It’s not very often that I applaud research from the International Monetary Fund.

That international bureaucracy has a bad track record of pushing for tax hikes and other policies to augment the size and power of government (which shouldn’t surprise us since the IMF’s lavishly compensated bureaucrats owe their sinecures to government and it wouldn’t make sense for them to bite the hands that feed them).

But every so often a blind squirrel finds an acorn. And that’s a good analogy to keep in mind as we review a new IMF report on the efficacy of “expenditure rules.”

The study is very neutral in its language. It describes expenditure rules and then looks at their impact. But the conclusions, at least for those of us who want to constrain government, show that these policies are very valuable.

In effect, this study confirms the desirability of my Golden Rule! Which is not why I expect from IMF research, to put it mildly.

Here are some excerpts from the IMF’s new Working Paper on expenditure rules.

In practice, expenditure rules typically take the form of a cap on nominal or real spending growth over the medium term (Figure 1). Expenditure rules are currently in place in 23 countries (11 in advanced and 12 in emerging economies).

Such rules vary, of course, is their scope and effectiveness.

Many of them apply only to parts of the budget. In some cases, governments don’t follow through on their commitments. And in other cases, the rules only apply for a few years.

Out of the 31 expenditure rules that have been introduced since 1985,

10 have already been abandoned either because the country has never complied with the rule or because fiscal consolidation was so successful that the government did not want to be restricted by the rule in good economic times. … In six of the 10 cases, the country did not comply with the rule in the year before giving it up. …In some countries, there was the perception that expenditure rules fulfilled their purpose. Following successful consolidations in Belgium, Canada, and the United States in the 1990s, these countries did not see the need to follow their national expenditure rules anymore.

But even though expenditure limits are less than perfect, they’re still effective – in part because they correctly put the focus on the disease of government spending rather than symptom of red ink.

Countries have complied with expenditure rules for more than two-third of the time. …expenditure rules have a better compliance record than budget balance and debt rules. …The higher compliance rate with expenditure rules is consistent with the fact that these rules are easy to monitor and that they immediately map into an enforceable mechanism—the annual budget itself. Besides, expenditure rules are most directly connected to instruments that the policymakers effectively control. By contrast, the budget balance, and even more so public debt, is more exposed to shocks, both positive and negative, out of the government’s control.

One of the main advantages of a spending cap is that politicians can’t go on a spending binge when the economy is growing and generating a lot of tax revenue.

One of the desirable features of expenditure rules compared to other rules is that they are not only binding in bad but also in good economic times. The compliance rate in good economic times, defined as years with a negative change in the output gap, is at 72 percent almost the same as in bad economic times at 68 percent. In contrast to other fiscal rules, countries also have incentives to break an expenditure rule in periods of high economic growth with increasing spending pressures. … two design features are in particular associated with higher compliance rates. …compliance is higher if the government directly controls the expenditure target. …Specific ceilings have the best performance record.

And the most important result is that expenditure limits are associated with a lower burden of government spending.

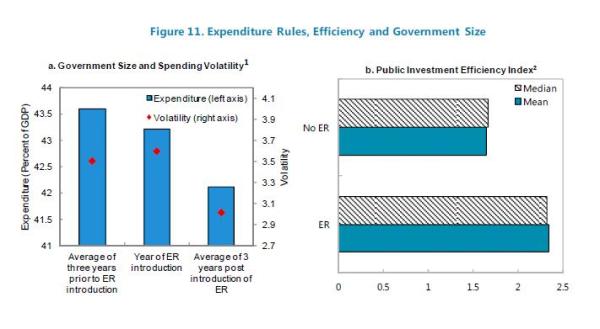

The results illustrate that countries with expenditure rules, in addition to other rules, exhibit on average higher primary balances (Table 2). Similarly, countries with expenditure rules also exhibit lower primary spending. …The data provide some evidence of possible implications for government size and efficiency. Event studies illustrate that the introduction of expenditure rules is indeed followed by smaller governments both in advanced and emerging countries (Figure 11a).

Here’s the relevant chart from the study.

And it’s also worth noting that expenditure rules lead to greater efficiency in spending.

…the public investment efficiency index of DablaNorris and others (2012) is higher in countries that do have expenditure rules in place compared to those that do not (Figure 11b). This could be due to investment projects being prioritized more carefully relative to the case where there is no binding constraint on spending

Needless to say, these results confirm the research from the European Central Bank showing that nations with smaller public sectors are more efficient and competent, with Singapore being a very powerful example.

One rather puzzling aspect of the IMF report is that there was virtually no mention of Switzerland’s spending cap, which is a role model of success.

Perhaps the researchers got confused because the policy is called a “debt brake,” but the practical effect of the Swiss rule is that there are annual expenditures limits.

So to augment the IMF analysis, here are some excerpts from a report prepared by the Swiss Federal Finance Administration.

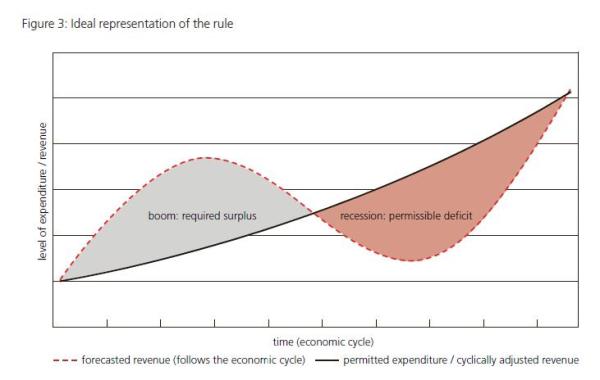

The Swiss “debt brake” or “debt containment rule”…combines the stabilizing properties of an expenditure rule (because of the cyclical adjustment) with the effective debt-controlling properties of a balanced budget rule. …The amount of annual federal government expenditures has a cap, which is calculated as a function of revenues and the position of the economy in the business cycle. It is thus aimed at keeping total federal government expenditures relatively independent of cyclical variations.

Here’s a chart from the report.

And here are some of the real-world results.

The debt-to-GDP ratio of the Swiss federal Government has decreased since the implementation of the debt brake in 2003. …In the past, economic booms tended to contribute to an increase in spending. …This has not been the case since the implementation of the fiscal rule, and budget surpluses have become commonplace. … The introduction of the debt brake has changed the budget process in such a way that the target for expenditures is defined at the beginning of the process, which must not exceed the ceiling provided by the fiscal rule. It has thus become a top-down process.

The most important part of this excerpt is that the debt brake prevented big spending increases during the “boom” years when the economy was generating lots of revenue.

In effect, the grey-colored area of the graph isn’t just an “ideal representation.” It actually happened in the real world.

Though the most important and beneficial real-world consequence, which I shared back in 2013, is that the burden of government spending has declined relative to the economy’s productive sector.

This is a big reason why Switzerland is in such strong shape compared to most of its European neighbors.

And such a policy in the United States would have prevented the trillion-dollar deficits of Obama’s first term.

By the way, if you want to know why deficit numbers have been lower in recent years, it’s because we actually have been following my Golden Rule for a few years.

So maybe it’s time to add the United States to this list of nations that have made progress with spending restraint.

But the real issue, as noted in the IMF research, is sustainability. Yes, it’s good to have a few years of spending discipline, but the real key is some sort of permanent spending cap.

Which is why advocates of fiscal responsibility should focus on expenditure limits rather than balanced budget requirements.