I generally focus on the profligate habits and abusive tactics of the federal government in Washington, but that doesn’t mean other levels of government are well behaved.

In a column for the Washington Post, Catherine Rampell outlines some of the reprehensible ways that state and local governments extract money from the citizenry.

Think of recent, infuriating stories on civil asset forfeiture, in which law enforcement seizes cash and other property from people who are never charged with crimes. Often the departments that do the seizing get to keep the proceeds, which leads to terrible incentives. …Onerous traffic fees and court fines — which have been blamed for long-simmering tensions in places like Ferguson, Mo. — often have a similarly mercenary motive.

She’s right to be infuriated.

Policies like asset forfeiture are disgusting ways of stealing money, particularly from the less fortunate. Indeed, it’s worth noting that the two first leaders of the Justice Department’s asset forfeiture office now say the practice should be ended because of rampant abuses.

But other revenue-raising policies also are objectionable.

…states and cities are also increasingly trying to monetize other behaviors seen as sinful or wayward, like marijuana use, strip club patronage, and gambling. Hence the explosion of state-sponsored lotteries, which prey on (mostly poor) people’s mathematical illiteracy… States have also been jockeying to expand casinos and other venues for legalized gambling, which voters seem to see as generating free money. …Then there are the expensive occupational licensure requirements for jobs that don’t seem to require state-level gatekeeping, like hair-braiding.

At this point, after reading various examples of greedy governments pillaging citizens, you may be thinking Ms. Rampell is a good libertarian.

Unfortunately, that doesn’t seem to be the case.

Her anger is misdirected. Instead of holding politicians accountable, she blames voters for their unwillingness to acquiesce to tax hikes as a way of dealing with “widespread budget crunches.”

If the political toxicity of spending and tax hikes encourages obfuscation at the federal level, it has led to far more destructive and distortionary policies at the state and local levels. Voters hate taxes and will punish any politician who threatens to raise them (or, in many cases, does not accede to cutting them). But schools, roads, police forces, garbage collection, firefighters, jails and pensions still cost money, even when you cut them back as much as voters will tolerate. So instead of raising taxes, state and municipal governments have resorted to nickel-and-diming constituents through other kinds of piecemeal, non-tax revenue raisers, an outcome that is less transparent, and likely to worsen the economy, inequality and social injustice. …It’s time to take off the fiscal blinkers and start rewarding politicians who have the courage to advocate raising revenues the old-fashioned way: through taxes.

Reward a politician for raising taxes? Isn’t that like rewarding a mosquito for taking your blood?

But I shouldn’t be snarky. After all, maybe Ms. Rampell is right and that budgets for state and local governments have been cut as much as possible.

That being said, I noticed she didn’t include any figures on the trends in spending by state and local governments.

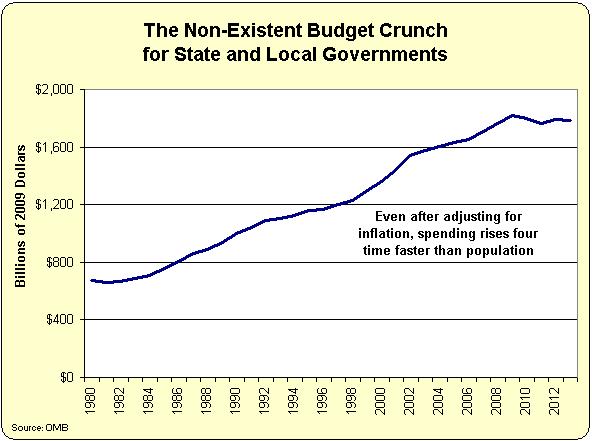

So I went to the Office of Management and Budget’s historical tables, specifically Table 15-2 which includes state and local government expenditures. And after adjusting the data for inflation, based on the composite deflator inTable 1-3, I put together a graph to determine whether there was a “budget crunch” for state and local government.

Um…not so much.

As you can see, state and local government spending has jumped dramatically, even when looking at inflation-adjusted dollars.

Indeed, the 164 percent increase in outlays since 1980 is four times greater than the 40 percent increase in the nation’s population over the same period.

In other words, the only “budget crunch” is the one being imposed on long-suffering taxpayers by state and local politicians.

Those officials are the folks who deserve Ms. Rampell’s ire.