This century has not been good news for economic liberty in the United States.

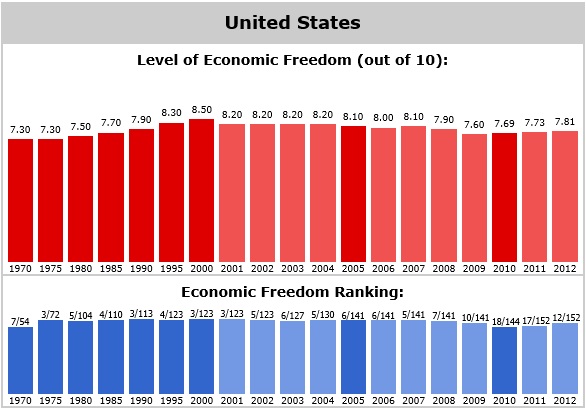

According to Economic Freedom of the World, America has dropped from being the 3rd-freest economy of the world in 2001 to the 12th-freest economy in themost recent rankings.

Perhaps more important, our aggregate score has fallen from 8.20 to 7.81 over the same period.

So why has the U.S. score dropped? Was it Bush’s spending binge? Obama’sstimulus boondoggle? All the spending and taxes in Obamacare? The fiscal cliff tax hike?

I certainly think all those policies were mistaken, but if you dig into the annual data, America’s score on “size of government” only fell from 7.1 to 7.0 between 2001 and 2012.

Which means economic freedom in the United States mostly declined for reasons other than fiscal policy. In other words, our score dropped because of what happened to our scores for trade policy, monetary policy, regulatory policy, and property rights and rule of law.

That triggered my curiosity. If America is #12 in the overall rankings, how would we rank if fiscal policy was removed from the equation?

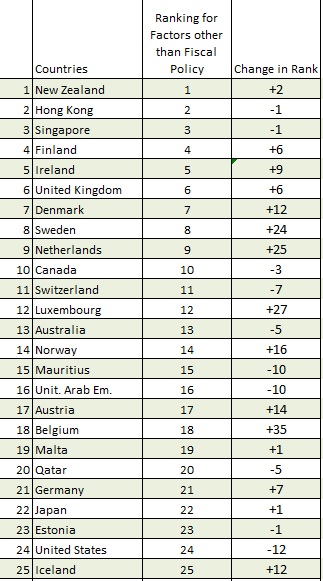

Here are the results, showing the top 25 jurisdictions based on the four non-fiscal policy factors. As you can see, the United States drops from #12 to #24, which means we trail 14 European nations in these important measures of economic freedom.

If you look in the second column, you’ll notice how many of those European nations have double-digit increases when you look at their non-fiscal rankings compared to their overall rankings.

This is for two reasons.

First, their fiscal scores are terrible because of high tax rates and a stifling burden of government spending.

Second, these same nations are hyper-free market on issues such as trade, regulation, money, rule of law and property rights.

In other words, the data back up points I’ve made about policy in nations such as Denmark and Sweden.

In an ideal world, countries should have free markets and small government. In Northern Europe, they manage to get the first part right. Which is important since non-fiscal factors account for 80 percent of a nation’s overall grade.

Now let’s return to the issue of America’s decline.

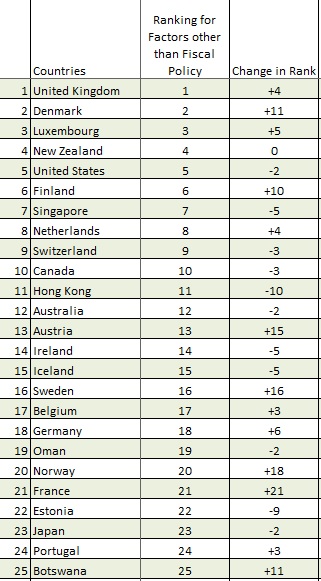

Here are the non-fiscal rankings from 2001. As you can see, the United States was #5 at the time, scoring higher than even Singapore and Hong Kong. And the U.S. was behind only three European nations back in 2001.

For what it’s worth, America’s score has fallen primarily because of a significant drop in the trade category (from 8.7 to 7.7) and a huge drop for rule of law and property rights (from 8.7 to 7.0).

In other words, it’s not good for prosperity when a nation begins to have problems such as protectionism and politicized courts.