The President today released his budget for fiscal year 2016, a document that also shows what will happen to taxes, spending, and red ink over the next 10 years if the White House’s budget is adopted.

Here are the four things that deserve critical attention.

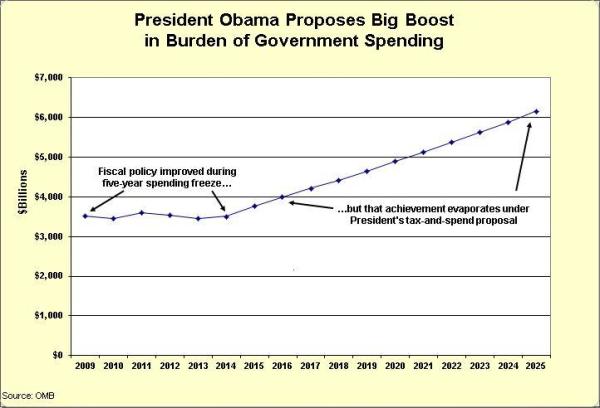

1. Obama proposes to have spending grow by an average of about 5.4 percent per year over the next five years and more than 5 percent annually over the next 10 years, well more than twice as fast as projected inflation.

Though it oftentimes doesn’t get sufficient attention, the change in government spending is the most important number (or set of numbers) in any budget. If the burden of spending is rising, regardless of whether that increase is financed by taxes or borrowing, more resources will be diverted from the economy’s productive sector.

In President Obama’s budget, he wants government spending in FY 2016 to be $3,999.5 billion, an astounding increase of 9.4 percent over the Congressional Budget Office’s estimate of $3,656 billion of spending in the current fiscal year (the President is proposing additional spending for FY 2015, so the annual increase between 2015-2016 in his budget is “only” 6.4 percent).

Even more troubling, he wants government spending to climb by more than twice as fast as inflation in future years. And most worrisome of all, he wants government to grow faster than the private sector, which means that the burden of government spending will climb as a share of GDP, both over the next five years and the next 10 years.

The challenge for the GOP: In part because spending rose so much in 2009, but also in part because Congress waged important fiscal battles over debt limits, shutdowns, and sequestration, there was a de facto spending freeze between 2009 and 2014. Unfortunately, spending is climbing by at least twice the rate of inflation in 2015, and Obama wants additional big increases in the future. It will be very revealing to see whether Republican control of both the House and Senate means policy moves back in the direction of spending restraint.

2. The President wants to renege on the 2011 debt limit agreement by busting the spending caps.

With great fanfare in 2011, the White House and Congress agreed to boost the debt limit, but only because both parties agreed on some modest caps to control the growth rate of discretionary spending.

But these spending caps don’t allow outlays to rise as fast as the President would prefer, so he is explicitly seeking to eviscerate the caps and allow bigger increases. These spending hikes would enable for defense spending and more domestic spending.

The challenge for the GOP: The spending caps and sequestration represent President Obama’s most stinging defeat on fiscal policy, so it’s hardly a surprise that he wants to gut any restraint on his ability to spend. This presumably should be a slam-dunk victory for Republicans since they can simply refuse to change the law. But there are some GOPers who want more defense spending, and even some who want more domestic spending. Indeed, the pro-spending caucus in the Republican Party was one of the reasons why the spending caps were already weakened two years ago.

3. The White House’s new budget wants a new tax on American companies competing in world markets.

The good news is that the President no longer is proposing to get rid of “deferral,” a policy from past budgets that would have resulted in a 35 percent tax on profits earned by American multinationals in other nations (and already subject to tax by the governments of those other nations). The bad news is that he instead wants to tax all previously accumulated foreign-source income at 14 percent and then tax all future foreign-source income at 19 percent.

To make matters worse, he wants to use this new pot of money to finance expanded federal involvement and interference in transportation and infrastructure.

The challenge for the GOP: Some Republicans favor more transportation spending from Washington and some companies may be tempted to acquiesce to some sort of deal, particularly if it only applies to accumulations of prior-year foreign-source income. Advocates of good policy in Congress should not enable a bigger federal role in transportation. Indeed, the only good policy is to phase out federal involvement and eliminate the federal gas tax.

4. President Obama wants class-warfare based increases in the death tax and the capital gains tax.

In addition to many other tax hikes in his budget, the President wants to boost the capital gains tax rate to 28 percent and he also wants to expand the impact of the death tax by eliminating a policy that acknowledges the actual value of assets when they are received by children and other heirs.

Since there shouldn’t be any double taxation of income that is saved and invested, both the death tax and capital gains tax should be abolished. Needless to say, increasing either tax would have a negative impact on the American economy.

The challenge for the GOP: Hopefully this policy will be deemed “dead on arrival.” Republicans presumably should be united in their opposition to class-warfare tax increases.