The business pages are reporting that Chrysler will be fully owned by Fiat after that Italian company buys up remaining shares.

I don’t know what this means about the long-term viability of Chrysler, but we can say with great confidence that the company will be better off now that the parent company is headquartered outside the United States.

This is because Chrysler presumably no longer will be obliged to pay an extra layer of tax to the IRS on any foreign-source income.

Italy, unlike the United States, has a territorial tax system. This means companies are taxed only on income earned in Italy but there’s no effort to impose tax on income earned – and already subject to tax – in other nations.

Under America’s worldwide tax regime, by contrast, U.S.-domiciled companies must pay all applicable foreign taxes when earning money outside the United States – and then also put that income on their tax returns to the IRS!

And since the United States imposes the highest corporate income tax in the developed world and also ranks a dismal 94 out of 100 on a broader measure of corporate tax competitiveness, this obviously is not good for jobs and growth.

No wonder many American companies are re-domiciling in other countries!

Maybe the time has come to scrap the entire corporate income tax. That’s certainly a logical policy to follow based on a new study entitled, “Simulating the Elimination of the U.S. Corporate Income Tax.”

Written by Hans Fehr, Sabine Jokisch, Ashwin Kambhampati, Laurence J. Kotlikoff, the paper looks at whether it makes sense to have a burdensome tax that doesn’t even generate much revenue.

The U.S. Corporate Income Tax…produces remarkably little revenue – only 1.8 percent of GDP in 2013, but entails major compliance and collection costs. The IRS regulations detailing corporate tax provisions are tome length and occupy small armies of accountants and lawyers. …many economists…have suggested that the tax may actually fall on workers, not capitalists.

Regarding who pays the tax, shareholders bear the direct burden of the corporate tax, of course, but economists believe workers are the main victimsbecause the levy reduces investment, which then means lower productivity and lower wages.

Statists would like us to believe that capitalists and workers are enemies, but that’s utter nonsense. Both prosper by cooperating. There’s a very strong correlation between a nation’s capital stock (the amount of investment) and the compensation of its workers.

So it’s no surprise to see that’s precisely what the authors found in their new research.

This paper posits, calibrates, and simulates a multi-region, life-cycle dynamic general equilibrium model to study the impact of U.S. and global corporate tax reforms. …when wage taxation is used as the substitute revenue source, eliminating the U.S. corporate income tax, holding other countries’ corporate tax rates fixed, engenders a rapid and sustained 23 to 37 percent higher capital stock… Higher capital per worker means higher labor productivity and, thus, higher real wages.

The impact is significant, both for worker compensation and overall economic output.

…real wages of unskilled workers wind up 12 percent higher and those of skilled workers 13 percent higher. …on balance, output rises – by 8 percent in the short term, 10 percent in the intermediate term, and 8 percent in the long term… The economy’s endogenous expansion expands existing tax bases, with the increased revenue making up for roughly one third the loss in revenue from the corporate income tax’s elimination.

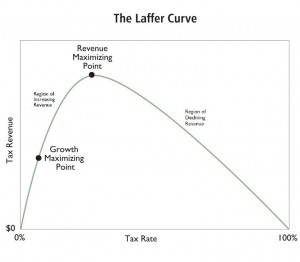

By the way, the authors bizarrely then write that “we find no Laffer Curve,” but that’s presumably because they make the common mistake of assuming the Laffer Curve only exists if a tax cut fully pays for itself.

But that’s only true for the downward-sloping side of the Laffer Curve.

In other cases (such as found in this study), there is still substantial revenue feedback.

And I guess we shouldn’t be surprised that full repeal of the corporate income tax doesn’t raise revenue. The Tax Foundation, after all, estimates that the revenue-maximizing rate is about 14 percent.*

Now that I’m done nit-picking about the Laffer Curve, let’s now look at one additional set of results from this new study.

…each generation, including those initially alive, benefits from the reform, with those born after 2000 experiencing an 8 to 9 percent increase in welfare.

I should point out, incidentally, that economists mean changes in living standards when they write about changes in “welfare.” It’s a way of measuring the “well being” of society, sort of like what the Founders meant when they wrote about “the general welfare” in the Constitution.

But, once again, I’m digressing.

Let’s focus on the main lesson from the paper, which is that the corporate income tax imposes very high economic costs. Heck, even the Paris-based Organization for Economic Cooperation and Development (which is infamous forwanting higher tax burdens on companies) admitted that the levy undermines prosperity.

The study even finds that workers would be better off if the corporate income tax was replaced by higher wage taxes!

To learn more about the topic, here’s a video I narrated many years ago about cutting the corporate income tax. There was less gray in my hair back then, but my analysis still holds today.

* For the umpteenth time, I want to emphasize that the goal should not be to maximize revenue for politicians. Instead, we should strive to be on the growth-maximizing point of the Laffer Curve.