Earlier this year, President Obama proposed a budget that would impose new taxes and add a couple of trillion dollars to the burden of government spending over the next 10 years.

The Republican Chairmen of the House and Senate Budget Committees have now weighed in. You can read the details of the House proposal by clicking hereand the Senate proposal by clicking here, but the two plans are broadly similar (though the Senate is a bit vaguer on how to implement spending restraint, as I wrote a couple of days ago).

So are any of these plans good, or at least acceptable? Do any of them satisfy my Golden Rule?

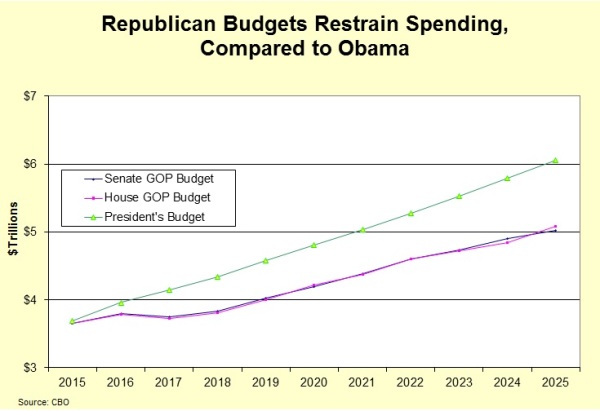

Here’s a chart showing what will happen to spending over the next 10 years, based on the House and Senate GOP plans, as well as the budget proposed by President Obama.

Keep in mind, as you look at these numbers, that economy is projected to expand, in nominal terms, by an average of about 4.3 percent annually.

The most relevant data is that the Republican Chairmen want spending to climb by about $1.4 trillion over the next decade (annual spending increases averaging about 3.3 percent per year), while Obama wants spending to jump by about $2.4 trillion over the same period (with annual spending climbing by an average of almost 5.1 percent per year).

At this point, some of you may be wondering how to reconcile this data with news stories you may have read about GOP budgets that supposedly include multi-trillion spending cuts?!?

The very fist sentence in a report from The Hill, for instance, asserted that the Senate budget would “cut spending by $5.1 trillion.” And USA Today had a storyheadlined, “House GOP budget cuts $5.5 trillion in spending.”

But these histrionic claims are based on dishonest math. The “cuts” only exist if you compare the GOP budget numbers to the “baseline,” which is basically an artificial estimate of how fast spending would grow if government was left on auto-pilot.

Which is sort of like a cad telling his wife that he reduced his misbehavior because he only added 4 new mistresses to his collection rather than the 5 that he wanted.

I explained this biased and deceptive budgetary scam in these John Stosseland Judge Napolitano interviews, and also nailed the New York Times for using this dishonest approach when reporting about sequestration.

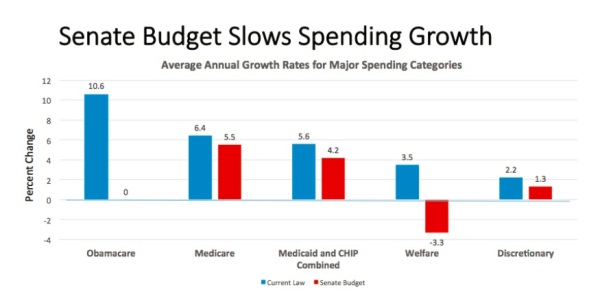

Interestingly, the Senate plan tries to compensate for this budgetary bias by including a couple of charts that properly put the focus on year-to-year spending changes.

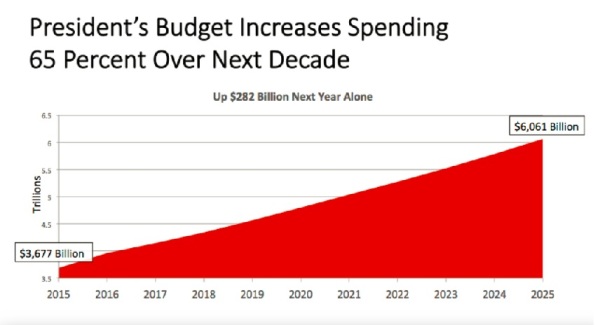

Here’s their chart on Obama’s profligate budget plan.

And here’s their chart looking at what happens to major spending categories based on the reforms in the Senate budget proposal.

So kudos to Chairman Enzi and his team for correctly trying to focus the discussion where it belongs.

By the way, in addition to a better use of rhetoric, the Senate GOP plan actually is more fiscally responsible than the House plan. Under Senator Enzi’s proposal, government spending would increase by an average of 3.25 percent per year over the next 10 years, which is better than Chairman Price’s plan, which would allow government spending to rise by an average of 3.36 percent annually.

Though both Chairman deserve applause for having more spending restraint than there was in the last two Ryan budgets.

But this doesn’t mean I’m entirely happy with the Republican fiscal plans.

Even though the two proposals satisfy my Golden Rule, that’s simply a minimum threshold. In reality, there’s far too much spending in both plans, and neither Chairman proposes to get rid of a single Department. Not HUD, not Education, not Transportation, and not Agriculture.

But the one thing that got me the most agitated is that the House and Senate proposals both indirectly embrace very bad economic analysis by the Congressional Budget Office.

Here’s some language that was included with the House plan (the Senate proposal has similar verbiage).

CBO’s analysis…estimates that reducing budget deficits, thereby bending the curve on debt levels, would be a net positive for economic growth. …The analysis concludes that deficit reduction creates long-term economic benefits because it increases the pool of national savings and boosts investment, thereby raising economic growth and job creation.

But here’s the giant problem. The CBO would say – and has said – the same thing about budget plans with giant tax increases.

To elaborate, CBO has a very bizarre view of how fiscal policy impacts the economy. The bureaucrats think that deficits are very important for long-run economic performance, while also believing that the overall burden of government spending and the punitive structure of the tax code are relatively unimportant.

And this leads them to make bizarre claims about tax increases being good for growth.

Moreover, the bureaucrats not only think deficits are the dominant driver of long-run growth, they also use Keynesian analysiswhen measuring the impact of fiscal policy on short-run growth. Just in case you think I’m exaggerating, or somehow mischaracterizing CBO’s position, check out page 12 of the Senate GOP plan and page 37 of the House GOP plan. You’ll see the “macroeconomic” effects of the plans cause higher deficits in 2016 and 2017, based on the silly theory that lower levels of government spending will harm short-run growth.

So hopefully you can understand why GOPers, for the sake of intellectual credibility, should not be citing bad analysis from the CBO.

But even more important, they should stop CBO from producing bad analysis is the future. The Republicans did recently replace a Democrat-appointed CBO Director, so it will be interesting to see whether their new appointee has a better understanding of how fiscal policy works.