Some of my left-wing friends have groused that Democrats didn’t do well in the mid-term elections because they failed to highlight America’s strong economic performance.

I’m tempted to ask “what strong economic performance?!?” After all, median household income is lower than it was when Obama took office. And labor force participation rates have plummeted.

However, my leftist buddies have a point. America’s economy does look good when compared to Europe.

But why should that be the benchmark for success?

If you look at today’s growth numbers compared to data on historical growth in the United States, you get a much different picture. Here’s some of what Douglas Holtz-Eakin, former head of the Congressional Budget Office, wrote as part of a study for the National Chamber Foundation.

Over the entire postwar period from 1947 to 2013, the trend for economic growth in America was 3.3%. Unfortunately, looking at the period as a whole masks a marked deterioration in U.S. growth performance. Since 2007, the rate has downshifted to a mere 1.5%, which translates into a meager 0.7% in growth per capita in the United States. …At the current pace of growth, it will take 99 years for incomes to double. The poor U.S. growth performance is a threat to American families and their futures.

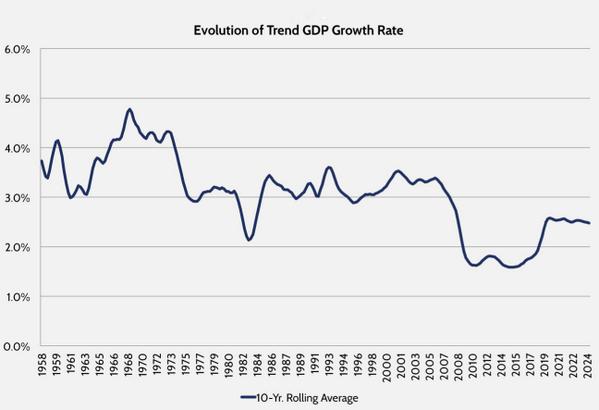

Here’s a chart from the report showing the 10-year rolling average of inflation-adjusted growth in the United States. As you can see, there was plenty of variation, but America usually enjoyed growth average a bit above 3 percent. But then, beginning about 2007/2008, that average dropped below 2 percent.

If you look at projections until 2024, you’ll notice that growth is projected to improve.

But you have to wonder if those projections will materialize.

And, even if they do, growth will only be about 2.5 percent annually, so we’ll still be enduring sub-par economic performance.

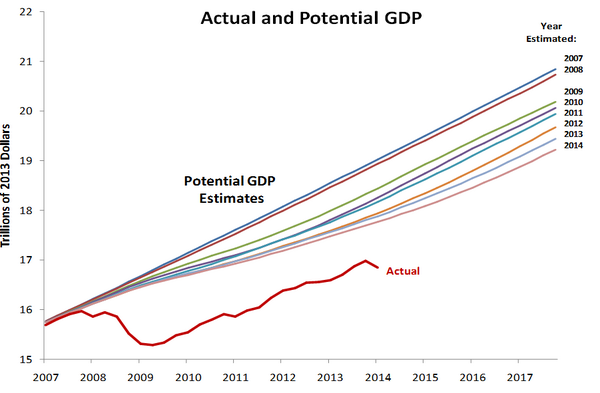

Moreover, it appears that those projections may be unrealistic. Here’s another chart from the National Chamber Foundation. It wasn’t in the study, but it’s worth including since it shows how the American economy has been routinely under-performing in recent years.

With this track record of anemic economic performance, it’s hard to have much sympathy for Democrats who thought they should be rewarded on election day. Doing better than France and Italy is not exactly a message that will resonate with voters, particularly when many people have been alive long enough to remember the good growth that America enjoyed during the Reagan and Clinton years, when policy was much more focused on small government and free markets.

But let’s set aside politics and consider the impact of growth on regular Americans rather than politicians. Holtz-Eakin explores some of the ramifications if the economy grows faster over the next decade.

Imagine that growth averages instead 3.3%—just one percentage point higher—for the next 10 years. …A full percentage point would eliminate $3 trillion in debt and slow the growth of the national debt. …Growing at a 3% rate means 1.2 million more jobs, and 1.3 million more if growth escalated to 3.5% for the next 10 years. …Three percent growth would mean another $4,200 in average incomes, while 3.5% growth would boost this an additional $4,500 to nearly $9,000. …faster economic growth would improve the future for the poor, the middle class, and the affluent alike.

By the way, it’s worth noting that faster growth leads to less debt mostly because the government collects a lot more tax revenue when people have higher incomes. And even a knee-jerk anti-taxer like me won’t complain if the IRS gets more money simply because people are more prosperous (though I reserve the right to then argue for lower tax rates).

Now let’s look at the most important question, which is to ask what policies will restore traditional American growth rates.

Doug has several suggestions, starting with entitlement reform.

The policy problem facing the United States is that spending rises above any reasonable metric of taxation for the indefinite future. ….Over the long term, the budget problem is primarily a spending problem, and correcting it requires reductions in the growth of large mandatory spending programs—entitlements like Social Security and federal health programs.

I certainly agree. Assuming, of course, that he wants good entitlement reformrather than gimmicks.

He also suggests tax reform.

The tax code is in need of dramatic improvements, including a modern international tax system, a lower corporation income tax rate, correspondingly lower rates on business income tax via so-called pass-thru entities, and broad elimination of tax preferences to preserve efficient allocation of investment… At the same time, one could improve work incentives by simplifying individual income tax rate brackets (recent proposals have suggested two brackets of 10% and 25%) and exclude a substantial portion of dividends and capital gains from taxation.

Once again, I agree. Though I reserve the right to change my mind and become a vociferous opponent if advocates decide that they wanted to finance these reforms with a value-added tax.

The study also includes suggestions for regulatory reform and other policy changes, but this post is too long already, so let’s now return to the central theme of economic growth.

Or, to be more accurate, the absence of economic growth. Because that’s the legacy of Obamanomics. We’re adopting European-style economic policies, so is it any surprise that our growth rates are declining in the direction of European-style stagnation?

And, to be fair, I’ll be the first to state that this bad trend began under Bush. Big government hinders prosperity, regardless of whether the policies are imposed by Republicans or Democrats.

Just as you get faster growth with good policy, even if those policies are implemented with a Democrat in the White House.

Simply stated, if you want better economic performance, there’s no substitute for free markets and small government.