If you’re a libertarian, you generally don’t act and think like other people. Most folks, when they heard about Governor Christie’s bridge-closing scandal, focused on the potential political ramifications.

But not me. My immediate reaction was to think that the problem could have been avoided if the bridge and its various entry points were privately owned. Sort of like the Ambassador Bridge between Canada and Michigan, which is the busiest border crossing in North America. Or the Progreso International Bridge, a major transportation link between Mexico and Texas.

If the George Washington Bridge also had private owners, they would want to maximize the flow of traffic, not arbitrarily close lanes for petty political purposes. So while others may speculate about Chris Christie and the 2016 presidential race, I daydreamed about how privatized bridges would improve transportation (just as I couldn’t stop myself from pontificating about private fire departments when sharing some libertarian humor).

All that being said, I’m digressing before I even get started. The purpose of today’s column is to focus on the real scandal in New Jersey.

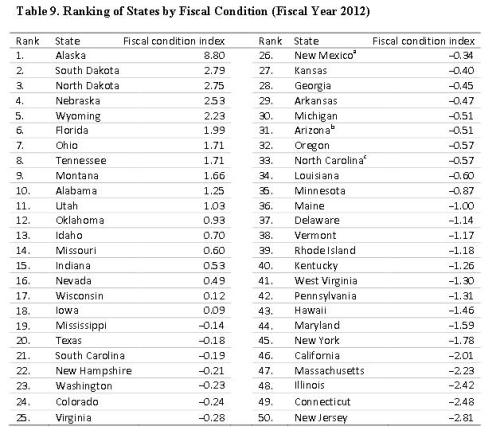

New research from the Mercatus Center looks at cash solvency, budget solvency, long-run solvency, and service-level solvency to show which states are fiscally responsible and which states face serious long-run problems.

And while Chris Christie may have taken a few steps to rein in excessive compensation for state bureaucrats (causing me to become giddy with infatuation), he still has a long way to go because the Garden State is in last place in this comprehensive new ranking of fiscal responsibility.

And that means New Jersey is even behind fiscal hell holes such as California, New York, and Illinois.

Here are the key takeaways from the study, which ranks all 50 states.

This paper contributes to that stream of research by applying models of fiscal condition to create indices measuring cash, budget, long-run, and service-level solvency as well as overall fiscal condition at the state level. It also discusses the relative strengths and weaknesses of each solvency index and provides a ranking — based on these indices and using fiscal year 2012 data — of the 50 US states. …Table 9…shows the state rankings based on fiscal condition with all four dimensions taken into account. …the states at the bottom are there due to years of poor financial management decisions, bad economic conditions, or a combination of both. New Jersey and Illinois face similar problems of tax revenues that have not kept up with expenditures, use of budget practices that only appeared to balance their annual budgets, and significant debt levels as a result of decades of using bonds without being able to pay for them. In addition, both states have underfunded their pension systems, resulting in billions in unfunded liabilities.

Now let’s take a look at the main chart from the study, showing the ranking for all 50 states.

And I want to focus on the bottom 10, which are a rogue’s gallery of big-government basket cases. New Jersey, as already noted, is in last place, but the next-worst state is Connecticut, which has become a fiscal mess ever since making the horrible mistake of adopting an income tax more than two decades ago.

Illinois is in 48th place, which is not surprising since the state is infamous for tax-and-spend fiscal policy. Massachusetts is number 47, making it the fourth-worst state…just as it is the fourth-worst state in the Tax Freedom Day rankings.

California is number 46, and I was surprised (given Jerry Brown’s attempts todrive successful people from the state) to read in the study that its fiscal condition actually has gotten better in recent years. And no rating of fiscal irresponsibility is complete without New York, which is in 45th place.

Indeed, you’ll notice that there’s a good bit of overlap between the states at the bottom of the Mercatus studyand the “death spiral” states that I shared last year. No wonder taxpayers are fleeing these oppressive jurisdictions.

Indeed, you’ll notice that there’s a good bit of overlap between the states at the bottom of the Mercatus studyand the “death spiral” states that I shared last year. No wonder taxpayers are fleeing these oppressive jurisdictions.

Likewise, you’ll see that there’s also overlap between the highest-ranking states and the states that have avoided the mistake of imposing an income tax.

And since we’re on the topic of top-ranked states, it is worth noting that five of the top 10 don’t have an income tax, but we should issue a caveat. Both Alaska and Wyoming have a lot of natural resources, so politicians in those states have lots of revenue to spend. Indeed, too much if we believe these numbersshowing state debt in Alaska.

And the same is true for North Dakota, which makes the mistake of maintaining an income tax while also collecting a flood of severance tax revenue.

P.S. If you want to further explore state fiscal performance, here are four additional rankings.

- The state business tax climate index.

- State spending growth between 2001-2011.

- A comprehensive measure of overall freedom by state.

- The famous “moocher index” of state dependency ratios.