I’ve shared lots of data and evidence about the harmful economic impact of government spending.

Simply stated,  budgetary outlays divert resources from more productive uses.And this results in labor and capital being misallocated, leading to less economic output.

budgetary outlays divert resources from more productive uses.And this results in labor and capital being misallocated, leading to less economic output.

The damage is even more pronounced when you look at how politicians finance the budget. Whether they use taxes or borrowing (or even printing money), there are additional distortions that hinder the private sector.

Today, we’re going to look at the economic impact of a particular type of government spending. A new working paper by two academics at the University of Miami has revealed a negative relationship between government consumption spending and economic growth.

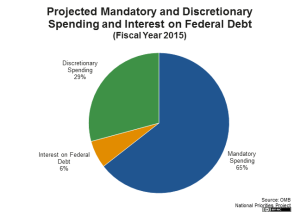

But before digging into the details, what do public finance economists mean when they talk about “consumption spending”? At the risk of over-simplifying, it’s the part of the budget used to purchase goods and services. Everything from soldiers to housing and from jails to education.

It’s basically the so-called discretionary portion of the federal budget, minus “investment spending” (which would be things like roads).

Anyhow, here are some of the key findings.

This paper tests the Mundellian hypothesis that too much government spending reduces economic growth… In this paper, we analyze annual panel data from 1999 to 2011 for 31 OECD countries to examine the role of government spending in determining economic growth. In particular, we will focus our attention on government consumption spending on non-market goods such as defense and justice for collective consumption and its effect on growth in real GDP growth. …We find that government consumption spending on non-market goods signifi cantly reduces economic growth. A one percentage point increase in government consumption of non-market goods as a percent of GDP is associated with a 0.86 percentage lower growth rate in GDP. …This result is compatible with Barro (1990)’s fi nding for the Summers and Heston database, but suggests a stronger negative eff ect of government consumption on economic growth.

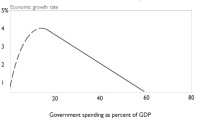

That’s a big number, which implies that we’re definitely on the downward-sloping portion of the Rahn Curve.

By the way, just in case you’re wondering why Obama’s “stimulus” was such a flop, the study also notes that “the 2009 American Reinvestment and Recovery Act envisaged less than 5% spending on public investment, and over 95% on consumption.”

In other words, Obama increased the type of government spending with the worst impact on the economy. Something to keep in mind when politicians, lobbyists, interest groups, and other insiders argue that there’s no need to cut back on discretionary spending.

In other words, Obama increased the type of government spending with the worst impact on the economy. Something to keep in mind when politicians, lobbyists, interest groups, and other insiders argue that there’s no need to cut back on discretionary spending.

But it’s also important to note that the study has some findings that may distress libertarians and small-government conservatives. It finds, for instance, that “government investment spending is positively related to growth.”

Also, it’s important to realize that the study is limited to only certain forms of discretionary spending. As the authors explain, they examine, “the impact of government consumption spending net of health, education and housing service.”

But even with those caveats, we have another strong piece of evidence that our economy would grow much faster if we reduced the burden of government spending.

And if you need more evidence on the harmful effect of government spending (either generally or specific types of outlays), allow me to call your attention to research even from normally left-leaning international bureaucracies such as theOrganization for Economic Cooperation and Development, International Monetary Fund, World Bank, and European Central Bank.

And you can find similar findings in the work of scholars from all over the world, including the United States, Finland, Australia, Sweden, Italy, Portugal, and the United Kingdom.