I’m ecumenical on tax reform. I’ll support any plan that rips up the internal revenue code and instead lowers tax rates, reduces double taxation, and cuts out distorting loopholes.

And as I explain in this interview, both the flat tax and national sales tax have a low tax rate. They also get rid of double taxation and they both wipe out therat’s nest of deductions, credits, exclusions, preferences, and exemptions.

You’ll notice, however, that I wasn’t very optimistic in the interview about the possibility of replacing the IRS with a simple and fair tax system.

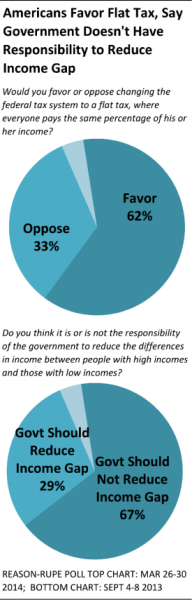

But perhaps I’m being needlessly gloomy. Newpolling data from Reason-Rupe show that there’s very strong support for reform. At least if you favor a flat tax.

But perhaps I’m being needlessly gloomy. Newpolling data from Reason-Rupe show that there’s very strong support for reform. At least if you favor a flat tax.

This doesn’t mean we can expect genuine tax reform tomorrow or the next day.

President Obama is viscerally committed to class-warfare tax policy, for instance, and special interest groups would vigorously resist if there was a real possibility (they would say threat) of scrapping the current tax code.

But it does suggest that tax reform – at least in the form of a flat tax – could happen if there was real leadership in Washington.

So maybe my fantasies will become reality!

And one of the best arguments for reform is that the internal revenue code is an unfair mess.

Consider how rich people are treated by the tax code. The system is so complicated that we can’t tell whether they’re paying too much (because ofhigh rates and pervasive double taxation) or paying too little (because of special preferences and tax shelters).

Regardless, we do know that they can afford lots of lobbyists, lawyers, and accountants. So even though they are far more likely to be audited, they have ample ability to defend themselves.

But the real lesson, as I explain in this CNBC interview, is that the right kind of tax reform would lead to a simple system that treats everyone fairly.

I’m also glad I used the opportunity to grouse about the IRS getting politicized and corrupted.

But I wish there had been more time in the interview so I could have pointed out that IRS data reveal that you get a lot more revenue from the rich when tax rates are more reasonable.

And I also wish I had seen the Reason-Rupe poll so I could have bragged that there was strong support for a flat tax.

Unfortunately, I wouldn’t have been able to make the same claim about the national sales tax. I haven’t seen any recent public opinion data on the Fair Tax or other similar plans, but a poll from last year failed to find majority support for such a proposal.

And a Reason-Rupe poll from 2011 showed only 33 percent support for a national sales tax.

That won’t stop me from defending the national sales tax. After all, it is based on the same principles as a flat tax.

But the polls do suggest (as do anecdotes from the campaign trail) that a flat tax is a more politically viable option for reformers.

The moral of the story is that it makes more sense to push for the flat tax. After all, if I have an easy route and a hard route to get to the same destination, why make life more difficult?

Though the ultimate libertarian fantasy is shrinking government back to what the Founding Fathers had in mind. Then we wouldn’t need any broad-based taxof any kind.