The United States is burdened with some very bad policies that hinder growth and undermine competitiveness. But sometimes you can win a race if your rivals have policies that are even more self-destructive.

And that’s a good description of why the U.S. economy is out-performing Europe and why people in the United States enjoy higher living standards than their European counterparts.

In 2010, I shared data showing that Americans had far higher levels of consumption than Europeans.

In 2012, I updated the numbers and showed once again that people in America far ahead of folks in Europe.

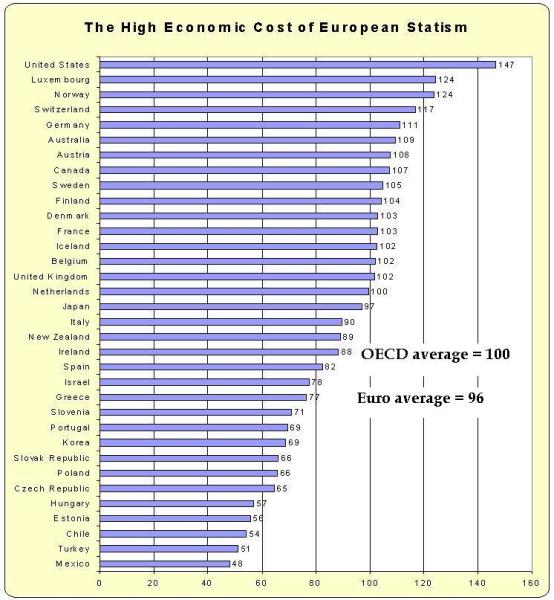

And here are the most recent numbers from the Organization for Economic Cooperation and Development, showing “average individual consumption” for various member nations of that international bureaucracy.

The average for all OECD nations is 100, and the average for eurozone nations is 96, so the U.S. score of 147 illustrates how much better off Americans are than citizens of other countries.

The only nations that are even close to the United States have oil (like Norway) or are low-tax international financial centers (such as Luxembourg and Switzerland).

So why is the United States doing better than Europe?

There are two responses.

First, notwithstanding what I’ve just written, it’s a bit misleading to compare the U.S. to Europe. Simply stated, there are vast differences among European nations in terms of policies and living standards, much more than you find between and among American states.

There are nations such as Switzerland and Finland, for instance, that rank above the United States in Economic Freedom of the World. But there are also highly statist and moribund countries such asFrance, Italy, and Greece, as well as transition economies in Eastern Europe that are still trying to catch up after decades of communist oppression.

So overall America-vs-Europe comparisons should be accompanied by a grain of salt.

Second, now that we’ve ingested some salt, let’s draw some general conclusions about the role of public policy. Most important, nations with bigger governments and more intervention (as is the case for many European countries) generally don’t grow as fast or have the same living standards as nations with smaller governments and more reliance on competitive markets.

The comparisons can get complicated because there are a wide range of policies that impact economic performance (many people focus on fiscal policy, but trade, regulation, monetary policy, and the rule of law are equally important). Comparisons also can get confusing because there are some relatively rich nations with bad policy and some relatively poor nations with good policy, which is why it is important to look at how rich or poor nations are (or were) when there were significant changes in policy.

For instance, many nations in Western Europe became relatively rich in the 1800s and early 1900s when the overall burden of government was very small. Now they’ve adopted welfare states and growth is much slower (or, in some cases, nonexistent), but they’re oftentimes still in better shape than nations (such as Estonia and Chile) that only recently have liberalized their economies.

Now that we’ve gone through all this background, let’s look at a couple of stories that make me pessimistic about Europe’s future because they capture the mentality that seems dominant among continental policy makers.

First, one of the bright spots for the continent is that there’s been vigorous corporate tax competition. In other words, politicians have been under pressure to lower tax burdens on the business community because of concerns that jobs and investment will migrate to nations with better policy.

As you can imagine, this irks the political class (even though lower rates haven’t resulted in less revenue!).

So you won’t be surprised to learn that there’s a new push for tax harmonization in Europe. Here are some of the details from a news report.

France, Germany and Italy have joined forces to outlaw tax competition between EU countries in a letter to the European Commission. …the language and tone in the joint letter to the new Economic and Taxation Commissioner, Pierre Moscovici, is much more aggressive than in the past. …the letter from the finance ministers of the eurozone’s three largest economies says that “the lack of tax harmonisation in the European Union is one of the main causes allowing aggressive tax planning, base erosion and profit-shifting to develop”. …Vanessa Mock, commission spokeswoman said Mr Moscovici “welcomes these significant contributions to the work being carried out by the commission”.

Hmmm…., the Frenchmen who is the Economic and Taxation Commissioner “welcomes” a call from the governments of France, Germany, and Italy to outlaw tax competition. I’m shocked, shocked, by this development.

But as one British politician explained, this approach of higher business taxes will further undermine European economic vitality.

Now let’s shift to our second story, which illustrates the self-serving greed of the political elite at the European Commission.

Here are some passages from a story on the spectacular golden parachutes offered to outgoing senior Eurocrats. And we’ll focus on the former President of the European Council since he’s such a deserving target of ridicule.

Herman Van Rompuy will be entitled to more than £500,000 for doing nothing at the taxpayer’s expense over the next three years, after finishing his term as president of Europe. After standing down on Monday, the former president of the European Council will be paid £133,723 a year, 55 per cent of his basic salary, until December 2017 – to ease him back into life outside the world of Brussels officialdom.

Gee, how kind of European taxpayers to “ease him back” into the real world.

Except, of course, Van Rompuy’s never been in the real world. He’s had his snout in the public trough his entire life.

And he also gets to pay far less tax on this money compared to the poor slobs in the private sector who are footing the bill for this official largesse.

…The “transitional allowance” does not require Mr Van Rompuy to do any work at all and the cash will be paid under reduced rates of EU “community” tax, which are far lower than taxation in his native country of Belgium. …Mr Van Rompuy has not been a stranger to controversy over the perks of EU officialdom since he took the post in December 2009. He was widely criticised four years ago for using his official motorcade of five limousines as a taxi service to take his family on 325-mile round trip to Paris airport en route to a private holiday in the Caribbean. …The cost of Mr Van Rompuy’s retirement is part of a much larger bill for the handover of the administration in EU as former European Commissioners serving in the last Brussels executive pocket “transitional allowances” worth around £30million.

This scam has been in operation for several years, and keep in mind thatexcessive pay and lavish perks for commissioners are matched by excessive pay and lavish perks for member of the European Parliament (including taxpayer-financed penile implants).

And lavish pay and perks for European Union bureaucrats.

And don’t forget these are the folks who are pushing for bigger government and higher taxes on a pan-European basis. Like many of our politicians in Washington, they think the private sector is some sort of piñata that is capable of producing endless amounts of revenue to finance ever-expanding government.

Even though the evidence from Greece, Italy, Spain, etc, confirms that Margaret Thatcher was right when she warned that the problem with big government is that sooner or later you run out of other people’s money.

P.S. European bureaucrats have decided taxpayer-financed tourism is a human right. And they also use taxpayer money to produce self-aggrandizing comic books.

P.P.S. The European political elite are so bad that even President Obama has felt compelled to oppose some of their tax initiatives.