The Obama Administration has already announced a bunch of tax increases that will be part of the President’s soon-to-be-released budget.

But, in a remarkable development, the White House has preemptively thrown in the towel and said that it will no longer pursue a proposed tax hike on 529 plans (IRA-type vehicles that allow parents to save for college education without being double taxed).

It’s obviously good news any time a tax hike is very unpopular, but this victory over Obama’s 529 plan has enormous implications.

Simply stated, it underscores a point I’ve been making for a long time about why opposing all tax hikes – particularly levies on the middle class – is critical if we want to have any chance of reforming and restraining the welfare state.

The Washington Examiner explores this development.

Obama’s abandonment of this relatively minor middle class tax-hike proposal suggests that liberals lack the spine to pursue their own long-term vision for America. …They have supported tax hikes on the wealthy to make deficits a bit smaller, but there are not enough wealthy people in America to fill the gap, nor can they be taxed at a high enough rate to pay for all the entitlement and social spending the Democrats want. Thus, Obama Democrats need large middle class tax hikes to sustain their vision for America’s future. Nothing else will work. And so if Obama is too scared to touch the favorite deductions of the middle class — whether it be the mortgage interest deduction or the 529 plan — then he is too scared to make his own long-term worldview a reality.

In other words, so long as we don’t give Washington any new sources of revenue, the left won’t be able to turn the United States into a European-style welfare state.

Peter Suderman of Reason has a similar assessment. Indeed, the title of his article is “How Obama’s 529 College Tax Plan Debacle Proves the Welfare State is Doomed.”

Here are some relevant passages.

…this is the sort of plan than inevitably follows from the long-term fiscal logic of the welfare state. …the existing welfare state is unaffordable. Either it will have to be cut, or reformed, or paid for—by someone, somehow. The administration and its allies would like to reassure you that the someones who will pay for all of this will be limited to the richest of the rich, but in practice there’s only so much money that can be squeezed out of the extremely wealthy. Which means that eventually, anyone looking for ways to keep the welfare state afloat will have to go after the middle class.

Writing for The Federalist, Robert Tracinskiechoes these sentiments.

…this is a desperate move by those who need to finance ever bigger government and are simply going where the money is: the vast American middle class. …There have already been trial balloons about raiding 401(k)s and IRAs. The truly committed leftist looks upon our private savings as a vast reserve of capital unfairly withheld from its proper function of servicing the needs of the state.

By the way, just in case you think Tracinski is exaggerating, just look at how governments in nations such as Poland and Argentina have seized private pension assets.

Returning to the topic at hand, here’s some of what Megan McArdle wrote forBloomberg.

…the administration has started scraping the bottom of the barrel when seeking out money to fund new programs. …We are simply running out of room to pay for generous new programs with higher taxes on the small handful of people who make many hundreds of thousands of dollars a year. I’m not saying that it’s impossible, politically or otherwise, to further raise their tax rates. I’m just saying that there’s not all that much money there left to get. …politicians will need to reach further down the income ladder in order to fund new spending — indeed, to fund the spending we’ve already done, in the form of entitlement promises. Where will they go for that money? Once you’ve hit your fiscal capacity to tax the rich, a few big sources of tax revenue are left: 1) A value-added tax. …2) Raising income taxes on the middle class. …3) Tax the savings of the middle class.

Last but not least, Ramesh Ponnuru of National Review reiterated his view that the welfare state desperately needs tax money from the middle class.

…everyone who has looked at the budget projections for the next few decades understands that, absent a sudden reduction in Americans’ life expectancy or other shocking development, middle-class -benefits are going to have to be cut, middle-class taxes are going to have to be raised, or both. The war between liberals and conservatives over the future of the welfare state is largely a matter of how much of each will be done. …government cannot realistically make up much of its long-term financing gap by raising taxes on the rich. A tax-heavy solution to that gap will eventually have to rely on much higher taxes on the middle class. That’s how they finance large welfare states in other developed countries. European social democracies don’t generally have much higher taxes on corporations or high earners than the United States. The chief difference between their tax policies and ours is that they levy value-added taxes that hit consumption.

Having cited several astute writers, let’s now draw the appropriate conclusion.

Without question, the moral of the story is that anybody who genuinely and seriously favors limited government should be unalterably opposed to any and all tax hikes.

And if you don’t believe all the folks cited above, perhaps because most of them lean to the right, then maybe you’ll be convinced by the fact that many leftists agree that you can’t finance big government without big tax hikes, particularly on the middle class.

The one big difference is that they want those tax hikes because of their support for bigger government.

The one big difference is that they want those tax hikes because of their support for bigger government.

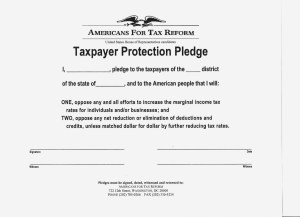

Which should be added evidence about the importance of resisting all tax increase. Heck, the no-tax-hike pledge is an IQ test for Republicans. Those that fail – such as Jeb Bush – should not be promoted to positions where they can cause damage.

Here’s what I wrote about this issue earlier this month. I was commenting on proposals for a new energy tax, but my analysis applies to any scheme for more revenue.

…the left understands very well that their spending agenda requires more revenue. That’s why Obama is relentless in urging more revenue. It’s why the leftists at the Paris-based OECD endlessly urge higher taxes in America (even to the point of arguing that tax-financed redistribution is somehow good for growth). And it’s why the DC establishment is so enamored with “bipartisan” tax-hiking budget deals, which inevitably lead to bigger government and more debt. Honoring the no-tax-hike pledge isn’t a sufficient condition to rein in big government, but it sure is a necessary condition. Amazingly, top Democrats even admit that their top political goal is to seduce Republicans into supporting higher taxes.

Let’s close with some thought experiments.

American needs genuine entitlement reform. But how likely is it that we’ll see the right kind of changes to programs such as Medicare and Medicaid if politicians instead manage to impose a value-added tax? What incentive would they have to do the right thing if they instead have the option of constantly increasing the VAT rate, as we’ve seen in Europe?

Or what are the odds of good Social Security reform if politicians enact some sort of energy tax. Why improve America’s retirement system, after all, if they have a new source of revenue and they have the option of continuously tweaking the rate upwards to prop up the current system?

What are the chances of getting a good spending cap, something akin tothe Swiss debt brake, if politicians succeed in getting some sort of financial transactions tax? Why deal with the problem of excessive government if there’s a new revenue source that can be periodically increased.

The left certainly understand that new revenue is necessary for their agenda. But does the right grasp the obvious implications?

This post already is very long, so I’m going to stop here. But those who are interested in more information should check out the postscripts below.

P.S. Some folks argue that Bill Clinton’s 1993 tax hike is “evidence” that higher taxes can lead to deficit reduction rather than higher spending, but Clinton’s own Office of Management and Budget produced data in early 1995 showing that assertion is false.

P.P.S. In my lifetime, there’s been a Democratic President with sensible views on tax policy.

P.P.P.S. It’s theoretically possible to put together a good fiscal deal involving more revenue, but only in the sense that it’s theoretically possible that I’ll be offered a $5-million contract to play for the Yankees next year.

P.P.P.P.S. The only exception to my no-tax-hike views is that I’m willing to allow higher taxes that are targeted solely on people who endorse higher taxes.