gets rid of that pernicious practice completely.

There are lots of additional metrics. Most of the candidates abolish the death tax, which is a very damaging form of double taxation.

They all lower or eliminate the corporate income tax.

Most of the candidates also replace depreciation with expensing, thus ensuring the proper treatment of business investment.

And the candidates generally scale back on favoritism in the tax code, particularly the deduction for state and local taxes.

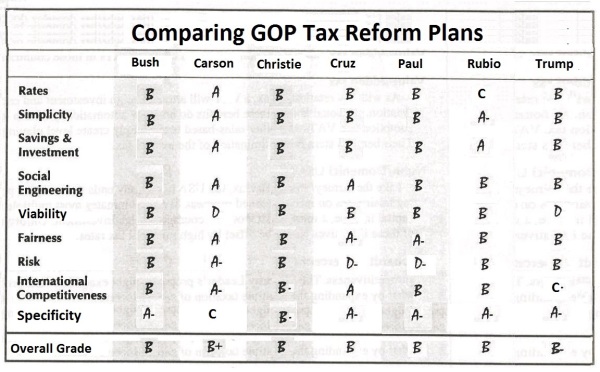

To summarize, the plans have lots of good features, but none of them are perfect. Which is why they all get similar grades. Here’s my back-of-the-envelope assessment (with apologies to John Kasich, Rick Santorum, Mike Huckabee, Carly Fiorina, etc, since I imposed my own arbitrary cutoff on which candidates merited close consideration).

Ben Carson gets the best grade because he says he wants a pure flat tax. But he doesn’t get an A because there are no details. In theory, you don’t need a lot of details because the plan is so simple, but the fact that he hasn’t even pinned down the rate (it was 10 percent, but is now 15 percent) leaves me uncertain. Moreover, he hasn’t put forth many details on how to reduce the burden of government spending, which would be necessary to make a low-rate flat tax viable.

By the way, Carly Fiorina would probably get a grade similar to Carson since she’s talked generically about a pure flat tax, and Rick Santorum’s more detailed support for a not-quite-pure flat tax also merits applause.

Jeb Bush and Chris Christie are almost identical (and John Kasich probably would be in the same category) because they make good progress (but not great progress) in almost all areas of the tax code.

Rand Paul and Ted Cruz are more aggressive taking big steps in the right direction, but the value-added tax is a very worrisome feature of their plans.

Donald Trump has the biggest net tax cut, but seems to have no interest in controlling the burden of government spending. He also is the only candidate (to my knowledge) who doesn’t want to replace America’s anti-competitive worldwide tax system with a territorial tax regime.

And Marco Rubio is unique in that his plan is great on double taxation, but is a bit of a dud with regards to tax rates.

Last but not least, Mike Huckabee’s support for replacing the income tax with a national sales tax is theoretically appealing, but it’s either impractical (because there aren’t enough votes to repeal the 16th Amendment) or too risky (because the crowd in Washington would adopt a sales tax without completely repealing the income tax).