I generally don’t feel a special degree of animosity for the internal revenue service. After all, it’s the politicians who have created the 74,000-plus page monstrosity of a tax code. Blaming the IRS for enforcing that system is like blaming the police for the drug war.

This isn’t to say the IRS is blameless. Just as cops sometimes take misguided laws and enforce them is bad ways, the IRS periodically will go beyond its legal mandate because of an enforcement-über-alles mentality.

But what gets me most upset is when the IRS allows itself – either with glee or reluctance – to become politicized.

For instance, the Washington Times reveals that the IRS may have violated taxpayer privacy by giving confidential taxpayer data to the political operatives in the White House.

The Internal Revenue Service may have given thousands of confidential filings from private taxpayers to the White House to review, a lawsuit against the Treasury Department just revealed. …“[T]he Treasury Inspector General for Tax Administration informed Cause of Action that there exist nearly 2,500 potentially confidential documents relating to investigations of improper disclosures of confidential taxpayer information by the IRS to the White House,” Cause of Action told The Daily Caller.

One possible example deals with the Obama Administration’s attack on the Koch brothers. As the Washington Examiner reported, Obama’s top economist at the time was the subject of an investigation.

The investigation by the Treasury Department Inspector-General for Tax Administration was sparked by Goolsbee’s remarks during an Aug. 27, 2010, White House news briefing in which he appeared to possess confidential tax information on Koch Industries, the private conglomerate controlled by the Koch brothers, Charles and David. …It is illegal for government officials to make public confidential tax information. Goolsbee was chief White House economist at the time. …senators requested the IG probe to determine if confidential tax records of individuals viewed by Obama as enemies were being passed around among senior staffers in the White House. …neither the report itself nor a summary of its findings have ever been made public.

Never made public? Gee, that’s mighty convenient.

It’s worth noting, by the way, that this isn’t the first White House to get in trouble for using the IRS as a political weapon.

…Section 6103 of the Internal Revenue Commission’s criminal code, which Congress enacted following revelations of President Nixon’s abuse of private tax information during the Watergate scandal. The second article of impeachment against Nixon in the House Judiciary Committee was based on those abuses.

So the ghost of Richard Nixon may approve of Obama, as suggested by this cartoon.

But this isn’t the only IRS scandal we need to monitor. Remember Lois Lerner, who became infamous for targeting the President’s opponents and then apparently losing her emails?

Well, we have an update. The Wall Street Journal opines on the latest development in the IRS targeting scandal.

…the IRS never “lost” emails after all. …Treasury Department Inspector General Russell George recently informed Congress that his forensic investigation has turned up as many as 30,000 emails from the account of former IRS Exempt Organizations Director Lois Lerner—emails the IRS has insisted were destroyed. The emails cover the crucial period from January 2009 through June 2011 when the IRS was ramping up its targeting… We can only imagine Mr. Koskinen’s shock in September when the Treasury IG said it had found 760 tapes that might hold Lerner emails. Or his further surprise when it took only a few weeks to identify and extract the specific Lerner documents—out of 250 million backup emails. And we can only imagine Mr. Koskinen’s apology for his agency’s email failure—since he hasn’t given one.

What can we learn from this episode?

Either the IRS didn’t bother to investigate these tapes or, more alarming, it did and chose not to produce the results. The IG is turning over the emails to the IRS, which is supposed to redact sensitive tax information before sending them to Congress. Mr. Koskinen needs to end the IRS stonewalling and turn the records over with dispatch without covering up incriminating evidence.

Indeed. One can’t help but wonder whether the delay in finding the emails and now the delay in turning them over to investigators is simply to allow time for smoking guns to be hidden.

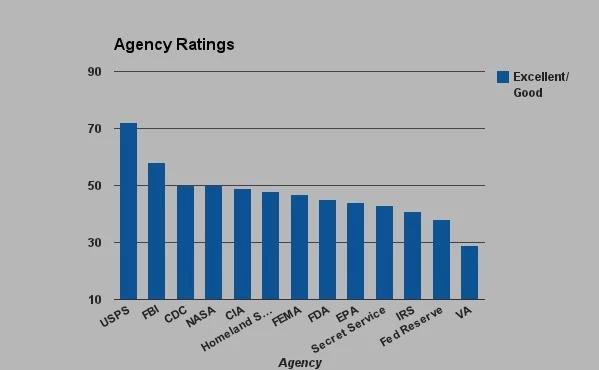

With all this rampant corruption and abuse, you would think the IRS is the lowest-ranked government bureaucracy.

But don’t forget there’s lots of competition for that honor. The Washington Post reports on polling data from Gallup regarding which agencies are perceived to be “good” or “excellent.” Both the Federal Reserve and the Veterans Administration rank below the IRS.

I guess I’m not surprised that the Veterans Administration is rated so poorly. After all, that bureaucracy created secret waiting lists and denied care to veterans (and then the bureaucrats awarded themselves bonuses!).

Though the Fed’s low rating surprises me, simply because I assumed many people wouldn’t be sufficiently familiar to give a grade, whether positive or negative.

And I’m baffled that the Postal Service has a high ranking. Have people never waited in line at a post office?!?

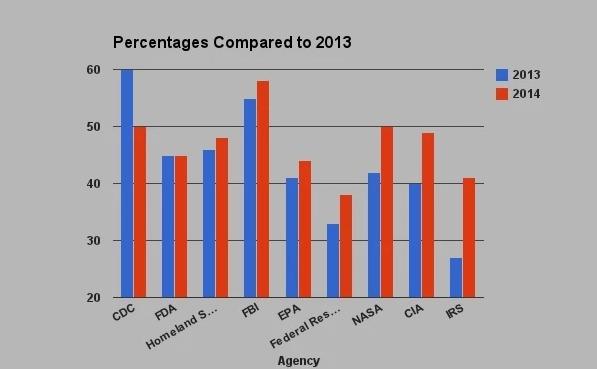

But let’s stick with the topic of the IRS. If we look at a comparison of 2013 and 2014 ranking, you can see that the IRS actually enjoyed a bump as the targeting scandal receded from the headlines.

By the way, I’m glad to see the EPA gets a relatively low score.

Let’s close with a good cartoon about the IRS, though it’s not terribly funny when you realize that many people in Washington actually have this perspective.