When I wrote recently that the IRS was corrupt, venal, and despicable, I didn’t realize that I was bending over backwards to be overly nice.

Every new revelation in the scandal shows that the agency is beyond salvage.

Writing for Real Clear Markets, Diana Furchtgott-Roth of the Manhattan Institute is appropriately skeptical of the IRS.

Coincidentally, Lerner’s computer crashed 10 days after Congress expressed concern about possible targeting of conservative groups. Emails between January 2009 and April 2011 were lost. Her computer is not available for examination, because it has already been recycled by the IRS. In a further coincidence, or not, a backup tape of agency emails made by the IRS was erased after 6 months. …As Georgia Republican Rep. Doug Collins said, the story sounds more and more implausible.

Diana then explains why this matters, using Obamacare as an example of why we should worry about a corrupt and politicized IRS.

Why should we care about missing emails from 2009 to 2011? As former Secretary of State Hillary Clinton said in a 2013 hearing about Benghazi, “What difference at this point does it make?” It is not just that Americans’ basic trust in the IRS is being called into question. Over the past five years the IRS has been concentrating its power, giving the agency increased opportunities to pick on people and groups it dislikes. …Sarah Hall Ingram, who was commissioner of the IRS’s Tax-Exempt and Government Entities Division from 2009 to 2012 during the Lois Lerner scandal, now heads the IRS Affordable Care Act Office. …Do Americans trust the IRS to calculate these subsidies and refunds impartially? The IRS already made a power grab in May 2012 by extending premium subsidies to the 34 states with federal exchanges.

She also points out that the IRS is carrying water for the President’s attempt to stifle opposing views.

…the IRS proposed regulations that would allow the agency to regulate the free speech of President Obama’s political opponents, while leaving the political activities of his friends untouched. …The regulations were targeted at tax-exempt organizations that file under 501(c)(4) of the IRS code… Under the new rules these groups would not be allowed to engage in voter education that mentions a candidate within two months of a general election or one month of a primary. Left untouched by the proposed regulations were unions, which file under 501(c)(5) of the Internal Revenue Code.

Stan Veuger of the American Enterprise Institute also is not persuaded by the IRS’s deceitful excuses.

The Internal Revenue Service (IRS) and the administration have consistently spouted lies and half-truths about the IRS scandal. The latest development in the controversy is that crucial emails have conveniently gone missing – is there any reason to believe that it is, as the administration claims, a mere accident? …This effort to keep conservative 501(c)(4) organizations from attempting to prevent president Obama’s reelection was, of course, hidden from the public. Ms. Lerner was careful to try and structure the IRS’ targeting in such a way that would not be appear to be a “per se political project,” in her own words, and denied in meetings with, and letters to, congressional oversight staff in 2012 that conservative groups were treated exceptionally or that the IRS’ ways of evaluating 501(c)(4)s had ever changed. The claims were false… In her response to a planted question from the audience at an American Bar Association tax conference, Ms. Lerner blamed the targeting of conservative groups on “our line people in Cincinnatti.” This has also turned out to be false. …non-Tea Party groups were never subjected to the same delays and investigations as Tea Party groups were. This once more suggest that obfuscation and dishonesty were central to the IRS’ approach to their targeting practices.

He even crunches some numbers to show that the claims from the IRS are utterly implausible.

It would be very helpful to see what communications took place between IRS officials and other Democrats. And this is where the missing emails come in. …They are gone, they now tell us, hard drives crashed and tapes were erased. Should we believe that? Of the 82 IRS employees tied to the targeting operation, 7 had their email disappear, or 8.5%. According to IRS commissioner John Koskinen, the industry standard is 3 to 5%. Under reasonable statistical assumptions, that makes the IRS scandal disappearance rate about as likely as the emails having been eaten by unicorn, with a probability far smaller than 1%. Given the IRS’ track record in this affair, that is way beyond anything that would justify giving the IRS and Lois Lerner the benefit of the doubt.

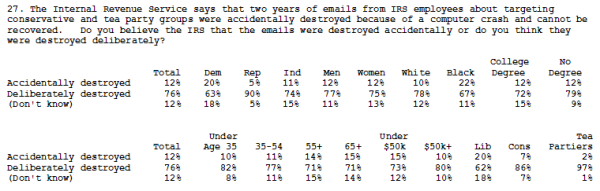

Amazingly, 12 percent of Americans believe the IRS. Here’s some polling data that Phil Kerpen shared on his twitter feed.

I’m particularly happy that younger people are more skeptical. They’re more tech-savvy and realize that the IRS’s excuses are a bunch of….well, a bunch of stuff that comes out of male cows.