My colleagues Chris Edwards and Nicole Kaeding have just released the biannual Fiscal Policy Report Card on America’s Governors from the Cato Institute.

The Report Card is on the Cato Institute’s most impressive publications sincedevelopments on the state level help illustrate the relationship between good fiscal policy and economic performance.

The top scores were earned by Pat McCrory of North Carolina and Sam Brownback of Kansas. Both have taken steps to significantly reduce marginal tax rates and restrain the burden of state government spending in their states.

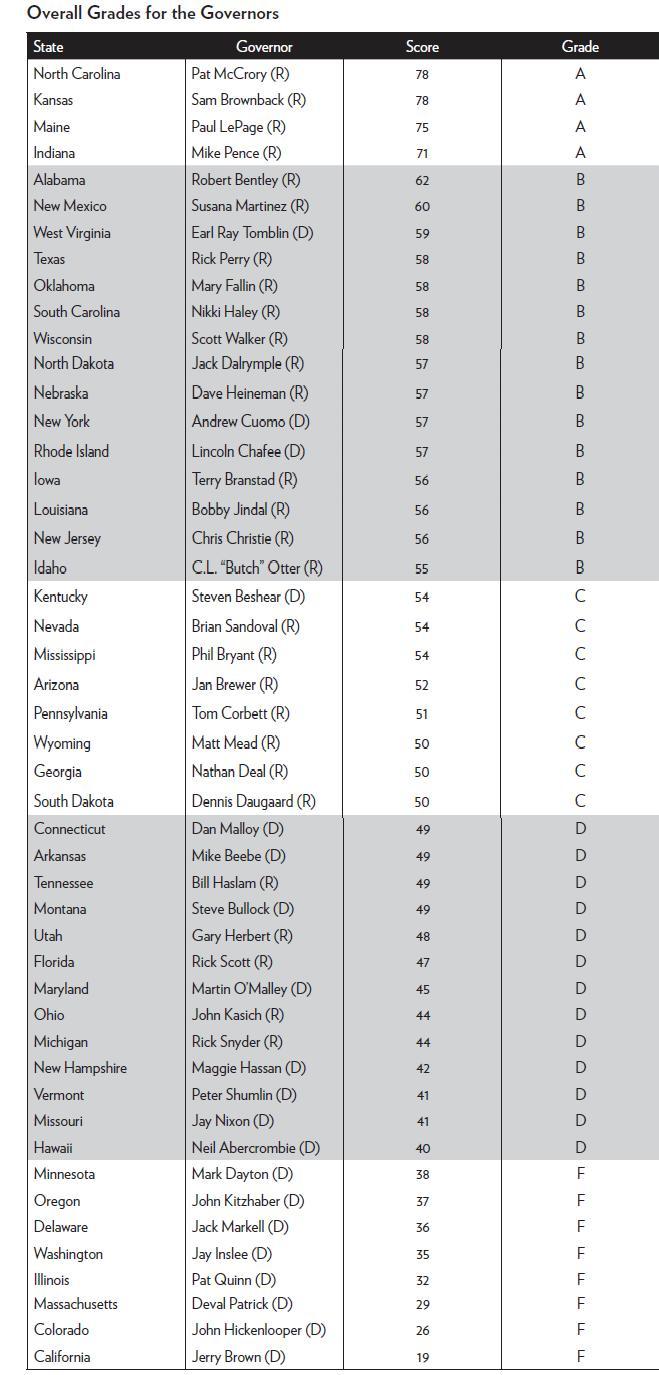

Here are all the scores. Paul LePage of Maine and Mike Pence of Indiana also earned high marks, while the governors of Minnesota, Oregon, Delaware, Washington, Illinois, Massachusetts, Colorado, and California all received failing grades.

Here some of what Chris and Nicole wrote for National Review about the results of their research .

Let’s start with the good news.

Pat McCrory of North Carolina signed a bill replacing individual-income-tax rates of 6.0, 7.0, and 7.75 percent with a single rate of 5.75 percent. He also cut the corporate-tax rate from 6.9 to 5.0 percent and repealed the estate tax. Sam Brownback of Kansas approved a plan in 2012 replacing three individual-income-tax rates with two and cutting the top rate from 6.45 to 4.9 percent. The reform also increased the standard deduction and reduced taxes on small businesses. Brownback cut income-tax rates further in 2013.

