It takes a special skill – or an abundance of chutzpah – to harm a person and then turn around and argue that it was all for their own good. But that’s exactly what the Obama administration, and the sycophants at the New York Times, are doing in light of new projections from the Congressional Budget Office suggesting that Obamacare will result in 2.5 million more unemployed.

The spin from the administration, echoed in a New York Times editorial, is that the 2.5 million projected to leave their jobs as a result of Obamacare are all workers who have been “trapped” in jobs they didn’t want in order to keep their health insurance. These workers have been liberated by Obamacare, according to the NYT. To be sure, there likely are some such individuals. But what CBO primarily looked at was the excessively high marginal tax rates created by the law and its perverse incentives on employment. Simply put, because earning more income results in a reduction (or loss) of healthcare subsidies, in addition to an increase in tax rates, many will now find that working is less appealing than not working. That is the real trap created, or made worse, by Obamacare.

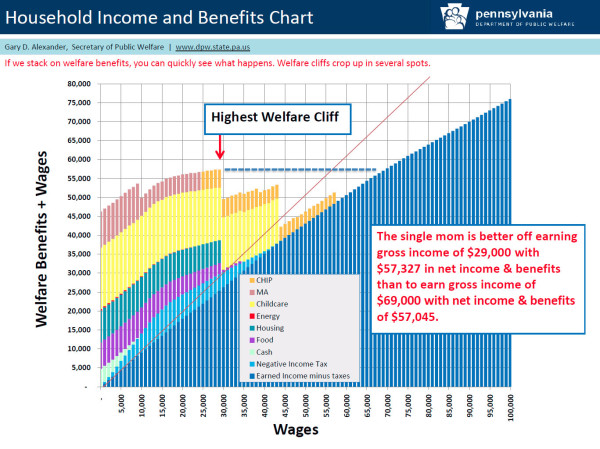

As Keith Hennessey notes, this “Obamacare trap” is really the same as the more general welfare trap:

Because the ACA premium subsidies depend on income, the higher your income, the smaller your premium subsidy. This makes sense if a policymaker has limited resources to spend and wants to help those who need it most. The problem is that it also means that as your income climbs you lose some of those government subsidies. It works the same way as a marginal tax rate increase: you get less net financial benefit for additional income. This is an unavoidable downside of a social safety net based on income.

This downside is independent of what the subsidies are used for. This same problem applies to food stamps, the Earned Income Tax Credit, low-income housing vouchers, and in fact any government benefit that gets reduced as one’s income climbs. The effect results from phasing out subsidies as income climbs, any kind of subsidies.

As explained in this presentation from Gary Alexander, this trap occurs when earning more money through work leaves people with less disposable income.

When working harder will lower your standard of living, what incentive is there to work harder?

The White House celebrates Obamacare’s discouragement of work as freeing people from having to take a job they don’t want just to provide themselves with healthcare. But it’s not clear how this is any different than doing so in order to pay for food, clothing, housing and other bills. By this logic, do we not all deserve such “liberation” and, if so, who will be left to pay for it?

P.S. High marginal tax rates also hobble American businesses, making them uncompetitive compared to their international counterparts. According to the Tax Foundation, the “marginal effective tax rate (METR) on corporate investment (i.e., the tax impact on capital investment as a portion of the cost of capital) is 35.3 percent in the U.S.—higher than in any other developed country.”