Congressman Paul Ryan, the Republican Chairman of the House Budget Committee, has unveiled the GOP’s latest budget plan.

Is this proposal deserving of applause or criticism? The answer is yes and yes, with a bit of emphasis on the former.

Let’s start with some depressing news. The Ryan budget has gotten weaker each year.

Three years ago, he put forth a budget that limited spending so that it grew 2.8 percent per year.

Two years ago, he put forth a budget that limited spending so that it grew 3.1 percent per year.

Last year, he put forth a budget that limited spending so that it grew 3.4 percent per year.

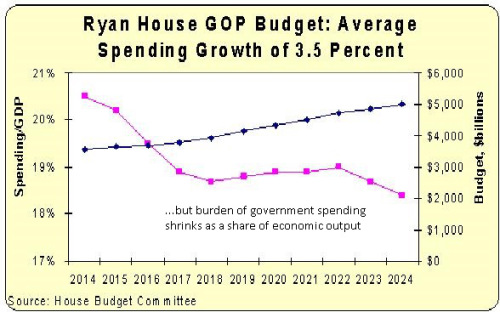

His latest budget continues this slide in the wrong direction. Here are the numbers from the new budget, showing that the burden of government spending will rise by an average of 3.5 percent annually over the next 10 years.

And this is during a time when inflation is projected to be about 2 percent per year!

Since it would be foolish to ever expect perfection from the political process, let’s now look at the positive features of the Ryan budget.

1. Spending may be growing, but it would grow at a slower rate than the President’s proposed budget.

2. Spending may be growing, but it would grow at a slower rate than nominal economic output, thus satisfying Mitchell’s Golden Rule.

3. Perhaps most important, the budget contains genuine and structural reform of both Medicareand Medicaid, so it at least partially solves thelong-run fiscal crisis.

4. The budget also foresees tax reform, including lower tax rates for households, a 25 percent corporate tax rate, and a move toward territorial taxation.

Now let’s close with some hard-to-judge news.

The tax reform would be “revenue neutral,” so it’s difficult to accurately assess the proposal without knowing the “revenue raisers” that would offset the “revenue losers” listed above (particularly since lawmakers would be bound bystatic scoring).

If lower tax rates are financed by getting rid of distortions such as thehealthcare exclusion, the net effect is very positive.

But if lower tax rates are financed with increased double taxation (a major shortcoming of the Cong. Camp tax plan), then it’s unclear whether policy has improved.

One final comment. I’m disappointed that the House Budget Committee’s report approvingly cites Congressional Budget Office analysis to suggest that the Ryan budget would boost economic performance.

I think that’s a tactically and morally dubious approach. It’s tactically misguided because the Ryan budget supposedly hurts growth from 2015-2017 according to CBO’s short-term Keynesianism.

And it’s morally dubious because it’s wrong to use bad arguments to advance good policy. The supposed added growth beginning in 2018 is based on the assumption that interest rates are the significant determinant of economic growth – which is the same thinking displayed in the left-wing debt video I shared yesterday.

Paul Ryan and the House GOP can legitimately claim that the proposed budget is good for growth. But improved economic performance would be the result of a smaller burden of government spending and a potentially less destructive tax system. Those are the policies that free up labor and capital for the productive sector and boost incentives to utilize those resources efficiently.