My tireless (and probably annoying) campaign to promote my Golden Rule of spending restraint is bearing fruit.

The good folks at the editorial page of the Wall Street Journal allowed me to explain the fiscal and economic benefits that accrue when nations limit the growth of government.

The good folks at the editorial page of the Wall Street Journal allowed me to explain the fiscal and economic benefits that accrue when nations limit the growth of government.

Here are some excerpts from my column, starting with a proper definition of the problem.

What matters, as Milton Friedman taught us, is the size of government. That’s the measure of how much national income is being redistributed and reallocated by Washington. Spending often is wasteful and counterproductive whether it’s financed by taxes or borrowing.

So how do we deal with this problem?

I’m sure you’ll be totally shocked to discover that I think the answer is spending restraint.

More specifically, governments should be bound by my Golden Rule.

Ensure that government spending, over time, grows more slowly than the private economy. …Even if the federal budget grew 2% each year, about the rate of projected inflation, that would reduce the relative size of government and enable better economic performance by allowing more resources to be allocated by markets rather than government officials.

I list several reasons why Mitchell’s Golden Rule is the only sensible approach to fiscal policy.

A golden rule has several advantages over fiscal proposals based on balanced budgets, deficits or debt control. First, it correctly focuses on the underlying problem of excessive government rather than the symptom of red ink. Second, lawmakers have the power to control the growth of government spending. Deficit targets and balanced-budget requirements put lawmakers at the mercy of economic fluctuations that can cause large and unpredictable swings in tax revenue. Third, spending can still grow by 2% even during a downturn, making the proposal more politically sustainable.

The last point, by the way, is important because it may appeal to reasonable Keynesians. And, in any event, it means the Rule is more politically sustainable.

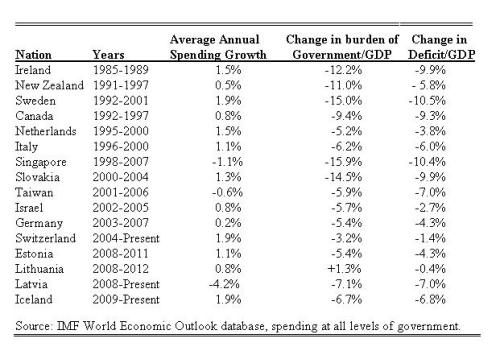

I then provide lots of examples of nations that enjoyed great success by restraining spending. But rather than regurgitate several paragraphs from the column, here’s a table I prepared that wasn’t included in the column because of space constraints.

It shows the countries that restrained spending and the years that they followed the Golden Rule. Then I include three columns of data. First, I show how fast spending grew during the period, followed by numbers showing what happened to the overall burden of government spending and the change to annual government borrowing.

Last but not least, I deal with the one weakness of Mitchell’s Golden Rule. How do you convince politicians to maintain fiscal discipline over time?

I suggest that Switzerland’s “debt brake” may be a good model.

Can any government maintain the spending restraint required by a fiscal golden rule? Perhaps the best model is Switzerland, where spending has climbed by less than 2% per year ever since a voter-imposed spending cap went into effect early last decade. And because economic output has increased at a faster pace, the Swiss have satisfied the golden rule and enjoyed reductions in the burden of government and consistent budget surpluses.

In other words, don’t bother with balanced budget requirements that might backfire by giving politicians an excuse to raise taxes.

If the problem is properly defined as being too much government, then the only logical answer is to shrink the burden of government spending.

Last but not least, I point out that Congressman Kevin Brady of Texas has legislation, the MAP Act, that is somewhat similar to the Swiss Debt Brake.

We know what works and we know how to get there. The real challenge is convincing politicians to bind their own hands.