I’m very fond of Estonia, and not just because of the scenery.

Back in the early 1990s, it was the first post-communist nation to adopt a flat tax.

More recently, it showed that genuine spending cuts were the right way to respond to the 2008 crisis (notwithstanding Paul Krugman’s bizarre attempt to imply that the 2008 recession was somehow caused by 2009 spending cuts).

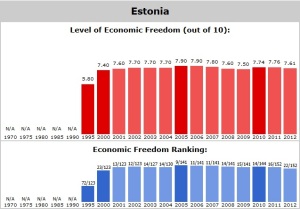

This doesn’t mean Estonia is perfect. It is ranked #22 byEconomic Freedom of the World, which is a respectable score, but that puts them not only behind the United States (#12), but also behind Switzerland (#4), Finland (#10), the United Kingdom (#12), Ireland (#14), and Denmark (#19).

This doesn’t mean Estonia is perfect. It is ranked #22 byEconomic Freedom of the World, which is a respectable score, but that puts them not only behind the United States (#12), but also behind Switzerland (#4), Finland (#10), the United Kingdom (#12), Ireland (#14), and Denmark (#19).

And you can see from the chart that Estonia’s overall score has dropped slightly since 2006.

But I don’t believe in making the perfect the enemy of the good. Estonia is still a reasonably good role model for reform, particularly for nations that emerged from decades of communist enslavement.

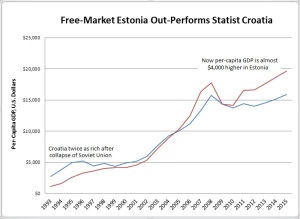

You can see how good policy makes a difference, for instance, by comparing Estonia with Croatia (#70). At the time of the breakup of the Soviet Empire, living standards in Croatia were low, but they were about twice as high as they were in Estonia. Today, though, per-capita economic output in Estonia is about $4000 higher than in Croatia.

At the time of the breakup of the Soviet Empire, living standards in Croatia were low, but they were about twice as high as they were in Estonia. Today, though, per-capita economic output in Estonia is about $4000 higher than in Croatia.

That’s a dramatic turnaround and it shows that markets are much better for people than statism. Sort of like the lesson we learn by comparing Poland (#48) and Ukraine (#122).

Let’s now take a closer look at one of the policies that has helped Estonia prosper. The flat tax was first adopted in 1994 and the rate was 26 percent. Since then, the rate has been gradually reduced and is now 20 percent.

For some people, the most amazing aspect of the Estonian flat tax is its simplicity, as noted by Kyle Pomerleau of the Tax Foundation.

Republican Presidential hopeful Jeb Bush claimed that it only takes 5 minutes to file taxes in Estonia. This claim was confirmed by a number of reporters and tax authorities in Estonia. For those of us that do our taxes by hand, this sounds like a dream. Depending on your situation, filing your taxes can tax a significant amount of time and due to the numerous steps involved (especially if you are claiming credits) may lead some to make errors. According to the IRS, it takes an average taxpayer with no business income 8 hours to fill out their 1040 and otherwise comply with the individual income tax. Triple that for those with business income.

For those keeping score, this means Estonia is kicking America’s derriere.

But Kyle is even more impressed by other features of the Estonian system.

…that it is not the best part of the Estonian tax code. The best part of the Estonian tax code has more to do with its tax base (what it taxes) rather than how fast people can pay their taxes. Specifically, the Estonian tax code has a fully-integrated individual and corporate income tax. This means that corporate income is taxed only once either at the entity level or at the individual level.

And this means Estonia’s flat tax is far better for growth than America’s system, which suffers from pervasive and destructive double taxation.

In total, the tax rate on corporate income is 20 percent in Estonia. Compare this to the integrated tax rate on corporate profits of 56 percent in the United States. Even more, this tax system provides de facto full expensing for capital investments because the corporate tax is only levied on the cash distributed to shareholders, which is also a significant boon to investment and economic growth.

Wow. No double taxation and expensing of business investment.

There is a lot to admire about Estonia’s sensible approach to business taxation.

Particularly when compared to America’s masochistic corporate income tax, which ranks below even the Greek, Italian, and Mexican systems.

Having the world’s highest statutory corporate tax rate is part of the problem. But as Kyle pointed out, the problem is actually far worse when you calculate how the internal revenue code imposes extra layers of tax on business income.

That’s why, at a recent tax reform event at the Heritage Foundation, I tried to emphasize why it’s economically misguided to have a tax bias against saving and investment.

The bottom line is that high taxes on capital ultimately lead to lower wages for workers.

———

Image credit: NakNakNak | Pixabay License.