Obamacare resulted in big increases in the fiscal burden of government(ironically, it would be even worse if Obama hadn’t unilaterally suspended parts of the law).

The legislation increased government spending, mostly for expanded Medicaidand big subsidies for private insurance.

There were also several tax hikes, with targeted levies on medical device makers and tanning beds, as well as some soak-the-rich taxes on upper-income taxpayers.

These various policies are bad news for economic performance, but the damage of Obamacare goes well beyond these provisions.

Writing for Real Clear Markets, Professor Casey Mulligan of the University of Chicago explains that Obamacare contains huge implicit tax hikes on work and other forms of productive behavior.

…can we begin to take seriously the idea that the fiscal policies and regulations hidden in the Affordable Care Act are shrinking our economy? …Politicians and journalists use the term tax more narrowly than economists do, but the economic definition is needed to understand the economic effects of the ACA. …Withholding benefits from people who work or earn is hardly different than telling them to pay a tax. For this reason, economists refer to benefits withheld as “implicit taxes.” What really matters for labor market performance is the reward to working inclusive of implicit taxes, and not the amount of revenue delivered to the government treasury… The ACA…is full of implicit taxes. Many of them have remained hidden in the “fog of controversy” surrounding the law and their effects excluded from economic analyses of it.

In other words, his basic message is that the government reduces incentives to be more productive and earn more money when it provides handouts that are based on people earning less money.

Indeed, click here to see a remarkable chart showing how redistribution programs discourage work.

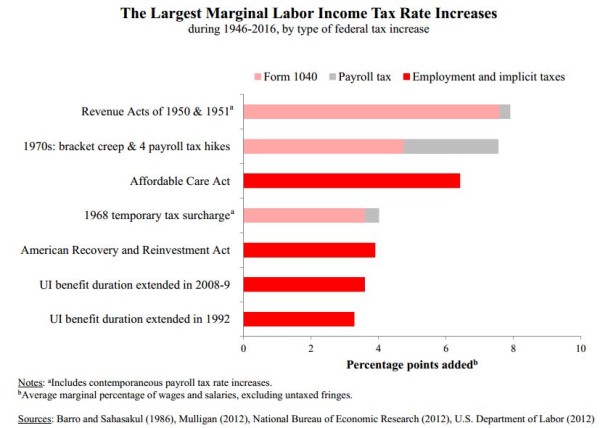

And speaking of charts, here’s one from Professor Mulligan’s article, and it shows the nation’s largest tax hikes based on what happened to the marginal tax rate on working.

Wow. No wonder we’re suffering from a very anemic recovery.

Professor Mulligan elaborates.

During a period that included more than a dozen tax increases, the ACA is arguably the largest as a single piece of legislation, adding about six percentage points to the marginal tax rate faced, on average, by workers in the economy. The only way to cite larger marginal tax increases would be to combine multiple coincident laws, such as the Revenue Acts of 1950 and 1951 and the new payroll tax rate that went into effect in 1950. Even with these adjustments, the ACA is still the third largest marginal tax rate hike during the seventy years. …Let’s not be surprised that, as we implement a new law that taxes jobs and incomes, we are ending up with fewer jobs and less income.

By the way, other academics also have found that Obamacare will lure many people out of the workforce and into government dependency.

The White House actually wants us to believe this is a good thing, as humorously depicted by this Glenn McCoy cartoon.

But rational people understand that our economic output is a function of how much labor and capital are being productively utilized.

In other words, Obamacare is a mess. It’s hurting the economy and should be repealed as the first step in a long journey back to market-based healthcare.

P.S. Mulligan’s chart also re-confirms that unemployment benefits increase unemployment. Heck, that’s such a simple and obvious concept that it’s easily explained in this Wizard-of-Id parody and this Michael Ramirez cartoon.