With tax day looming, let’s wallow in misery by contemplating the burden on America’s taxpayers.

But we’ll ignore the angst caused be dealing with an indecipherable tax code and an oppressive IRS and simply focus on the amount of money that gets extracted from our income each year.

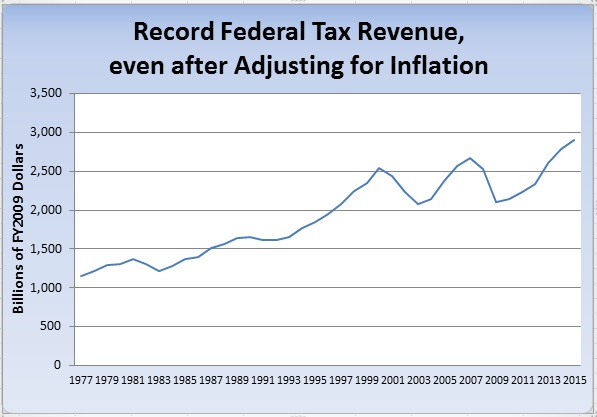

The bad news is that the federal government is collecting a record amount of money, even after adjusting for inflation. Here’s a chart, based on the latest numbers from the Office of Management and Budget.

But there is some good news. This isn’t a record tax burden when measured as a share of economic output.

Federal taxes are projected to consume 17.7 percent of GDP this year. That’s higher than the post-WWII average of 17.2 percent of GDP, but there have been several years in which the federal tax burden has been higher than 17.7 percent, most recently in 2007, when it reached 17.9 percent of economic output.

So while it’s bad news that the IRS is collecting a record amount of revenue in inflation-adjusted dollars, I guess we should consider ourselves lucky that it’s not a record share of GDP.

I discuss the growing federal tax burden in this CNBC debate with Jared Bernstein.

A few points are worth emphasizing from the interview, two of which deal with corporate taxation.

First, it’s silly to talk to compare “taxes by individuals” to “taxes paid by corporations.” That’s because all taxes on business ultimately are paid by individuals, whether as workers, consumers, or shareholders. To be blunt, corporations may collect taxes, but the burden inevitably falls on people.

Second, the fact that corporate tax receipts are lagging is a sign that tax rates are too high rather than too low. In other words, there’s a Laffer Curve effect, and there’s lots of evidence that a lower corporate rate will generate more revenue. Which is precisely what happened when personal tax rates were reduced on the “rich” in the 1980s.

Third, if we want a balanced budget, the only responsible approach is spending restraint. As I’ve noted before, our long-run fiscal challenge is because of a rising burden of spending. Indeed, spending is more than 100 percent of the long-run problem.

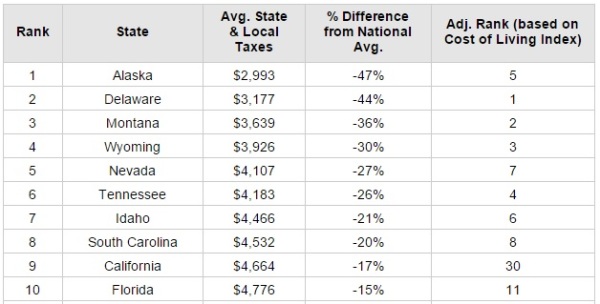

By the way, let’s not forget about the role of state and local governments. WalletHub just released a report on state and local tax burdens.

Here are the 10 best states.

I’m mystified to see California in the top 10.

Though maybe this is a Laffer Curve-based result. In other words, perhaps taxes are so high that people are paying less?

Moreover, the Golden State drops to 30 if you adjust for the cost of living (see column on far right).

Now here are the 10 worst states.

I’m not surprised to see Illinois in last place, but who knew that Nebraska was a hotbed of taxaholism?

And if you look at the right-most column, you’ll see that New York and Connecticut could be considered the worst states when adjusting for cost of living. Both jurisdictions are richly deserving of that designation.