The new leftist website, Vox, has an article by Sarah Kliff on Vermont’s experiment with a single-payer healthcare system.

But I don’t really have much to say about what’s happening in the Green Mountain State, other than to declare that I much prefer healthcare experiments to occur at the state level. Indeed, we should reform Medicaid andMedicare and also fix the tax code so that Washington has no role in healthcare. Then the states can experiment and compete to see what works best.

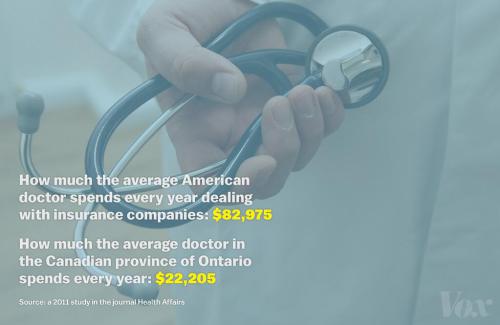

But that’s a topic for another day. The real reason I cite Kliff’s article is that Ezra Klein tweeted this image from the article and stated that is was “The case for single payer, in one graphic.”

I don’t know if the numbers in the graphic are correct, but I have no reason to think they’re wrong.

Regardless, I certainly don’t disagree with the notion that our healthcare system is absurdly expensive and ridiculously inefficient.

In other words, the folks at Vox have accurately diagnosed a problem.

However, do these flaws prove “the case for single payer”?

It’s probably true that “single payer” has a lower monetary cost than the system we have today (assuming you don’t include the cost of substandard care and denied treatment), but that doesn’t mean it’s the ideal system.

Indeed, there is a better way to deal with the waste, inefficiency, and bureaucracy of the current system. The answer is free markets and genuine insurance, both of which would help address the real problem of third-party payer.

Third-party payer, for those who are new to the healthcare field, is what you get when somebody other than the consumer picks up the tab. And because of government intervention, that’s what happens with about 90 percent of healthcare spending in the United States. Here’s what John Goodman had to say about this problem.

Almost everyone believes there is an enormous amount of waste and inefficiency in health care. But why is that? In a normal market, wherever there is waste, entrepreneurs are likely to be in hot pursuit — figuring out ways to profit from its elimination by cost-reducing, quality-enhancing innovations. Why isn’t this happening in health care? As it turns out, there is a lot of innovation here. But all too often, it’s the wrong kind. There has been an enormous amount of innovation in the medical marketplace regarding the organization and financing of care. And wherever health insurers are paying the bills (almost 90 percent of the market) it has been of two forms: (1) helping the supply side of the market maximize against third-party reimbursement formulas, or (2) helping the third-party payers minimize what they pay out. Of course, these developments have only a tangential relationship to the quality of care patients receive or its efficient delivery.

And here’s some analysis from a study published by the National Bureau of Economic Research.

In most industries, higher quality is associated with higher prices. That is not true in medical care, however, largely because of the public sector. …Every analysis of medical care that has been done highlights the significant waste of resources in providing care. Consider a few examples: one study found that physicians spent on average of 142 hours annually interacting with health plans, at an estimated cost to practices of $68,274 per physician (Casalino et al., 2009). Another study found that 35 percent of nurses’ time in medical/surgical units of hospitals was spent on documentation (Hendrich et al., 2008); patient care was far smaller. …In retail trade, the customer is the individual shopper. If Wal-Mart finds a way to save money, it can pass that along to consumers directly. In health care, in contrast, the situation is more complex, since patients do not pay much of the bill out-of-pocket. Rather, costs are passed from providers to insurers to employers… About one-third of medical spending is not associated with improved outcomes, significantly cutting the efficiency of the medical system and leading to enormous adverse effects.

Here’s my humble contribution to the discussion, starting with an explanation of how special tax breaks deserves some of the blame.

…how many people realize that this bureaucratic process is the result of government interference? For all intents and purposes, social engineering in the tax code created this mess. Specifically, most of us get some of our compensation in the form of health insurance policies from our employers. And because that type of income is exempt from taxation, this encourages so-called Cadillac health plans. …We have replaced (or at least agumented) insurance with pre-paid health care.

I then explain why this isn’t a good idea.

Insurance is supposed to be for unforseen major expenses, such as a heart attack. But our gold-plated health plans now mean we use insurance for routine medical costs. This means, of course, we have the paperwork issues…, but that’s just a small part of the problem. Even more problematic, our pre-paid health care system is somewhat akin to going to an all-you-can-eat restaurant. We have an incentive to over-consume since we’ve already paid. Except this analogy is insufficient. When we go to all-you-can-eat restaurants, at least we know we’re paying a certain amount of money for an unlimited amount of food. Many Americans, by contrast, have no idea how much of their compensation is being diverted to purchase health plans. Last but not least, we need to consider how this messed-up approach causes inefficiency and higher costs. We consumers don’t feel any need to be careful shoppers since we perceive that our health care is being paid by someone else. Should we be surprised, then, that normal market forces don’t seem to be working?

And I ask readers to think about the damage this approach would cause if applied in other sectors of the economy.

Imagine if auto insurance worked this way? Or homeowner’s insurance? Would it make sense to file insurance forms to get an oil change? Or to buy a new couch? That sounds crazy. The system would be needlessly bureaucratic, and costs would rise because we would act like we were spending other people’s money. But that’s what would probably happen if government intervened in the same way it does in the health-care sector.

This is probably more than most people care to read, but it underscores the point that we don’t have a free market in health care. Not now, and not before Obamacare.

So the folks at Vox are right about the current system being a mess. But I disagree with the notion that more government is a way to solve problems created by government.

The real answer, as I’ve already noted, is to get Washington out of health care. This means entitlement reform AND tax reform.

And if you want to get a flavor of why this would generate better results, watchthis Reason TV video and read these stories from Maine and North Carolina.

So how do we get there? Repealing Obamacare is a necessary but far from sufficient condition. Cato’s Adjunct Scholar, John Cochrane, has a nice roadmapof what’s really needed.

Though Vermont certainly is welcome to travel in the other direction. It’s always good to have bad examples and I wouldn’t be surprised if the “Moocher State” played that role.