Last month, I shared a very interesting video from Canada’s Fraser Institute that explored the link between economic performance and the burden of government spending.

There’s now an article in the American Enterprise Institute’s online magazine about this research.

There’s now an article in the American Enterprise Institute’s online magazine about this research.

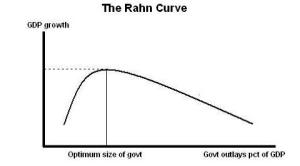

The first half of the article unveils the overall findings, explaining that there is a growth-maximizing size of government (which, when put onto a graph, is shaped like a hump, sort of a spending version of the Laffer Curve).

One recent addition to the mounting evidence against large government is a study published by Canada’s Fraser Institute, entitled “Measuring Government in the 21st Century,” by Canadian economist and university professor Livio Di Matteo. Di Matteo’s analysis confirms other work showing a positive return to economic growth and social progress when governments focus their spending on basic, needed services like the protection of property. But his findings also demonstrate that a tipping point exists at which more government hinders economic growth and fails to contribute to social progress in a meaningful way. …Government spending becomes unproductive when it goes to such things as corporate subsidies, boondoggles, and overly generous wages and benefits for government employees. …Di Matteo examines international data and finds that, after controlling for confounding factors, annual per capita GDP growth is maximized when government spending consumes 26 percent of the economy. Economic growth rates start to decline when relative government spending exceeds this level.

This is standard Rahn Curve analysis and it shows that the public sector is far too large in almost all industrialized nations.

And if you happen to think that 26 percent overstates the growth-maximizing size of government (as I argued last month), then it’s even more apparent that significant fiscal restraint would be desirable.

But I’m more interested today in the specific topic of Canada and the Rahn Curve. The article has some very interesting data.

For a real-life example of how scaling back government has led to positive and practical economic benefits, Americans should look north. …total government spending as a share of GDP went from 36 percent in 1970 (just over 2 percentage points higher than in the United States) to 53 percent when it peaked in 1992 (14 percentage points higher than in the United States). …the federal and many provincial governments took sweeping action to cut spending and reform programs. This led to a major structural change in the government’s involvement in the Canadian economy. The Canadian reforms produced considerable fiscal savings, reduced the size and scope of government, created room for important tax reforms, and ultimately helped usher in a period of sustained economic growth and job creation. This final point is worth emphasizing: Canada’s total government spending as a share of GDP fell from a peak of 53 percent in 1992 to 39 percent in 2007, and despite this more than one-quarter decline in the size of government, the economy grew, the job market expanded, and poverty rates fell dramatically.

Simply stated, none of this should be a surprise.

The Canadian economy had the breathing room to expand when the burden of spending was reduced. Why? Because more labor and capital were available to be allocated by market forces.

This is one of the reasons why Canada now ranks higher than the United States in bothEconomic Freedom of the World and the Index of Economic Freedom.

And it’s also worth noting that spending restraint has facilitated significant tax cuts in Canada. Indeed, some American companies are moving north of the border!

Here’s my video that includes a discussion of Canada’s dramatically successful period of spending restraint in the 1990s.