Since I criticized Paul Ryan’s Roadmap budget plan yesterday as part of my column against the value-added tax, I now feel obliged to defend the proposal in one important respect.

But first, some background.

In a recent piece for the American Enterprise Institute, James Pethokoukis applauded former Florida Governor Jeb Bush for being willing to accept a tax increase deal.

…whatever the real-time political impact of what Bush said, the fiscal analysis supporting it is sound. …Would a GOP president really not accept an entitlement reform deal somehow that kept spending at 20% but only raised revenue to 18.4% of GDP from its postwar average of 17.4%?

I actually would accept such a deal as well, at least in theory. After all, the burden of federal government spending – if left on autopilot – is expected togrow to about 40 percent of economic output by 2050.

Heck, if I knew I could restrain federal spending so it only consumed 20 percent of GDP in 2050, I’d even accept tax revenues of 20 percent of GDP.

So does this mean I’m a Jeb Bush-style squish on taxes?

Not at all. Simply stated, the deal that Pethokoukis proposes doesn’t exist. Anywhere.

So saying I’d accept such a deal is about as relevant as me saying I’m willing to play quarterback next year for the Georgia Bulldogs.

And even if such a deal did exist, I strongly suspect the other side wouldn’t fulfill its side of the bargain. That’s certainly been the track record of previous tax-hiking budget deals. The tax hike gets imposed, but promised spending “cuts” quickly evaporate.

So Pethokoukis (and Jeb Bush) are simply being impractical when they put tax hikes on the table.

You’re probably wondering at this point how this connects to Congressman Paul Ryan’s Roadmap proposal.

Time to reward your patience. Pethokoukis tries to defend Jeb Bush by asserting that Ryan’s Roadmap plan assumes higher levels of taxes and spending.

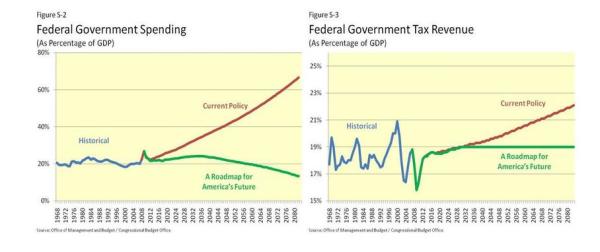

Look at Paul Ryan’s much-celebrated — at least in conservative circles — Roadmap for America. According to its budget plan, government spending in 2039 would be 23.7% of GDP with revenue of 19.0%. Now according to CBO’s alternate budget forecast, 2039 spending is currently on path to be 25.9%. So the Ryan plan would increase historical tax revenue by just less than two percentage points while reducing projected spending by just more than two percentage points. That is nowhere close to 10-to-1. It’s not even 2-to-1.

So does this mean Jeb Bush is more philosophically sound than Paul Ryan?

Hardly. Pethokoukis is mixing apples and oranges. Or, to be more accurate, he’s mixing apples and rocks.

The Ryan Roadmap, like all budget proposals on Capitol Hill, is measured against a “baseline” estimate of what happens if government is left on autopilot.

And that baseline assumes huge increases in the burden of government spending (because of entitlements and demographic changes) and a big increase in the overall tax burden (since even modest growth over time pushes households into higher tax brackets).

Compared to that baseline, Ryan’s Roadmap would significantly reduce the upward trajectory of spending, and also mitigate the increased tax burden.

Here are a pair of charts from the House Budget Committee, showing the long-run impact of the plan on taxes and spending.

So while I don’t like the fact that the plan includes a VAT, I very much applaud what Congressman Ryan is trying to achieve.

Jeb Bush’s theoretical budget deal, by contrast, would involve adding even more tax revenue on top of all the additional tax revenue that CBO projects. And Bush’s supposed spending cuts would be based on Washington’s funny budget math and measured against the CBO baseline as well, so I feel very safe in asserting that government would be much bigger under a risky tax-hike deal than it would be with Ryan’s Roadmap.

This is why the no-tax hike pledge is a valuable way of weeding out politicians who aren’t serious about dealing with the problem of big government.

P.S. It’s worth noting that the New York Times accidentally admitted that the only successful budget deal was the one that cut taxes.

P.P.S. The first President Bush was a disaster for advocates of limited government, as was the second President Bush, and there’s a very big reason at this point to be skeptical about version 3.0.