Last week, I applauded the Chairmen of the House and Senate Budget Committees for proposing budgets that complied with my Golden Rule, which means the burden of government would grow slower than the private sector.

But my praise was limited because neither budget is ideal from the perspective of libertarians and small-government conservatives.

Even though the two proposals satisfy my Golden Rule, that’s simply a minimum threshold. In reality, there’s far too much spending in both plans, and neither Chairman proposes to get rid of a single Department. Not HUD, not Education, not Transportation, and not Agriculture.

Heck, the budgets don’t even go after low-hanging fruit such as the Small Business Administration, National Endowment for the Arts, Corporation for Public Broadcasting, or Legal Services Corporation.

And it turns out that there’s another reason to be semi-disappointed with the GOP budgets.

Stephen Ohlemacher of the Associated Press has a story on the Republican plans and he looks at one of the GOP’s most prominent claims.

The new House and Senate Republican budgets make a big boast: They both balance the federal budget within 10 years, without raising taxes.

But there are two problems with this assertion.

First, the GOPers are assuming that certain “temporary” tax breaks will expire. And this means more money for the government.

…millions of American families and businesses would have to pay more in taxes to make the math work…current law assumes that more than 50 temporary tax breaks that expired at the start of the year will not be renewed. …All together, the tax breaks add up to $898 billion over the next decade, according to CBO. …Most Republicans in Congress have voted numerous times to temporarily extend them. And over the past year, the Republican-controlled House has voted to make some of the more popular ones permanent.

Second, Republicans say they want to repeal Obamacare, but they want to keep all the revenue currently associated with the Obamacare tax hikes.

…they rely on more than $1 trillion in tax revenue from the health law that would supposedly be repealed. …In 2012, CBO said repealing the president’s health law would reduce tax revenues by $1 trillion over the following decade. That number has certainly gone up as more of the law’s tax increases have come into effect. But despite calling for the health law to be repealed, both budget resolutions include all the revenue that would come from the law’s taxes.

Both of these criticisms are valid.

Regardless of what you think about temporary tax provisions (some of them are good and some are special interest junk), letting these “extenders” expire is a way to boost the long-run revenue haul of the federal government. In an ideal world, by contrast, the good provisions would be made permanent and the bad ones would be repealed and the money used to finance good tax changes.

Similarly, while Republicans say they want to repeal the specific Obamacare tax hikes, that they don’t plan on letting go of the money. Which is just a way of saying that they are letting Obamacare boost the long-run revenue stream going to Washington.

By the way, this doesn’t mean that the GOP budgets are bad compared to current law. It simply means that they could – and should – be better. Specifically, they could incorporate lower tax levels and lower spending levels.

Which brings me to the part of the AP article that rubs me the wrong way. The headline, at least the one picked by Business Insider, says that eliminating red ink without a higher tax burden is “probably not possible.” And the language in the report is similar.

Balancing the federal budget is hard. Doing it without more tax revenue is even harder.

So why am I irked by this passage? Well, balancing the budget without new money for DC may be “harder” in the sense that it would require more spending restraint. And someone might be correct if they predicted that achieving balance is “probably not possible” because politicians are reluctant to exercise fiscal discipline.

But that doesn’t mean it can’t be done.

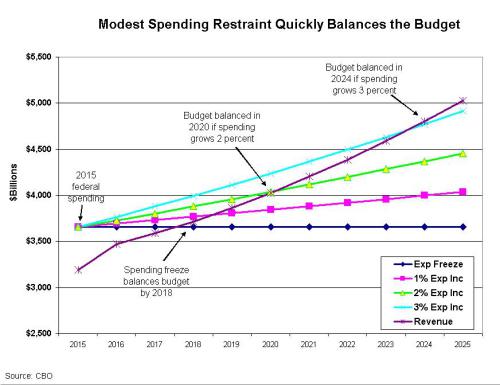

Earlier this year, I shared this chart showing how modest spending restraint can quickly balance the budget. As you can see, it’s actually very simple to get rid of red ink if politicians simply exercise a modest bit of fiscal discipline.

But I’ll admit that I used the Congressional Budget Office’s January projections of revenue, which assumed (like the GOP budgets) that the government would get revenues from the Obamacare tax hikes, as well as revenues from expiring provisions.

So does that mean that it’s impractical to balance the budget without all this added money going to DC?

Nonsense.

Let’s look at the numbers (and we now have new revenue projections from CBO, but they haven’t changed much) and see what happens if you remove the $2 trillion of revenues (over 10 years) associated with Obamacare and the extenders.

Since the revenue numbers climb over time, let’s assume that this means revenues will be $250 billion lower in 2025.

Does that cripple any hope of balancing the budget?

Hardly. It simply means that spending over the next 10 years could grow only about 2.7 percent per year rather than (as assumed in the House and Senate budgets) 3.3 percent per year.

So the bottom line is that we don’t need more revenue in Washington. We simply need more spending restraint.

P.S. By the way, this video explains why our goal should be smaller government, not fiscal balance.

That being said, there’s overwhelming evidence from nations all over the worldthat spending restraint is the best way to quickly reduce red ink.

———

Image credit: Andy Withers | CC BY-NC-ND 2.0.