Since I’ve been in Washington for nearly three decades, I’m used to foolish demagoguery.

But the left’s reaction to corporate inversions takes political rhetoric to a new level of dishonesty.

Every study that looks at business taxation reaches the same conclusion, which is that America’s tax system is punitive and anti-competitive.

Simply stated, the combination of a very high tax rate on corporate incomealong with a very punitive system of worldwide taxation makes it very difficult for an American-domiciled firm to compete overseas.

Yet some politicians say companies are being “unpatriotic” for trying to protect themselves and even suggest that the tax burden on firms should be further increased!

In this CNBC interview, I say that’s akin to “blaming the victim.”

While I think this was a good interview and I assume the viewers of CNBC are an important demographic, I’m even more concerned (at least in the short run) about influencing the opinions of the folks in Washington.

And that’s why the Cato Institute held a forum yesterday for a standing-room-only crowd on Capitol Hill.

Here is a sampling of the information I shared with the congressional staffers.

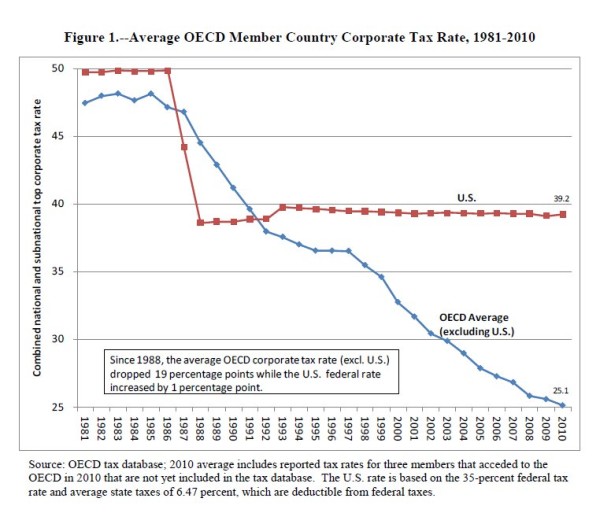

We’ll start with this chart showing how the United States has fallen behind the rest of the world on corporate tax rates.

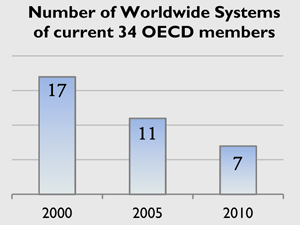

Here’s a chart showing the number of nations that have worldwide tax systems. Once again, you can see a clear trend in the right direction, with the United States getting left behind.

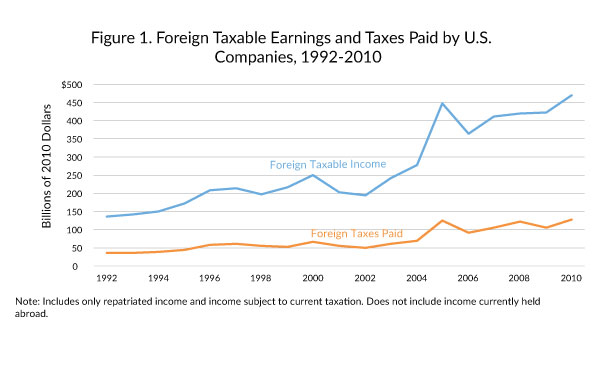

Next, this chart shows that American companies already pay a lot of tax on the income they earn abroad.

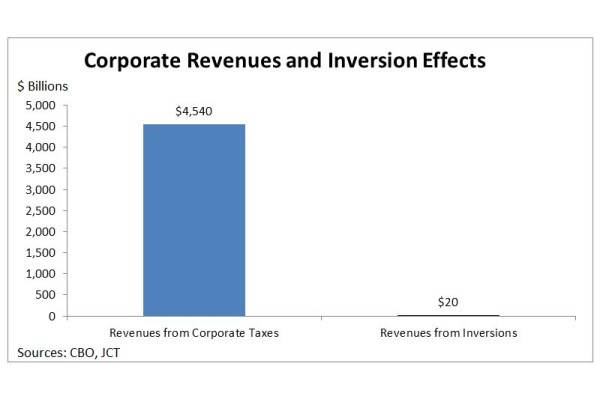

Last but not least, here’s a chart showing that inversions have almost no effect on corporate tax revenue in America.

The moral of the story is that the internal revenue code is a mess, which is why (as I said in the interview) companies have both a moral and fiduciary obligation to take legal steps to protect the interests of shareholders, consumers, and employees.

The anti-inversion crowd, though, is more interested in maximizing the amount of money going to politicians.

Actually, let me revise that last sentence. If they looked at the Laffer Curve evidence (here and here), they would support a lower corporate tax rate.

So we’re left with the conclusion that they’re really most interested in making the tax code punitive, regardless of what happens to revenue.