The standard argument against an easy-money policy is that it creates distortions in an economy that lead to either rapid increases in the price level, like we endured in the 1970s, or unsustainable asset bubbles, like we experienced last decade.

Those arguments are completely valid, but they only tell part of the story.

Central banks also should be criticized because “quantitative easing” and “zero interest rate policies” create major imbalances in capital markets.

A major new study from Swiss Re quantifies the damage to savers. Here are some excerpts from a CNBC report.

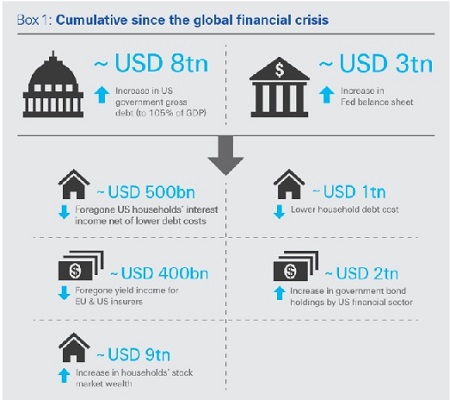

The Federal Reserve’s efforts to stimulate the U.S. economy after the financial crisis ended up costing savers nearly half a trillion dollars in interest income, according to report released Thursday. Since the central bank dropped interest rates to near zero at the end of 2008, savers have labored under plain-vanilla bank accounts and money market funds that have yielded close to nothing. …In a landmark report, Swiss Re quantifies just how much savers and others have languished… The reinsurance firm put the number at $470 billion in the 2008-13 period studied, so the number is likely even higher now. …”the impact of foregone interest income for households and long-term investors has become substantial.” …Swiss Re said the “financial repression” has taken its toll not only on savers but also on some areas of investing.

Here’s a chart from the Swiss Re report. As you can see, an easy-money policy is a massive tool for redistribution, with savers being hurt and government being subsidized.

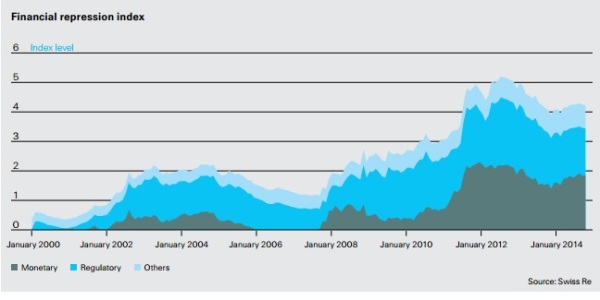

Indeed, Swiss Re actually calculates a “financial repression index.”

Financial repression reflects the ability of policymakers to direct funds to themselves that would otherwise go elsewhere.

And the level of this repression has been at record highs in recent years.

It is true that some households benefit from easy money and artificially low interest rates. Their debt expenses have been reduced and they also are enjoying higher asset values.

But those benefits may be fleeting if the end result is a bubble that bursts, as happened in 2008.

Writing for the Washington Times, my Cato colleague Richard Rahn agrees that central banks are hurting savers, but he augments this analysis by making the very important point that easy-money policies simply don’t work.

Government economic policymakers have been trying to solve a problem of too much government spending, taxing and regulation by inappropriately using monetary policy, which has not and cannot solve the fundamental problems (it is like using a hammer rather than a shovel to dig a hole). The major central banks have been holding down interest rates, which is actually a massive indirect tax levied on the world’s savers. Historically, savers would receive about 3 percent interest above the rate of inflation on their safest investments, but now interest rates often do not cover even the low inflation that is occurring in the developed countries. …Many economists expected savers to save less and consume more as a result of low or even negative interest rates… When businesses and individuals look at the world debt situation and the increased chances of another financial collapse, their rational response is to increase “precautionary” savings, even though they are not receiving interest on them.

So the bottom line is that central banks are engaging in “financial repression” today and creating risks of price instability and/or asset bubbles tomorrow.

But there’s no compensating benefit to make all these costs (and future risks) worthwhile.

That’s not a good deal.

So what’s the alternative?

In the short run, the best hope is that central bankers, including the ones at the Federal Reserve, will take their feet off the figurative gas pedal and follow some sort of monetary rule that precludes destructive intervention.

In the long run, the ideal answer would be a return to market-provided private currencies. This isn’t just silly libertarian fantasy. There actually have been countries that successfully used this “free banking” approach.

Professor Larry White has a must-read historical review of what happened before governments monopolized currency issue.

When we look into these episodes, we find a record of innovation, improvement, and success at serving money-users. As in other goods and services, competition provided the public with improved products at better prices. The least regulated systems were not only the most competitive but also by and large the least crisis-prone. …the record of these historical free banking systems, “most if not all can be considered as reasonably successful, sometimes quite remarkably so.”…Those systems of plural note issue that were panic prone, like those of pre-1913 United States and pre-1832 England, were not so because of competition but because of legal restrictions that significantly weakened banks. Where free banking was given a reasonable trial, for example in Scotland and Canada, it functioned well for the typical user of money and banking services.

The history of central banking, by contrast, is not nearly as successful. There’s been massive erosion in the value of money and central banks are largely responsible for the boom-bust cycle that has afflicted many economies.

At this point, you may be wondering why central banking triumphed over free banking if the latter is so superior.

The answer is simple. As Professor White explains, look at what’s in the best interest of the political elite.

Free banking often ended because the imposition of heavy legal restrictions or creation of a privileged central bank offered revenue advantages to politically influential interests. The legislature or the Treasury can tap a central bank for cheap credit, or (under a fiat standard) simply have the central bank pay the government’s bills by issuing new money. …Central banks primarily arose, directly or indirectly, from legislation that created privileges to promote the fiscal interests of the state or the rent-seeking interests of privileged bankers, not from market forces.

In other words, a system of competitive currencies is perfectly plausible, but it’s not in the interest of politicians (just as having no income tax is plausible, but also not in the interest of politicians).

For more information on free banking, here’s a CF&P video I narrated.

Professor White also has a good video explaining why a central bank isn’t needed.