Even though I fret about a growing burden of government and have little faith in the ability (or desire) of politicians to make wise decisions, I somehow convince myself that good things will happen.

Here’s some of what I wrote two years ago, when asked whether I thought America could be saved from a Greek-style fiscal collapse.

I think there’s a genuine opportunity to save the country. …we can at least hold the line and prevent government from becoming bigger than it is today. Sort of a watered-down version of Mitchell’s Golden Rule. The key is the right kind of entitlement reform.

But in that same article, I also issued this warning.

I may decide to give up if something really horrible happens, such asadoption of a value-added tax. Giving politicians a big new source of revenue, after all, would cripple any incentive for fiscal restraint.

To be blunt, imposing a big national sales tax – in addition to the income tax – would be a horrible defeat for advocates of limited government. A VAT wouldlead to more spending and more debt.

And that’s when folks might consider looking for escape options because America’s future will be very grim.

Here’s a video I narrated on why the value-added tax is awful public policy.

Thankfully, I’m not the only one raising the alarm.

In a recent editorial, the Wall Street Journal wisely opined on the huge downside risk of a value-added tax.

It’s the hottest trend among tax collectors, raising a gusher of revenue for spendthrift governments worldwide. …a new report from accounting firm Ernst & Young says that VAT “systems are spreading” around the world and “rates are rising.”

By the way, the comment about “rates are rising” is an understatement, as illustrated by the table prepared by the Heritage Foundation.

Politicians love VATs both because they generate huge amounts of revenue and because the tax is hidden in the price of products and thus can be increased surreptitiously.

The WSJ explains.

The VAT is a sort of turbo-charged national sales tax on goods and services… Politicians love it because it is the most efficient revenue-raiser known to man, and its rates can be raised gradually to finance new entitlements or fill budget holes. The VAT is typically introduced with a low rate but then moves up over time until it swallows huge chunks of national economies. …Because VATs are embedded in the price of products, they can often rise unnoticed by the consumer, which is why liberals love them as a vehicle for periodic stealth tax hikes.

And in this case, “periodic” is just another way of saying “whenever politician want more money.”

And if recent history is any indication, “whenever” is “all the time.”

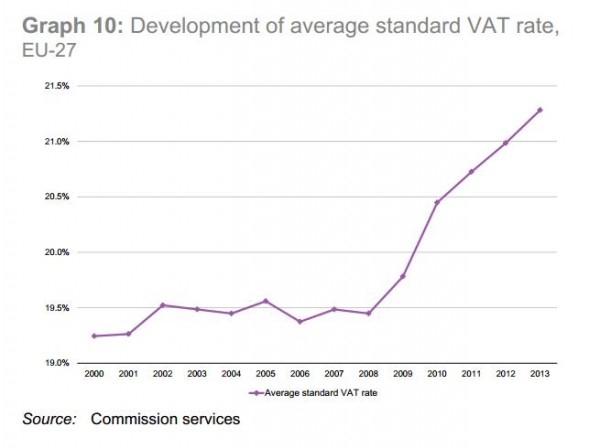

E&Y says standard VAT rates now average a knee-buckling 21.6% in the European Union, up from 19.4% in 2008. Average standard rates in the industrial countries of the Organization for Economic Cooperation and Development have climbed to 19.2% from 17.8% in 2009. Japan is another example of the VAT upward ratchet. The Liberal Democratic Party tried to introduce the tax for years and finally succeeded with a 3% rate in 1989. Eight years later the shoguns raised it to 5%. Last year it climbed to 8%, whacking consumption and sending the economy back to negative growth.

The Japanese experience is especially educational since the VAT is a relatively new tax in that nation.

And here’s a chart showing what’s happened in the past few years to the average VAT rate in the European Union.

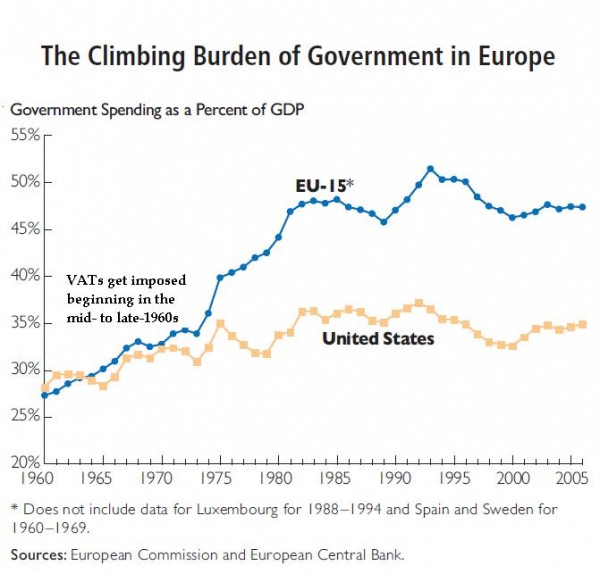

Now let’s look at another chart that is far more worrisome.

It shows that the burden of government spending in Europe, before VATs were adopted, wasn’t that much different than the fiscal burden of the public sector in the United States.

But once the VAT gave politicians a new source of revenue, spending exploded.

By the way, you won’t be surprised to learn that politicians increased spending even more than they increased taxes.

So not only did VATs lead to more spending, they also led to more debt. I guess that’s a win-win from the perspective of statists.

Let’s now return to the WSJ editorial. Proponents sometimes claim that VATs are neutral and efficient. That may be somewhat true in theory (just as an income tax, in theory, might be clean and simple), but in the real world, VATs simply make it possible for politicians to auction off a new source of loopholes.

…while VAT systems are often presented as models of simplicity that theoretically treat all goods and services alike, politicians can’t resist picking winners and losers, creating higher or lower rates for industries at their whim. “The politicians always start running with exemptions,” says E&Y’s Gijsbert Bulk.

Here’s the bottom line.

Americans, be warned. …don’t think it can’t happen here. Liberals campaign on soaking the rich, but they know there’s only so many rich to soak. To finance the growing entitlement state, they need a new broad-based tax that hits the middle class, where the big money is. That means either a VAT or a new energy tax, like the BTU tax Bill and Hillary Clinton proposed in 1993 or the cap-and-tax scheme that President Obama wanted.

The WSJ is correct. We need to be vigilant in the fight against the VAT.

But what makes this battle difficult is that some putative allies are on the wrong side.

Tom Dolan, Greg Mankiw, and Paul Ryan have all expressed pro-VAT sympathies. The same is true of Kevin Williamson, Josh Barro, and Andrew Stuttaford. And I’ve written that Mitch Daniels, Herman Cain, and Mitt Romney were not overly attractive presidential candidates because they expressed openness to the VAT.