What’s the defining characteristic of our political masters?

Going all the way back to when they ran for student council in 6th grade, is it a craven desire to say or do anything to get elected?

Is it the corrupt compulsion to trade earmarks, loopholes, and favors in exchange for campaign cash?

Or is it the knee-jerk desire to buy votes by spending other people’s money?

The answer is yes, yes, and yes, but I want to add something else to the list.

One of the most odious features of politicians is that they think they’re entitled to all of our money. But it goes beyond that. They also think they’re doing us a favor and being magnanimous if they let us keep some of what we earn.

Think I’m joking or exaggerating?

Consider the fact that the crowd in Washington says that provisions in the internal revenue code such as IRAs are “tax expenditures” and should be considered akin to government spending.

So if you save for retirement and aren’t subject to double taxation, you’re not making a prudent decision with your own money. Instead, you’re the beneficiary of kindness and mercy by politicians that graciously have decided to give you something.

And the statists at the Washington Postwill agree, writing that folks with IRAs are getting “a helping hand” from the government.

Or if you have a business and the government doesn’t impose a tax on your investment expenditures, don’t think that you’re being left alone with neutral tax policy. Instead, you should get on your knees and give thanks to politicians that have given you a less-punitive depreciation schedule.

And the Congressional Budget Office, the Joint Committee on Taxation, and theGovernment Accountability Office will all agree, saying that you’re benefiting from a “tax expenditure.”

The same attitude exists in Europe. But instead of calling it a “tax expenditure” when taxpayers gets to keep the money they earn, the Euro-crats say it is a “subsidy” or a form of “state aid.”

Speaking at the European Competition Forum in Brussels, EU commissioner Joaquin Almunia said he would investigate whether moves by national governments to tailor their tax laws to allow companies to avoid paying tax had the same effect as a subsidy. Subsidising certain businesses could be deemed as anti-competitive, breaching the bloc’s rules on state aid. …The remarks by the Spanish commissioner’s, who described the practice of “aggressive tax planning” as going against the principles of the EU’s single market, are the latest in a series of salvos by EU officials aimed at clamping down on corporate tax avoidance. …He added that the practice “undermines the fairness and integrity of tax systems” and was “socially untenable.”

Needless to say, Senor Almunia’s definition of “fairness” is that a never-ending supply of money should be transferred from taxpayers to the political elite.

The head of the Paris-based Organization for Economic Cooperation and Development wants to take this mentality to the next level. He says companies no longer should try to legally minimize their tax burdens.

International technology companies should stop considering it their “duty” to employ tax-dodging strategies, said Angel Gurria, head of the Organization for Economic Cooperation and Development. …The OECD, an international economic organization supported by 34 member countries including the U.S., U.K., Germany and Japan, will publish the results of its research on the issue for governments to consider within the next two years, Gurria said.

And you won’t be surprised to learn that the OECD’s “research on the issue” is designed to create a one-size-fits-all scheme that will lead to companies paying a lot more tax.

But let’s think about the broader implications of his attitude about taxation. For those of us with kids, should we choose not to utilize the personal exemptions when filling out our tax returns? Should we keep our savings in a regular bank account, where it can be double taxed, instead of an IRA or 401(k)?

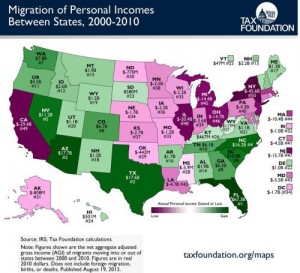

Should we not take itemized deductions, or even the standard deduction? Is is somehow immoral to move from a high-tax state to a low-tax state? In other words, should we try to maximize the amount of our income going to politicians?

Should we not take itemized deductions, or even the standard deduction? Is is somehow immoral to move from a high-tax state to a low-tax state? In other words, should we try to maximize the amount of our income going to politicians?

According to Mr. Gurria, the answer must be yes. If it’s bad for companies to legally reduce their tax liabilities, then it also must be bad for households.

By the way, it’s worth pointing out that bureaucrats at the OECD – including Gurria – are completely exempt from paying any income tax. So if there was an award for hypocrisy, he would win the trophy.