Early last year, with the sequester about to begin, President Obama stated that “these cuts are not smart, they are not fair, they will hurt our economy, they will add hundreds of thousands of Americans to the unemployment rolls.”

He made this statement because Keynesian theorysays government spending can boost “aggregate demand” and goose an economy. So less government spending obviously must be bad for growth.

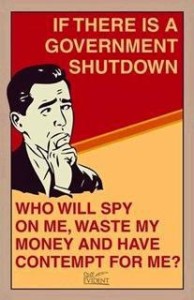

Then, in October, Obama claimed that the partial government shutdown “inflicted completely unnecessary damage on our economy” and also asserted that, “every analyst out there believes it slowed our growth.”

Then, in October, Obama claimed that the partial government shutdown “inflicted completely unnecessary damage on our economy” and also asserted that, “every analyst out there believes it slowed our growth.”

This statement also was based on the notion that government spending is a form of “stimulus” for economic performance. So anything that slows spending must be a downer for the economy and job creation.

The President had good reasons to worry, at least based on the aforementioned Keynesian perspective. The burden of government spendingdeclined in 2013, both in nominal terms and as a share of economic output.

In other words, the sequester and the partial shutdown did exactly what the President warned about.

So did this mean the economy under-performed? Before we look at the data, I’m going to take a wild guess and predict just the opposite.

Simply stated, you don’t get more growth by expanding the size and scope of government. Here’s what I wrote last year about Keynesian fiscal policy.

Keynesian economics is the perpetual motion machine of the left. You build a model that assumes government spending is good for the economy and you assume that there are zero costs when the government diverts money from the private sector. With that type of model, you then automatically generate predictions that bigger government will “stimulate’ growth and create jobs. Heck, sometimes you even admit that you don’t look at real world numbers. Which perhaps explains why Keynesian economics has a long track record of failure. …The ongoing damage of counterproductive government outlays is much larger and more serious than thetransitory costs of redeploying resources when spending is reduced. And overseas borrowing at best creates illusory growth that will be more than offset when the bills come due. Ultimately, the real-world evidence is probably the clincher for most people. As noted above, it’s hard to find a successful example of Keynesian spending.

Now let’s look at some real-world data.

The Wall Street Journal points out that the economy finally experienced some semi-decent growth in 2013, leading the editors to opine that less government leaves more resources in the productive sector of the economy.

Thursday’s news of 3.2% growth in the fourth quarter of 2013 was greeted with cheers and relief. The economy has now grown at 2.5% or faster for three quarters, and the pace in the last six months is the fastest since 2003-2004…The best news is that growth all came from private spending and investment, not the artificial high of unsustainable government spending. The official government contribution to growth was a negative 0.9% due to falling defense outlays and the federal budget sequester. The national-income accounts have a bias that treats government spending as a net contributor to growth even when it’s wasted. Remember how the Keynesians predicted that less spending would mean slower overall growth? Maybe the opposite is true: When government shrinks, the private economy has more money and room to expand.

I obviously agree with these sentiments, but let me augment the passage from the WSJ editorial with a few additional comments.

1. There is a bias in some of the government data. Or, to be more accurate, some data is presented in ways that lead some folks to make sloppy assumptions about government spending contributing to growth. That’s why I prefer looking at how national income is earned (GDI data) rather than how national income is allocated (GDP data).

2. When the burden of government spending shrinks, the economy expands because labor and capital will be used more efficiently. Simply stated, those resources are far more likely to be utilized productively when they’re allocated on the basis of market forces rather than political deal-making.

3. And let’s not forget to add an important caveat that we shouldn’t draw too many conclusions from a quarter or two of data, particularly when there are many factors that determine economic performance.

That being said, there certainly seems to be lots of evidence showing that bigger government is counterproductive and smaller government enhances growth.

We have good evidence, for instance, of nations growing faster when government outlays are constrained, including Canada in the 1990s and the United States during both the Reagan years and Clinton years.

And the Baltic nations imposed genuine spending cuts in recent years and are now doing much better than other European countries that relied on either Keynesian spending or the tax-hike version of austerity.

But if you think those anecdotes are inadequate, you can review some scholarly research on the negative impact of excessive government spending from international bureaucracies such as theOrganization for Economic Cooperation and Development, International Monetary Fund, World Bank, and European Central Bank. And since most of those organizations lean to the left, these results should be particularly persuasive.

Moreover, you can find similar findings in the work of scholars from all over the world, including the United States, Finland,Australia, Sweden, Italy, Portugal, and the United Kingdom.

Let’s close with a couple of encore performances. First here’s my video on Keynesian economics.

And here’s my video on Obama’s failed stimulus.

Hmmm…maybe, just maybe, politicians should obey the Golden Rule.