Keynesian economics is a failure.

It didn’t work for Hoover and Roosevelt in the 1930s. It didn’t work for Japan in the 1990s. And it didn’t work for Bush or Obama in recent years.

No matter where’s it’s been tried, it’s been a flop.

So why, whenever there’s a downturn, do politicians resuscitate the idea that bigger government will “stimulate” the economy?

I’ve tried to answer that question.

Keynesian economics is the perpetual motion machine of the left. You build a model that assumes government spending is good for the economy and you assume that there are zero costs when the government diverts money from the private sector. …politicians love Keynesian theory because it tells them that their vice is a virtue. They’re not buying votes with other people’s money, they’re “stimulating” the economy!

I think there’s a lot of truth in that excerpt, but Sheldon Richman, writing forReason, offers a more complete analysis. He starts by identifying the quandary.

You can’t watch a news program without hearing pundits analyze economic conditions in orthodox Keynesian terms, even if they don’t realize that’s what they’re doing. …What accounts for this staying power?

He then gives his answer, which is the same as mine.

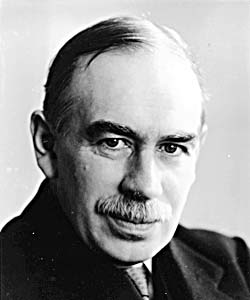

I’d have said it’s because Keynesianism gives intellectual cover for what politicians would want to do anyway: borrow, spend, and create money. They did these things before Lord Keynes published his The General Theory of Employment, Interest, and Money in 1936, and they wanted to continue doing those things even when trouble came of it.

Makes sense, right?

But then Sheldon digs deeper, citing the work of Professor Larry White of George Mason University, and suggests that Keynesianism is popular because it provides hope for an easy answer.

Lawrence H. White of George Mason University, offers a different reason for this staying power in his instructive 2012 book The Clash of Economic Ideas: The Great Policy Debates and Experiments of the Last Hundred Years: namely, that Keynes’s alleged solution to the Great Depression offered hope, apparently unlike its alternatives. …White also notes that “Milton Friedman, looking back in a 1996 interview, essentially agreed [that the alternatives to Keynesianism promised only a better distant future]. Academic economists had flocked to Keynes because he offered a faster way out of the depression, as contrasted to the ‘gloomy’ prescription of [F.A.] Hayek and [Lionel] Robbins that we must wait for the economy to self-correct.” …Note that the concern was not with what would put the economy on a long-term sustainable path, but rather with what would give the short-term appearance of improvement.

In other words, Keynesian economics is like a magical weight-loss pill. Some people simply want to believe it works.

Which is understandably more attractive than the gloomy notion the economyhas to go through a painful adjustment process.

But perhaps the best insight in Sheldon’s article is that painful adjustment processes wouldn’t be necessary if politicians didn’t make mistakes in the first place!

A related aspect of the Keynesian response to the Great Depression—this also carries on to the current day—is the stunning lack of interest in what causes hard times. Modern Keynesians such as Paul Krugman praise Keynes for not concerning himself with why the economy fell into depression in the first place. All that mattered was ending it. …White quotes Krugman, who faulted economists who “believed that the crucial thing was to explain the economy’s dynamics, to explain why booms are followed by busts.” …why would you want to get bogged down trying to understand what actually caused the mass unemployment? It’s not as though the cause could be expected to shed light on the remedy.

This is why it’s important to avoid unsustainable booms, such as thegovernment-caused housing bubble and easy-money policy from last decade.

Hayek, Robbins, and Mises, in contrast to Keynes, could explain the initial downturn in terms of the malinvestment induced by the central bank’s creation of money and its low-interest-rate policies during the 1920s. …you’d want to see the mistaken investments liquidated so that ever-scarce resources could be realigned according to consumer demand… And you’d want the harmful government policies that set the boom-bust cycle in motion to end.

Gee, what a radical notion. Instead of putting your hope in a gimmicky weight-loss pill, simply avoid getting too heavy in the first place.

For further information, here’s my video on Keynesian economics.