Sometimes the best way to help the cause of freedom is to stop a bad idea. And that’s why I’m vociferously opposed to a value-added tax.

Here’s what I wrote today for National Review. I start by explaining that it’s a bad idea to give Washington a big new tax to finance a larger burden of government spending.

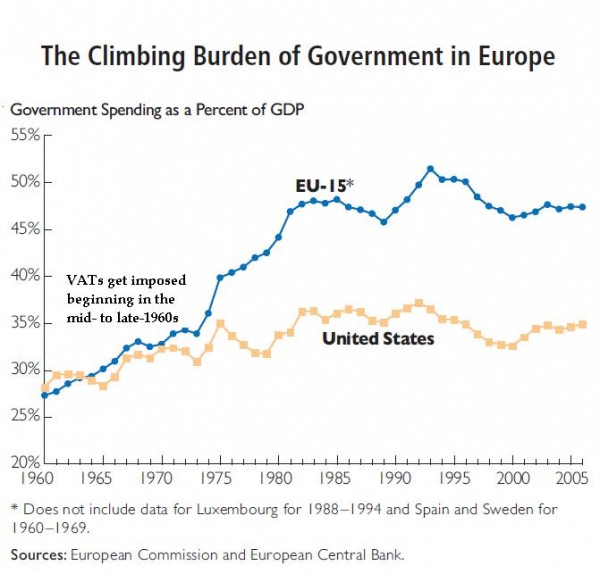

It’s especially good news that the United States has resisted the value-added tax (VAT), which is tempting because of its revenue-generating capacity. …Hostility to the VAT is justified by the European experience. Back in the mid 1960s, the burden of government spending in Europe was only slightly above the American level. But as VATs were implemented, the welfare state expanded, and now government consumes a much higher share of economic output on the other side of the Atlantic.

European politicians embraced the VAT because it’s the only way to finance leviathan-sized government.

…there’s a limit to how much revenue can be generated by an income tax. As honest leftists will admit (at least off the record), the Laffer Curve is real. …Indeed, income-tax revenues (personal and corporate) average less than 12 percent of GDP in OECD nations. …In other words, the only effective way to finance European-sized government is to have European-style taxation. Which is exactly why the Left desperately wants a VAT.

I then express dismay that a couple of very attractive candidates have inserted this pernicious tax in their otherwise good proposals.

…some conservatives think the VAT is an acceptable risk if it’s part of a bigger tax-reform plan. Senators Rand Paul and Ted Cruz, for instance, both have proposals that would lower personal-income-tax rates, reduce double taxation of income that is saved and invested, and eliminate corporate income taxes and payroll taxes. …Paul and Cruz would offset some of the revenue loss by imposing VATs.

The two Senators actually have good plans, at least on paper. My concern is about what happens once either one of them left the White House.

…something that looks pretty on a blackboard might not be so appealing once you add the sordid reality of politics to the equation. To be blunt, unless there’s a magic guarantee that principled conservatives such as Rand Paul and Ted Cruz (and their philosophical clones) would always hold the presidency, a VAT would be a very risky gamble. …What happens in the future when a statist wins the White House? …Raising the VAT rate would be a comparatively simple option for our hypothetical left-wing president. And because it has such a broad tax base (all “value added” in the economy, including wages paid to workers), even small rate increase would generate a lot of revenue to finance bigger government. …And I’m sure this future statist president also would boost tax rates on the “rich” and also impose higher levels of double taxation.

Incidentally, any good tax reform plan can be distorted by bad politicians in the future. But the downside risk of a VAT is monumentally greater because of its revenue-generating capacity.

…there’s a downside risk to other types of tax reform. But it’s a matter of magnitude. If we did something like Ben Carson’s flat tax or the more incremental tax-reform plans of Jeb Bush and Marco Rubio, it’s obviously possible for a future leftist to undo those reforms, in which case we could degenerate back to the current system. That’s obviously bad news, but it’s not nearly as bad as what might happen with the Cruz and Paul plans. When the wrong politicians got back in charge, they’d restore all the bad features of the income tax and also use the VAT as a money machine to expand the welfare state. And when the dust settles, we’d be France.

I realize that some people won’t believe what I just wrote. Maybe you lean left and you’re used to dismissing my arguments. Or maybe you’re a huge fan of Rand Paul or Ted Cruz and you think I’m somehow trying to knock them down because of some sinister agenda.

So maybe you’ll be more persuaded when a left-leaning columnist reaches the same conclusion. Here is some of what Catherine Rampell just wrote for the Washington Post.

Ted Cruz and Rand Paul have a really compelling tax proposal. …an interesting, serious and provocative idea: a value-added tax. …The VAT is also one of the first proposals out of the International Monetary Fund’s bag of tricks for countries that need to raise money. …it’s good these candidates have given voice to The Tax That Dare Not Speak Its Name. There’s only so much revenue a country can wring out of an income tax system, particularly one as Swiss-cheesed as ours. A well-designed VAT could help get our fiscal house in order.

This must be some sign of harmonic convergence. We both recognize that Paul and Cruz are proposing a VAT, and we both understand that there’s a limit to how much money can be raised from an income tax, and we both concur that a VAT will give politicians a way of dramatically boosting the tax burden.

But we don’t really agree. Because I’m horrified about the prospect of a new tax whereas Ms. Rampell thinks the VAT would be good because she favors bigger government.

By the way, Catherine confirms one of the fears I expressed in my article. The VAT would actually lead politicians to make the income tax even worse because of their fixation on distributional issues.

The main downside of a VAT is that it hurts the poor more than the rich, because the poor spend a larger share of their incomes on basic necessities. There’s an easy way to counteract that problem, though: Just make the income tax system more progressive.

By the way, while she’s right that the VAT is a money machine for big government, I can’t resist pointing out a mistake in her column.

Unlike an income tax, it doesn’t discourage saving or working

No, that’s not true. One of the good features of a VAT (assuming all other taxes could be abolished) is that it would generate revenue in a way that minimizes the negative impact on incentives.

But it would still drive a wedge between pre-tax income and post-tax consumption.

This is also the case for the flat tax. A “good” tax system is only “pro growth” in the sense that it does less damage than the current system.

Just in case you haven’t reached the point of VAT exhaustion, here’s my video explaining why the VAT is such a bad idea.

But if you don’t want to spend a few minutes watching a video, just keep this image in mind anytime sometime tells you we should roll the dice and adopt a VAT.

P.S. None of this suggests that Rand Paul and Ted Cruz should be rejected by voters. All candidates have some warts. I like the Jeb Bush tax plan, but I’m worried by his failure to take the no-tax pledge. I like the Marco Rubio tax plan, but I’m not a big fan of his big tax credits for kids. And I could come up with similar complaints about other candidates.

All I’m saying is that Paul and Cruz have one part of their agenda that should be jettisoned.