With all the controversy over the failed and costly Obamacare program, it’s understandable that other entitlements aren’t getting much attention.

But that doesn’t mean there aren’t serious problems with Medicaid, Medicare, and Social Security.

Indeed, the annual Social Security Trustees Report was released a few days ago and the updated numbers for the government-run retirement program are rather sobering.

Thanks in part to sloppy journalism, many people only vaguely realize that Social Security is actuarially unsound.

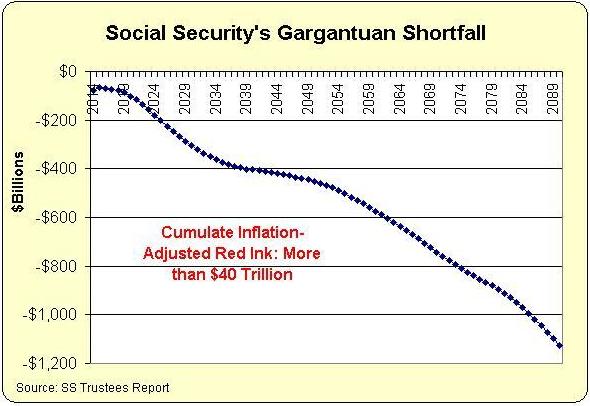

In reality, the level of projected red ink is shocking. If you look at the report’s annual projections and then adjust them for inflation (so we get an idea of the size of the problem based on the value of today’s dollars), we can put together a very depressing chart.

How depressing is this chart? Well, cumulative deficits over the next 75 years will total an astounding $40 trillion. And keep in mind these are inflation-adjusted numbers. In nominal dollars, total red ink will be far more than $150 trillion.

That’s a lot of money even by Washington standards.

Just as worrisome, the trend is in the wrong direction. Last year, the cumulative inflation-adjusted shortfall was $36 trillion. The year before, the total amount of red ink was $30 trillion. And so on.

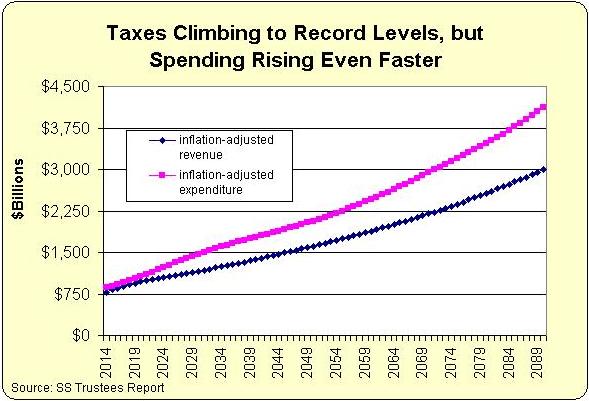

But regular readers know I’m not fixated on deficits and debt. I’m much more worried about the underlying problem of too much spending. So let’s look at the annual data showing how much payroll tax will be generated by Social Security and how much money will be paid out to beneficiaries.

As you can see, the problem is not inadequate tax revenue. Indeed, revenues will climb to record levels. The problem is that spending is projected to increase at an even faster rate.

Once again, don’t forget that these are inflation-adjusted numbers. In nominal dollars, the numbers are far bigger!

Why is the program becoming an ever-larger fiscal burden? The answer boils down to demographics. Simply stated, we will have more and more old peopleand fewer and fewer younger workers.

So if we do nothing, we’ll be Greece in 20 or 30 years.

That’s not a happy thought, so let’s close on a humorous note. Here’s a jokeabout how Social Security works, and you can enjoy some Social Security-themed cartoons here, here, and here.

P.S. I’m confident that few people will be surprised to learn that Obama’ssupposed solution to this mess involves a huge tax increase.

P.P.S. The real solution is personal retirement accounts. I think Australia is the best role model, but Chile also is a big success.