I’m delighted that so many presidential candidates are talking about partial tax reform and I’ve specifically analyzed the plans put forth by Marco Rubio, Rand Paul, Jeb Bush, and Donald Trump.

These proposals all make the tax code less punitive, and that would be good news for job creation, growth, and American competitiveness.

But that doesn’t mean any of them are perfect. They all fall short of the pure flat tax, which is the gold standard for full tax reform. Another problem is that these proposals won’t be plausible or sustainable unless unaccompanied by someprudent plans to restrain the growth of federal spending.

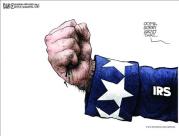

Today, though, I want to focus on another shortcoming. The various plans need to be augmented by long-overdue restrictions on the IRS, which has become and abusive and rogue bureaucracy.

Consider a few examples.

- The IRS goes beyond the law to make the system worse, as we saw when it imposed a regulation that forced U.S. banks to put foreign tax law above American tax law.

- Bureaucrats at the IRS then decided to ignore the text of the FATCA legislation and make up a different enforcement mechanism in order to salvage an unworkable and destructive law.

- Moreover, the IRS disregarded legislative text and arbitrarily rewrote the Obamacare legislation to enable additional subsidies.

- This is the bureaucracy that – in an odious display of bias – interfered with the electoral process by targeting the President’s opponents. And then awarded bonuses to itself after this corrupt behavior!

- The IRS also is one of the worst offenders in the government’s asset-forfeiture racket, which arbitrarily steals money from law-abiding citizens.

- While the IRS slaps harsh penalties and interest payments on taxpayers who make inadvertent errors, the agency is seemingly incapable of preventing massive fraud against taxpayers, routinely sending checks to crooks and con artists milking the system for EITC payments and false refunds.

- And the IRS (with help from negligent courts) routinely violates legal protections and civil liberties of American citizens.

These horror stories provide plenty of evidence that the internal revenue service should have its wings clipped.

But let’s add another straw to the camel’s back. The tax collection agency in the midst of an audit fight with Microsoft and the IRS is making a mockery of its own rules and flagrantly abusing the company’s legal rights.

This is bad news for one of America’s most successful firms, but it also is creating a very dangerous precedent that could victimize many other companies – large and small – in the future.

Writing for The Hill, CF&P President Andy Quinlan highlights some of the IRS’s most offensive actions.

First, the IRS is flouting its own rules as part of its persecution of Microsoft.

Government officials, counter to federal law, are trying to bully the company into extending an audit process that should have ended over 6 years ago. …Federal law provides a three-year time period for the completion of an audit, yet IRS officials have been digging through the company’s files for over nine years.

Second, the IRS won’t even tell the company how much money it wants!

Seattle-based Microsoft had to force a hearing on this matter because the IRS refused to submit a final tax bill to Microsoft for a dispute over taxes owed from 2004 to 2006. The IRS has been dragging out this audit process for close to a decade, and continues to pressure the company to sign waivers extending the audit infinitum.

Third, the IRS has been whining about supposedly inadequate budgets, but the bureaucrats are paying a private law firm millions of dollars to participate in this never-ending audit.

In 2014, the government in an unprecedented move hired Quinn Emanuel, a L.A.-based litigation firm to help audit the company. The IRS has billions in budget, teams of lawyers and accountants, yet they decided spend $2.2 million dollars outsourcing their legal team to lawyers that charge in excess of $1000 an hour. It should come as no shock to anyone following the IRS scandal that Quinn Emanuel is chock full of lawyers who are also large contributors to the party in power.

Fourth, the IRS’s rogue behavior may become standard practice if the bureaucrats don’t face any repercussions for stepping over the line.

This fight actually has little to do with Microsoft. It has everything to do with the prospect of the IRS abusing power, wasting taxpayer money and setting dangerous precedents for enforcement against small businesses. …The actions of the IRS that put this matter into court threatens to set a dangerous precedent on the power of the federal government with regard to tax issues. Congress needs to protect citizens against IRS overreach, and now a potential new procedure that will allow private tax information to be shared with outside law firms.

Wow, what a damning indictment against a vindictive bureaucracy.

And while Microsoft is a big company with plenty of money to defend itself, this is still outrageous. Particularly since the IRS will employ these thuggish tactics against less powerful taxpayers if it isn’t slapped down for by either Congress or the courts.

By the way, I should say something about the underlying dispute. The IRS is not happy about the prices that Microsoft charged when doing intra-firm sales between the parent company and foreign subsidiaries.

Yet if the bureaucrats really think Microsoft abused the “transfer pricing” rules, then the IRS should come up with its own estimate and – if necessary – they can go to court to see who’s right.

Yet if the bureaucrats really think Microsoft abused the “transfer pricing” rules, then the IRS should come up with its own estimate and – if necessary – they can go to court to see who’s right.

For what it’s worth, I suspect the IRS isn’t presenting Microsoft with a bill precisely because the bureaucrats ultimately wouldn’t prevail in a legal fight. The agency probably hopes a never-ending audit eventually will force the company to voluntarily over-pay just to end the torture.

Since I’m a policy wonk, I can’t resist noting that the only reason this kind of dispute even exists is because the United States has the highest corporate tax rate in the entire world. So companies naturally seek to maximize the income they earn in other nations (sort of like entrepreneurs and investors decide it’s better to do business in low-tax states such as Texas rather than fiscal hellholes such as Illinois).

And there’s nothing wrong – legally or ethically – with taxpayers choosing not to overpay the federal government.

The IRS can, of course, ask politicians to change the law if their goal is to grab more money. But as explained by Brian McNicoll in a column for the Washington Times, it shouldn’t try to confiscate more loot with endless harassment and dubious tactics.

If Microsoft’s business strategies are a problem for the IRS, it is up to Congress to change the tax law. But as long as those strategies are legal, no one should question Microsoft for doing what it can to limit its tax obligation. …there is reason Congress gives the IRS three years — not eight and certainly not carte blanche to go on indefinitely. …If the IRS has something on Microsoft, by all means bring it forward. But if it doesn’t, it needs to close the books on this near-decade of harassment and send Microsoft a bill for its taxes.

Returning to our main point, this is why tax reform should be accompanied by reforms to rein in the IRS’s improper behavior.