One of my goals is to convince people that even small differences in long-run growth can have a powerful impact on living standards and societal prosperity.

In other words, the economy is not a fixed pie. The right policies, such as free markets and small government, can create a better life for everybody.

And bad policy, needless to say, can have the opposite impact.

Very few people realize, for instance, that Argentina was one of the world’s 10-richest nations at the end of World War II, but interventionist policies have weakened growth and caused the country to plummet in the rankings.

Hong Kong, by contrast, had a relatively poor economy at the end of the war, but now is one of the globe’s most prosperous jurisdictions.

If you want more examples, check out this chart showing how North Korea and South Korea have diverged over time.

Or how about the chart showing how Chile has out-performed other major Latin American economies.

This comparison of living standards in the United States and Europe also is very compelling.

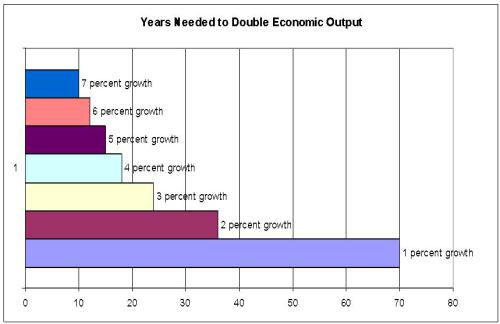

Here’s a simple guide to highlight the difference between weak growth and strong growth. It shows how long it takes a nation to double economic output depending on annual growth.

As you can see, a nation with 1 percent growth (think Italy) will have to wait 70 years before the economic pie doubles in size.

But a nation that grows 4 percent or faster each year (think Singapore) will double GDP in less than 20 years.

So why am I plowing through all this material?

My answer is simple, but depressing. I’m worried that the United States is becoming more like Europe. During the Bush-Obama years, we’ve seen big increases in the size and scope of government, and it’s no surprise that we’re now suffering from anemic economic performance.

That’s the first point I made in this interview with Michelle Fields of PJTV.

Much of the material in the interview will be familiar to regular readers, but a few points deserve some emphasis.

I say that America becoming more like Europe isn’t the end of the world, but I should elaborate. What I meant is that we can survive 2 percent growth instead of 3 percent growth. We could even survive 1 percent growth.

But if we continue on the current path of ever-growing government and combine that with an aging population and poorly designed entitlement programs, then we will see the end of the world. At least in the sense of fiscal crisis and economic collapse.

All the points I make about jobs, employment, labor force participation, unemployment insurance and disability are simply different ways of saying that it’s not good for the economy when politicians continuously make dependency more attractive than work.

If you want to know more about why the so-called stimulus was a failure, my article in The Federalist is a nice place to start.

The libertarian fantasy world of a small central government is a very good goal, but it’s still possible to make significant progress if politicians follow Mitchell’s Golden Rule.