Now for the not-so-good news.

…all eight governors earning an “F” were Democrats. …Jerry Brown of California and Pat Quinn of Illinois, for example, earned “F” grades for their large tax hikes.

If you look at the data on state spending, Governor Brownback of Kansas and Governor Bentley of Alabama both got high scores of 85, largely because per-capita spending fell during their tenure.

Governor Kasich of Ohio did the worst job on spending (why am I not surprised), getting a low score of 16 (Governor Abercrombie of Hawaii and Governor Hickenlooper of Colorado were the next lowest, both “earning” a score of 22).

Interestingly, the left is very anxious to undermine the achievements of America’s best governors.

I’ve previously defended the pro-growth reforms to unemployment insuranceadopted by Governor McCrory of North Carolina.

And now let me take this opportunity to defend Governor Brownback of Kansas.

The New York Times is desperately hoping he loses his reelection bid since that might dissuade other state policy makers from enacting good reforms.

Mr. Brownback’s proudly conservative policies have turned out to be so divisive and his tax cuts have generated such a drop in state revenue that they have caused even many Republicans to revolt. …it is unsurprising that many Kansas Republicans have turned on Mr. Brownback. This is a state that once had a tradition of centrist Republicans, like former Senator Bob Dole… More than 100 current and former Republican elected officials have endorsed Mr. Davis.

The Wall Street Journal, however, points out that the anti-Brownback GOPers are largely sore losers.

…many of the “Republicans” on the list are in fact independents who long ago defected from the GOP. …six state Senators whom tea-party groups ousted in 2012 for obstructing tax and government reforms are supporting Mr. Davis.

What really matters, though, is that Governor Brownback’s reforms are designed to rejuvenate a state economy that has lagged its neighbors.

Here are some details from another WSJ editorial.

By liberal accounts Kansas is experiencing a major fiscal and economic meltdown like well, you know, Illinois. …But some early economic indicators suggest they may be producing modest positive effects. The danger is that a coalition of Democrats and big-spending Republicans will pull out the rug before the benefits fully materialize.

What are those benefits?

Well, it’s still early, but the preliminary results are positive.

Kansas has long trailed its neighbors in private job and economic growth. …All of Kansas’s surrounding states save Nebraska had lower top tax rates, and most also had lower unemployment. …Since the tax cuts took effect, the gap in job creation between Kansas and neighboring states has shrunk. Kansas’s rate of private job growth between January 2013 and June 2014 averaged 167% of that in Nebraska, 105% of Iowa and 61% in Oklahoma. That compares to 61%, 85% and 42%, respectively, between 2004 and 2012. While Kansas added jobs at a slower pace than Missouri this year, its private economy grew more than twice as fast as its eastern neighbor last year.

Statists are grousing about lower-than-expected revenues, but their command of the facts leaves something to be desired.

Tax-reform critics complain that revenues (as expected) declined this year and that receipts were $235 million—or about 4%—below the state’s estimate last year. However, predicting revenues was particularly challenging this year because federal tax changes encouraged investors to shift income to 2012 from 2013. Revenues missed the mark in numerous states including Iowa ($185 million; 3%), Missouri ($308 million; 4%) and Oklahoma ($283 million; 5%).

And here’s some analysis from Reason.

While The New York Times denounces as “ruinous” the Kansas tax cut, it is sitting in a state, New York, with a top rate of 8.82 percent. If all the government spending paid for by those high taxes were the panacea that the Times claims it is, you might expect New York to have a lower unemployment than Kansas. But check the numbers, and Kansas’s seasonally adjusted unemployment rate for June was a low 4.9 percent, while New York’s was 6.6 percent. “Ruinous,” indeed.

Given the high stakes, it will be very interesting to see whether Brownback is reelected next month.

Same with Scott Walker of Wisconsin (who, by the way, earned a B), who gotnational attention for his efforts to rein in the privileged position of state bureaucrats and Pat Quinn of Illinois (who got an F), who attracted a lot of attention for his destructive tax hikes.